Back

Taskedo

If u learn more you ... • 1y

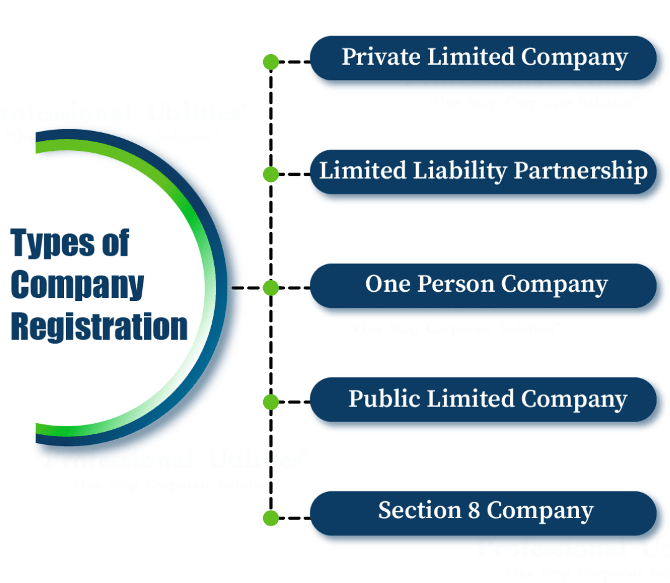

LLP or PRIVATE ltd which is better for a startup!?

Replies (11)

More like this

Recommendations from Medial

CA Chandan Shahi

Startups | Tax | Acc... • 11m

💡 Not Every Registered Pvt Ltd/LLP/Firm is a Startup! 🚀 Just because your business is registered as a Private Limited Company, LLP, or Partnership Firm doesn’t automatically make it a Startup. There’s a clear definition in the notification issued

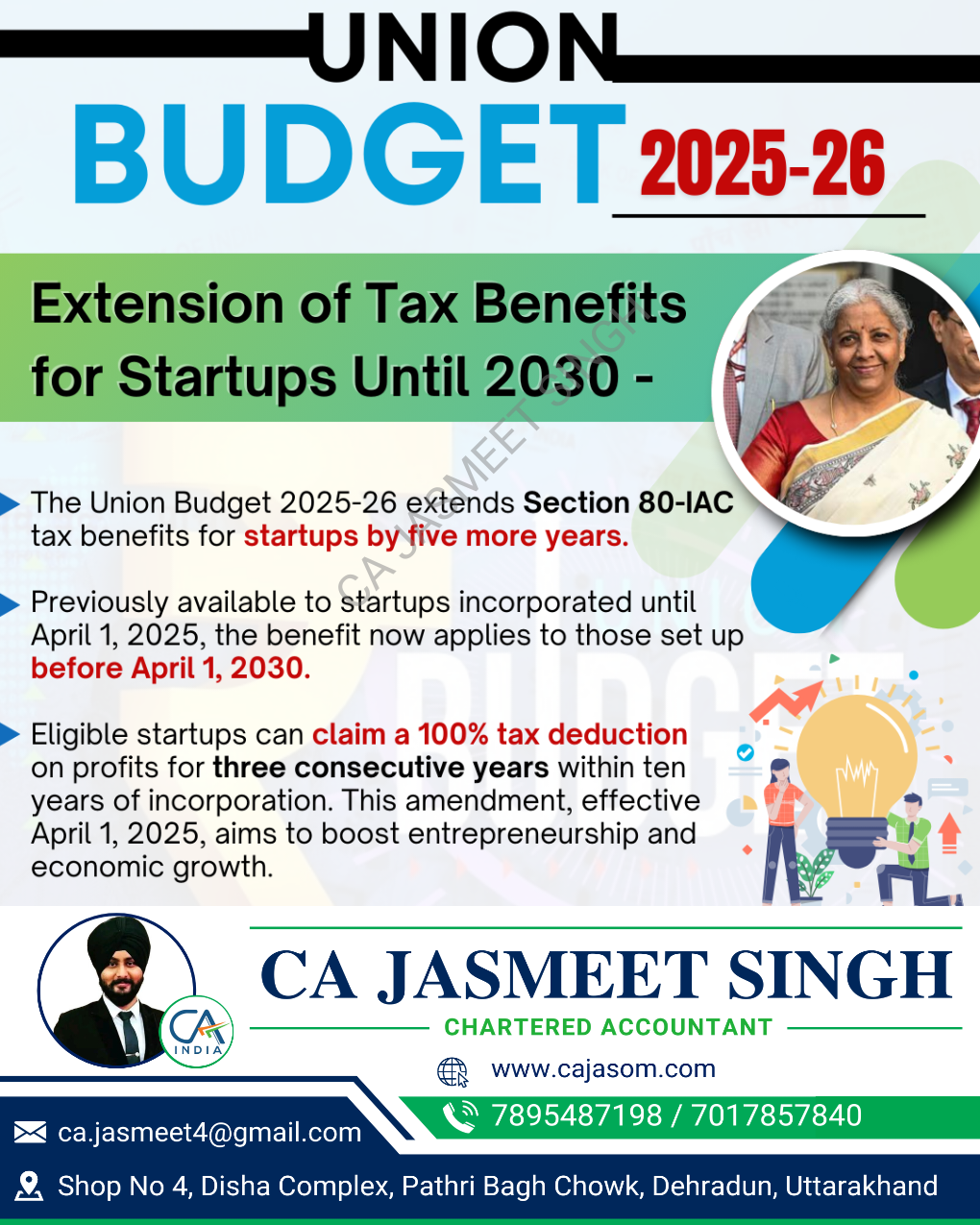

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Anonymous

Hey I am on Medial • 1y

I'm thinking of starting an export buisness. Not sure which type of business should I register with? Partnership/Private Limited/LLP. To be specific, I'm not sure if the importers are looking for a more credible organization like pvt ltd. to do bus

See Morekavish sethi

#travel #tourism #bu... • 11m

Hello Friends I need some suggestions, I have a startup business in the travel industry. Which is LLP, for a few months I am burning can I do a job now or can I continue? And if I add my experience as a startup founder, in my CV is it fine for o

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)