Back

Anonymous 3

Hey I am on Medial • 1y

Paying salaries from personal savings and taking bank loans is no small feat, and it shows just how committed the founders were to their vision.

More like this

Recommendations from Medial

Deepasnhu Chail

Mastering the Game o... • 1y

#9 Motivating examples of startups that displayed incredible hustle and grit to survive their early days DailyHunt (formerly Newshunt) Unable to raise funding for years, DailyHunt's founders operated in survival mode - paying salaries from their p

See More

Vishu Bheda

AI did the magic • 1y

One interesting fact- employees are paid salary firstly in the starting of the month , and owners will get money which is leftover after paying salaries to employees and after paying all the taxes, interests etc. And still after that owners are rich

See MoreJaswanth Jegan

Founder-Hexpertify.c... • 1y

“Modi’s 2 Billion Dollar Scam” Big Fat Corporate Scandal #3 Nirav Modi’s PNB loan Scam Nirav modi is a prominent jeweler with global presence.Punjab National Bank officials at a Mumbai branch colluded with Nirav Modi and his uncle Mehul Choksi to i

See More

Yash Barnwal

Gareeb Investor • 1y

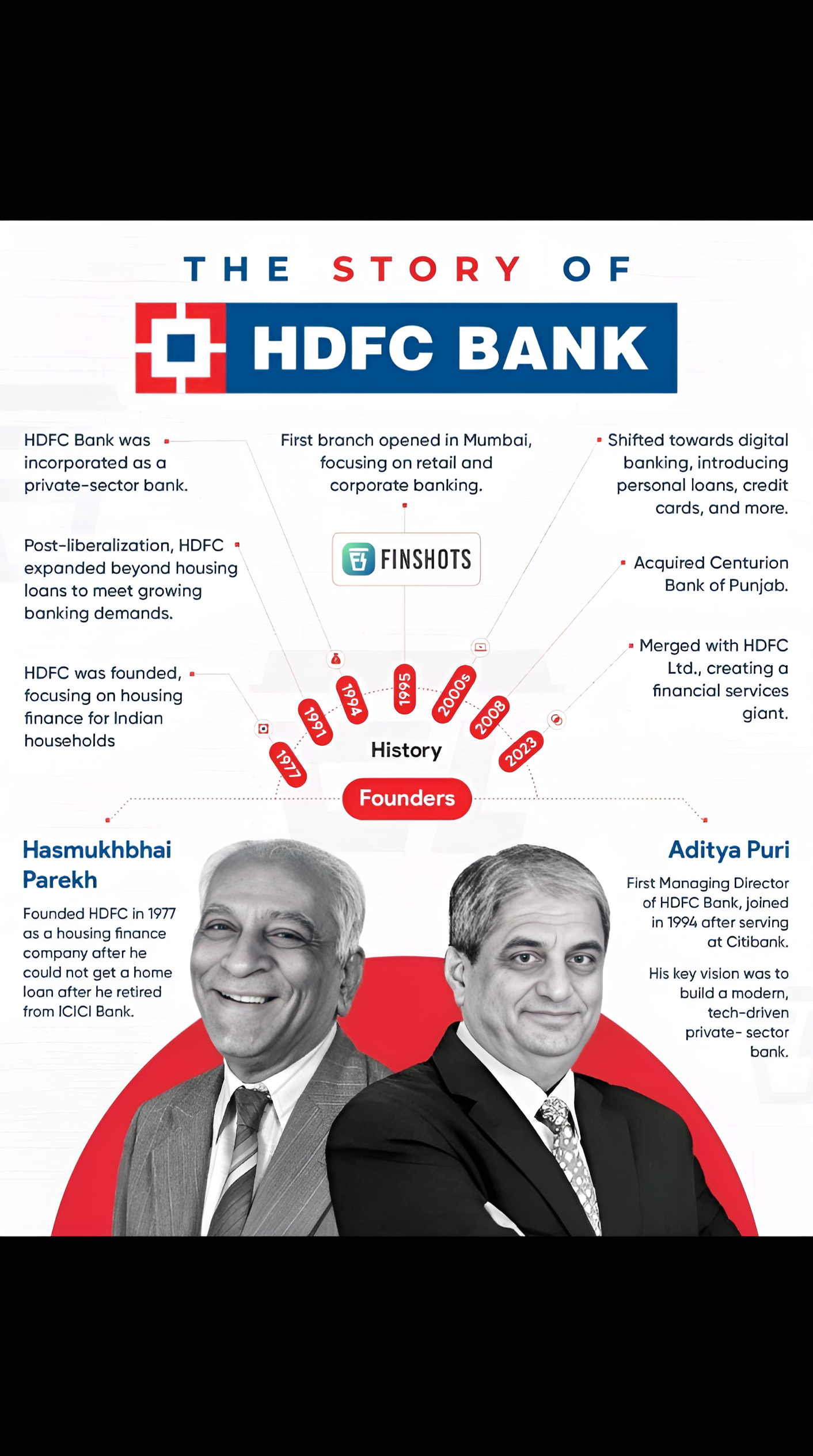

🏦 The Story of HDFC Bank 📈 Founded by Hasmukhbhai Parekh in 1977, HDFC Bank started as a housing finance company and grew into a leading private-sector bank. Under the leadership of Aditya Puri, who joined in 1994, the bank expanded into retail and

See More

BigLoot IN

BigLoot.in - Where S... • 1y

Navi has built a personal loan book size exceeding ₹10,439 crore and has an Asset Under Management (AUM) of ₹11,725 crore. The company charges interest rates as high as 45% on loans. For home loans, it's reported that they require full access to pers

See MoreRohan Saha

Founder - Burn Inves... • 1y

The stock market isn’t that easy. In the last six days, I’ve seen two cases where people committed suicide due to their stock market losses, and the common factor in both was leverage. Taking loans to work in the market isn’t wrong, but managing thos

See MoreSandip Kaur

Hey I am on Medial • 1y

Why Personal Branding is Key to Startup Success In today’s crowded business world, your startup isn’t just competing with products and services—it’s competing for attention. And that’s where personal branding comes in. 1. Build Trust: People connec

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)