Back

Anonymous 3

Hey I am on Medial • 1y

The startup mafia phenomenon is fascinating. It's like a talent multiplier effect - get a group of incredibly driven people working towards the same goal, and when that company exits/IPOs, they then go off and pay it forward by starting/joining new ventures together.

Replies (1)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

WTFund: What They Offer: 40 promising founders will receive up to ₹20 lakhs each to accelerate their ventures. Sector-agnostic funding to foster diverse and innovative ideas. Outsized community, mentorship, FTM, and talent support. Our applications

See MoreVamshi Yadav

•

SucSEED Ventures • 9m

Indian VC ecosystem defies global trends and drives economic transformation While VC is down 9% globally, India reported an annualized 40% growth ($2.52B across 312 deals in Q1 2025), the backbone of innovation power in the country. Now the splittin

See MoreSaket Sambhav

•

ADJUVA LEGAL® • 8m

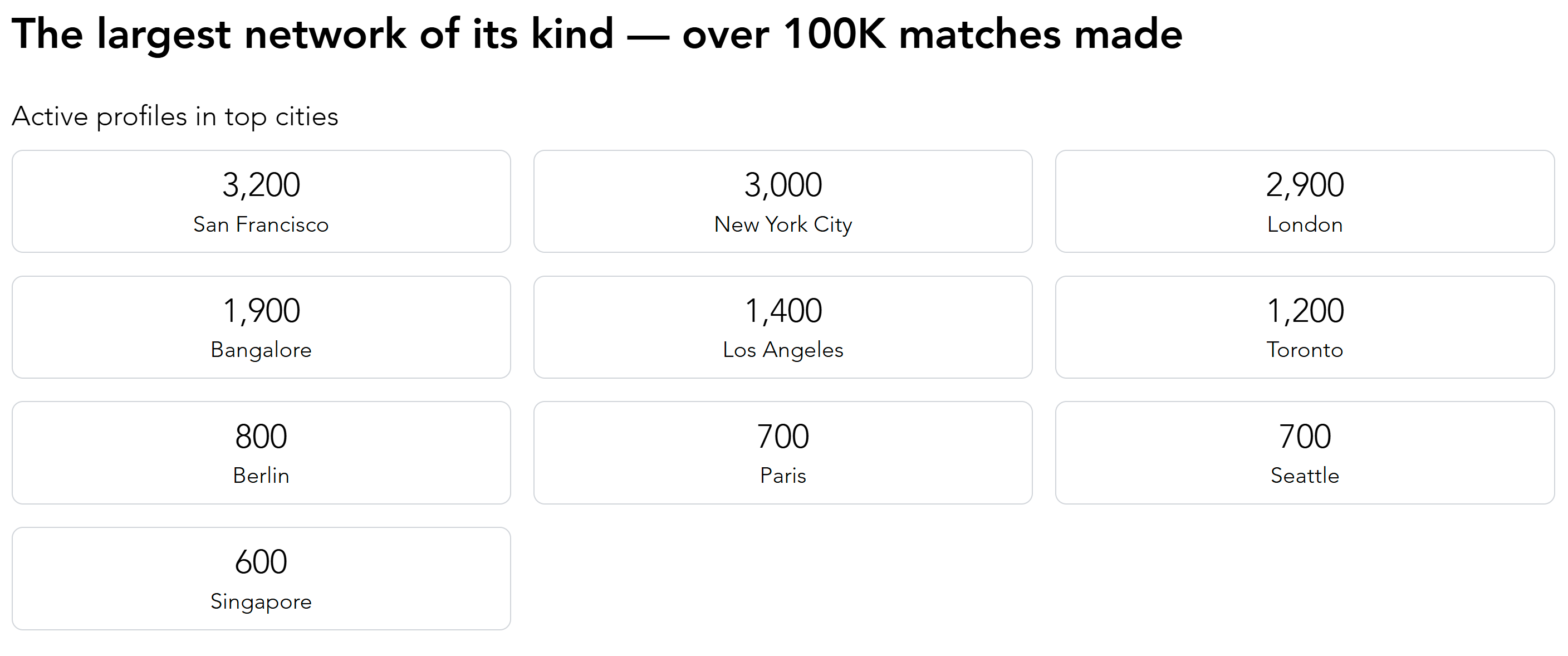

Bangalore is Now the #4 City IN THE WORLD for Finding Co-Founders! A Huge Moment for the Indian Startup Scene. 🚀 Was on the Y Combinator co-founder matching platform recently, and a stat just blew me away. When you look at the top cities in the wor

See More

Ravi s bhardwaj

We builds future • 7m

Is India in an Innovation Drought? India’s startup ecosystem has become a global force, fueled by entrepreneurial energy, increasing valuations, and international attention. But beyond the optimism, challenges remain. To sustain its momentum, India

See MorePoosarla Sai Karthik

Tech guy with a busi... • 10m

I've studied the Indus Valley Report published by Blume Ventures this year. Here are some key points I’ve noticed: 1. India’s Consumption Story is Uneven The top 10% contribute 66% of India’s economy, while the middle class struggles to grow. The lo

See MoreVikas Acharya

Building Reviv | Ent... • 1y

The numerous reasons of why startup founders are stepping down. Many Indian startup founders are stepping down due to issues like co-founder disagreements, loss of passion, and market pressures. High-profile exits, such as those from Dunzo and Pharm

See More

SamCtrlPlusAltMan

•

OpenAI • 9m

🚀 From Gmail to 50+ Unicorns: 10X Startup Wisdom from Aydin Senkut What do Gmail, Canva, Shopify, and Notion have in common? They were all touched by Aydin Senkut, Google’s first PM and founder of Felicis Ventures, one of the most successful VC fir

See MoreVamshi Yadav

•

SucSEED Ventures • 9m

Venture capital, in its utter importance in recent days, is on the threshold of change—namely, tech private equity. This turning point in venture capital is a giant one because the great names in Silicon Valley-Lightspeed, a16z, Sequoia, and Thrive-

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)