Back

Aditya Gururaj Muttagi

Consultant at EXL Se... • 1y

I use you credit card for rent, groceries, bills and things I need which anyway I would have paid in cash. At the end I get reward points and also improve my credit score. Win win! It depends on the person's financial discipline

More like this

Recommendations from Medial

Basavaraja V

Software Engineer • 1y

Many people want to make big purchases online but don't have a credit card. At the same time, some credit card holders have unused credit limits. ConnectCred solves this problem by allowing shoppers to make purchases through a service that connects t

See More

Satyam Kumar

Pocket says nil.. Mi... • 10m

CRED CRED is a members-only credit card bill payment platform that rewards its members for clearing their credit card bills on time. CRED members get access to exclusive rewards and experiences from premier brands upon clearing their credit card bil

See More

Praveen Kumar

Start now or Regret ... • 1y

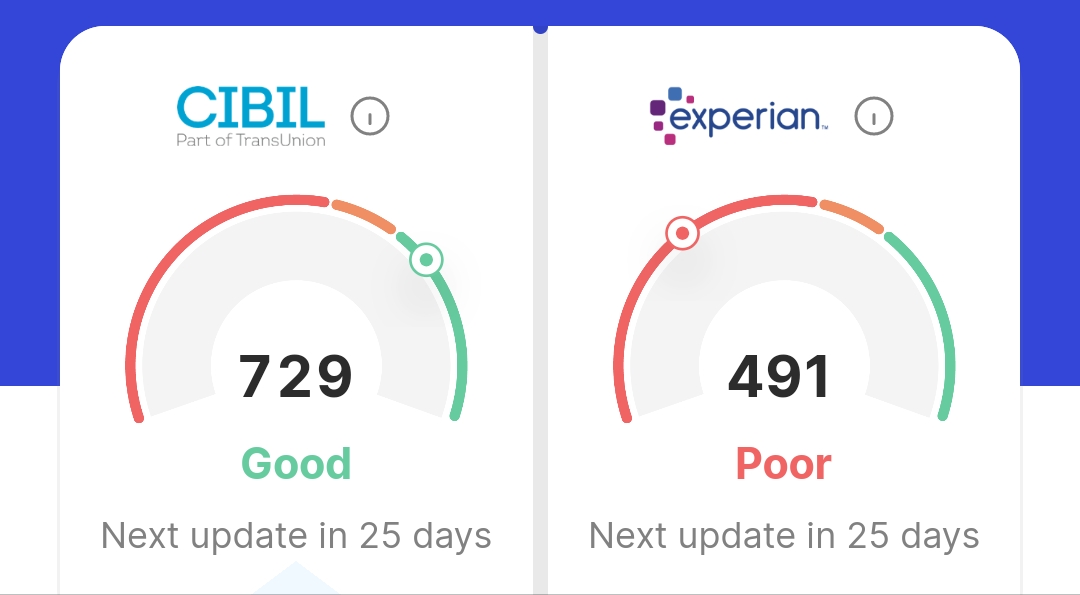

hii , At the age of 19 I have unfortunately taken a loan for my friend in mpocket and the loan was never paid.I have neglected that time because I don't have money .Now I am salaried with 5.2 lpa but I have less credit scores , so no credit card are

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)