Back

Poosarla Sai Karthik

Tech guy with a busi... • 10m

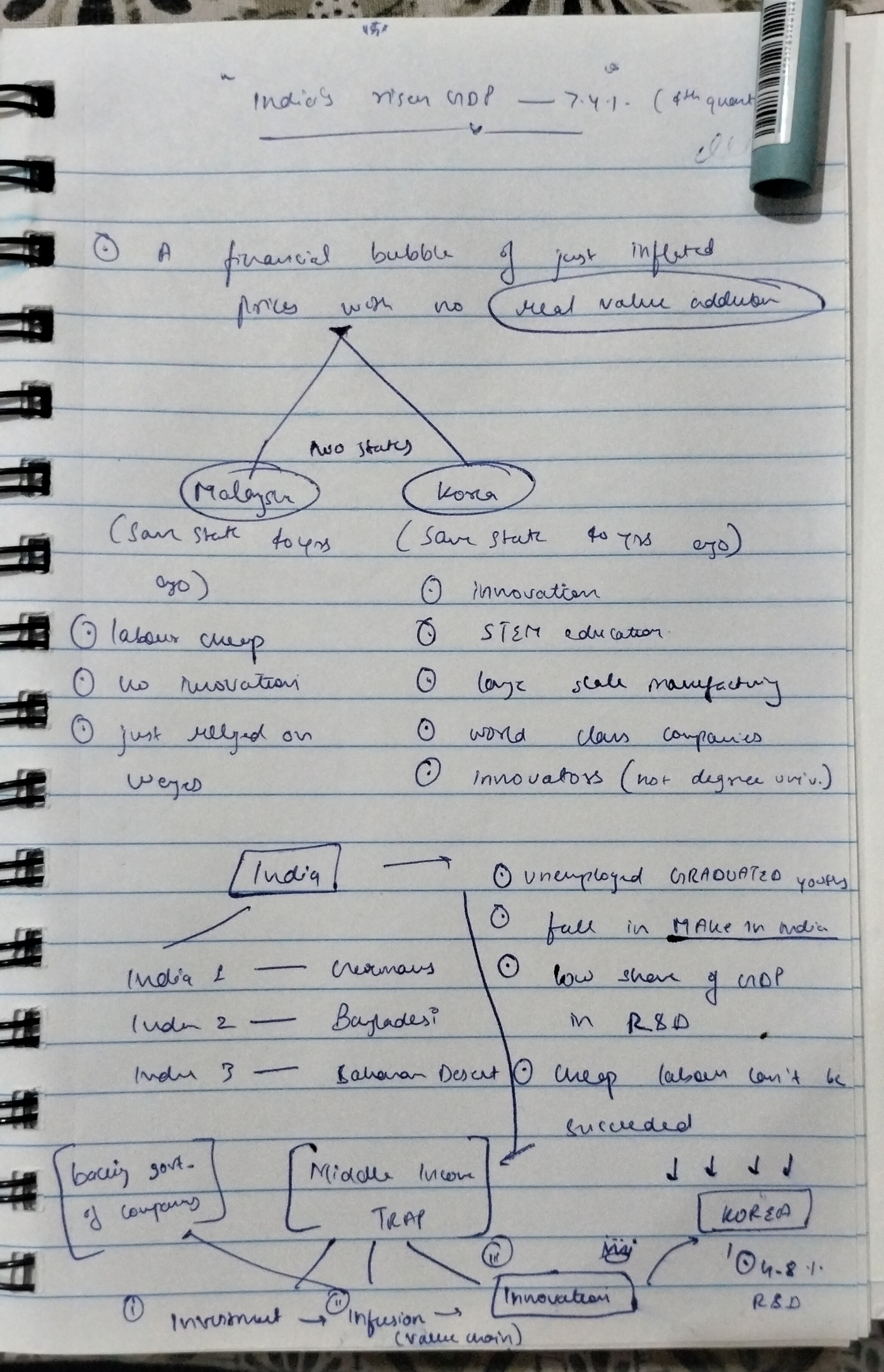

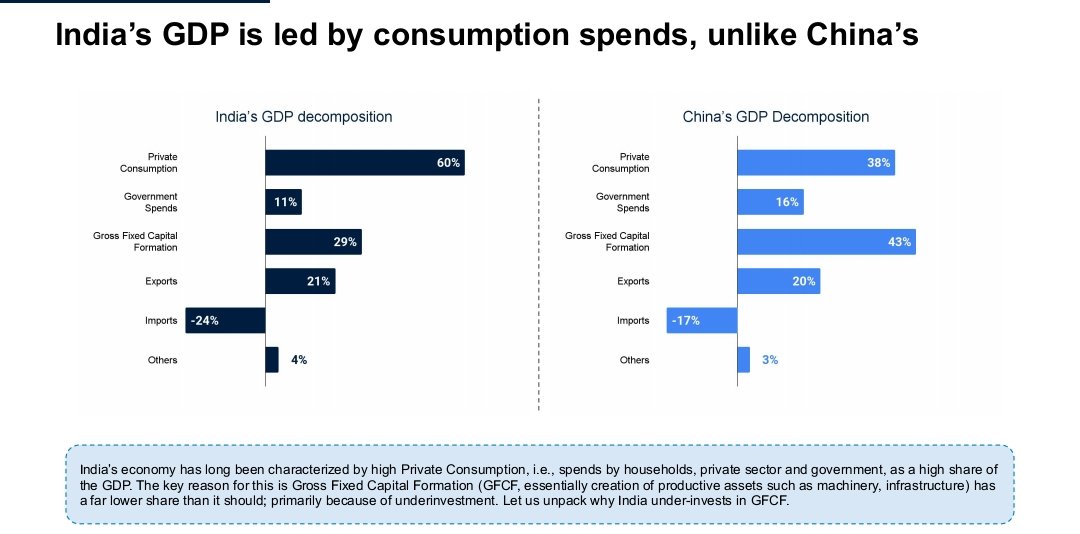

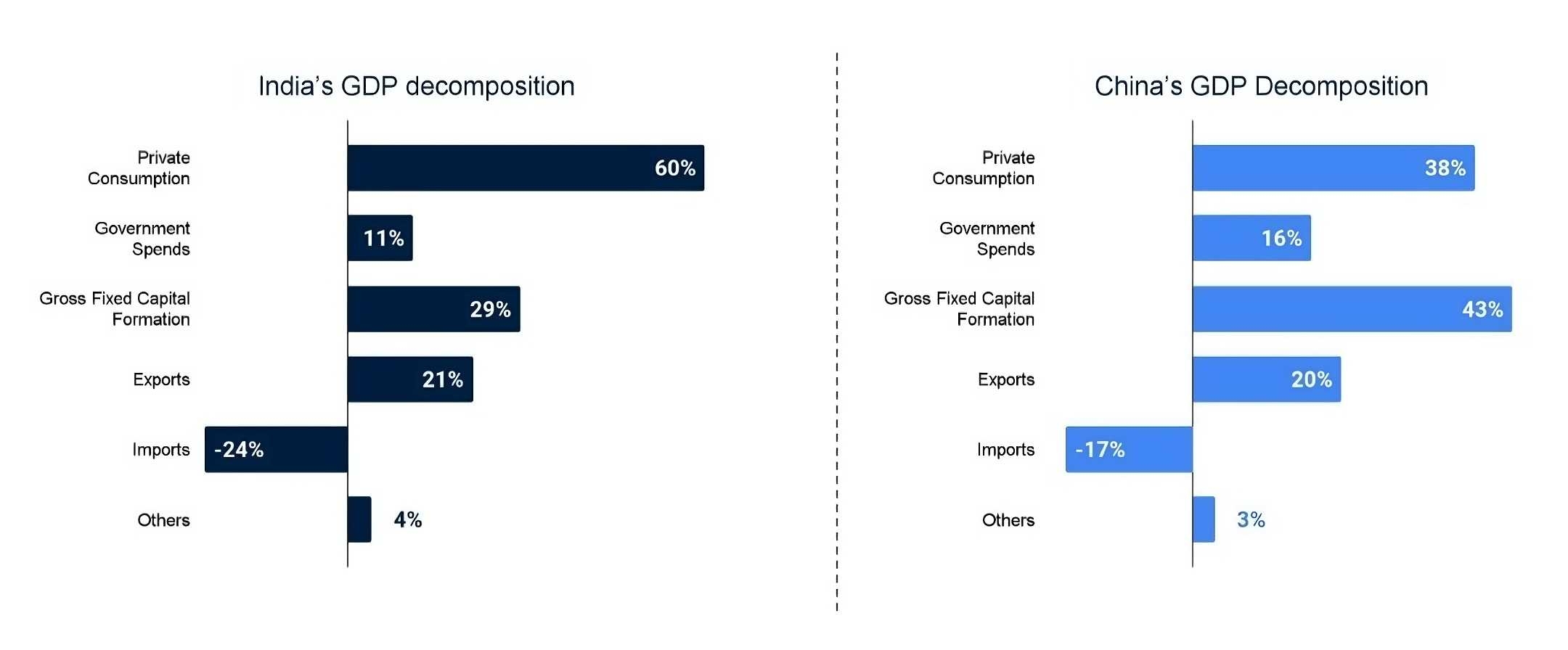

I've studied the Indus Valley Report published by Blume Ventures this year. Here are some key points I’ve noticed: 1. India’s Consumption Story is Uneven The top 10% contribute 66% of India’s economy, while the middle class struggles to grow. The lower-income segment still has limited purchasing power. 2. UPI is King, But Monetization Remains a Challenge India recorded ₹24.5 trillion in UPI transactions, but due to zero MDR (Merchant Discount Rate), providers struggle to generate revenue. 3. India’s Manufacturing Dream is Still Distant Despite the hype, manufacturing remains stuck at 13% of GDP (vs. China’s 26%). Regulatory hurdles, slow logistics, and a skill gap are major bottlenecks. 4. More Degrees, Fewer Jobs Unemployment among graduates stands at 28.7%, compared to just 3.2% for non-graduates, highlighting a mismatch between education and employability. 5. Startups Can’t Burn Cash Anymore VCs have turned cautious—unlike before, they now demand profitability before scaling. As a result, startups are opting for SME IPOs and venture debt instead of traditional VC funding. 6. Quick Commerce is Booming, But Sustainability is Uncertain 10-minute deliveries grew 24x since 2022, but outside Tier-1 cities, unit economics are weak. If discounts vanish, demand may collapse. 7. India Wants Its Own AI, But Talent is Scarce ₹20,000 crore has been invested in AI, but India lacks enough high-end researchers. We’re still catching up with global leaders. 8. Indians Are Spending More, Saving Less Household savings have hit a 20-year low (5.1% of GDP), while personal loans are at an all-time high. Short-term consumption is up, but long-term financial security is at risk. 9. Startup IPOs Are the New Exit Strategy With VC funding drying up, startups are going public earlier. In 2024, 13 startup IPOs raised ₹29,000 crore, but many aren’t ready for public market scrutiny. 10. The Indian Diaspora is a Goldmine for Brands NRIs sent $107 billion in remittances in 2024 and spend heavily on Indian fintech, ethnic fashion, and luxury goods—a massive opportunity for startups. 11. Startups Are Moving Back to India Previously, firms registered in Singapore or the US for better funding access. Now, regulatory changes and India’s booming stock market are bringing them back. 12. The Next Billion Users Are Online—But Poor India2 & India3 are coming online, but their spending power remains weak. Winning businesses will crack affordability without sacrificing margins. This is my take on the report. What are your thoughts? (P.S. I know I’m posting late, but it’s worth it.)

Replies (11)

More like this

Recommendations from Medial

Daxshh

A business geek and ... • 8m

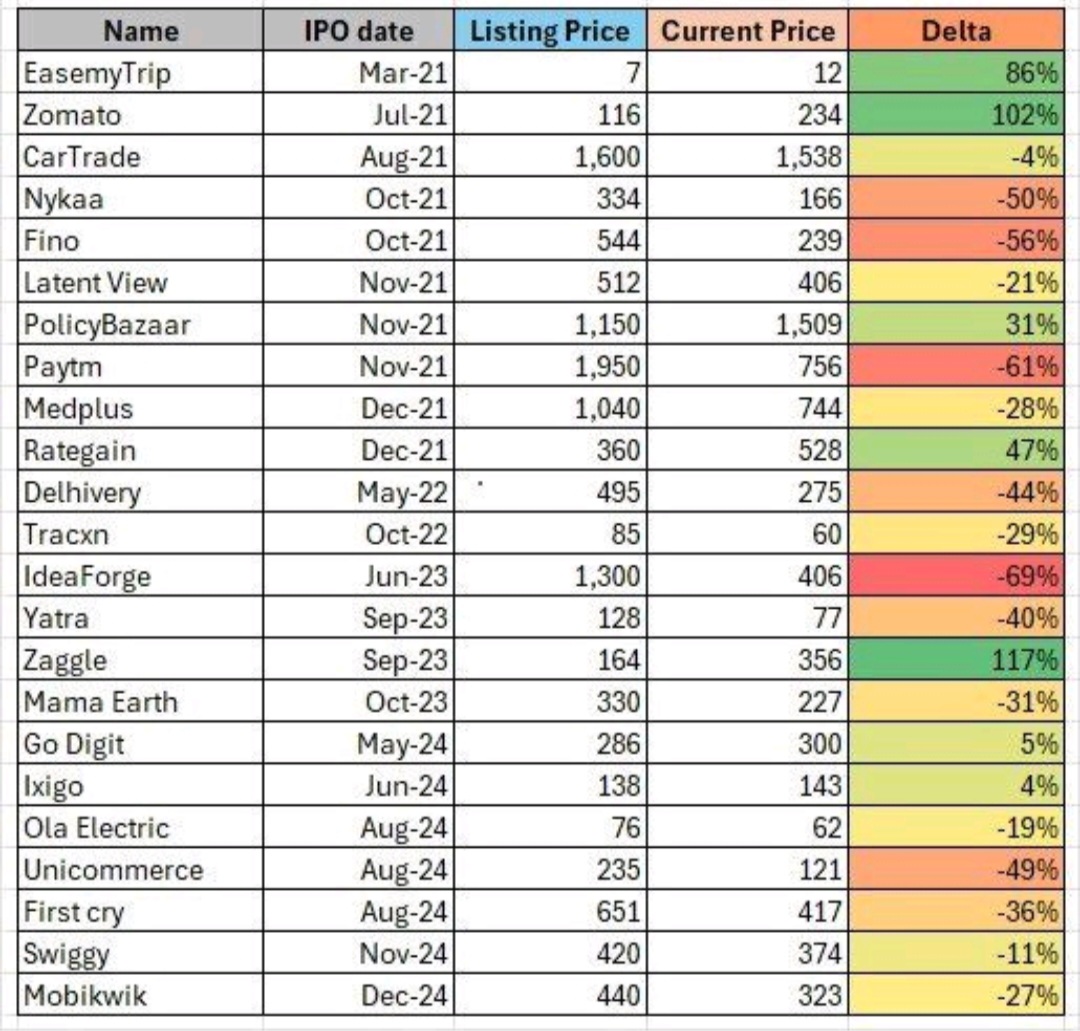

HOW KOREA SUCCEEDED WHILE INDIA REMAINS ON PAPER! I had an insightful evening learning about our own GDP growing in the 4th quarter!! Which is really on paper GDP, and the realities are still the same for most of us!! What's lacking and what are

See More

Vikas Acharya

Building Reviv | Ent... • 1y

As per Inc42 data, 20 startups are in various stages of undertaking their IPO preparations at the outset of 2025 Key factors that are likely to contribute to the public listing mania in 2025 are India’s strong position in the equities market and rat

See More

Account Deleted

Hey I am on Medial • 1y

Startups in India VS US - Which is Better? here's a break down of startup ecosystems of India and the U.S. There are approximately 80K startups in the U.S. and about 17,000 in India. When we compare the number of unicorns, there are about 700 pl

See More

Business Digital Twenty Four

Innovation | Insight... • 9m

India’s startup ecosystem is making global headlines in 2025, firmly establishing itself as a powerhouse of innovation, investment, and entrepreneurship. With record-breaking funding, a surge in IPOs and M&A activity, and rapid advances in technology

See More

Kunal K

Here to share my tho... • 11m

India’s economic trajectory remains strong in 2025, with a projected GDP growth rate of 6.5-7%, making it one of the fastest-growing major economies. Despite global headwinds, India’s resilience can help survive the tough times. Key Growth Drivers:

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)