Back

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

🌟 Exploring Hindustan Unilever Limited (HUL): A Giant in FMCG 🌟 Hindustan Unilever Limited (HUL) has been a cornerstone of India's fast-moving consumer goods (FMCG) sector since 1933. With a vast portfolio spanning foods, beverages, cleaning agent

See More

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

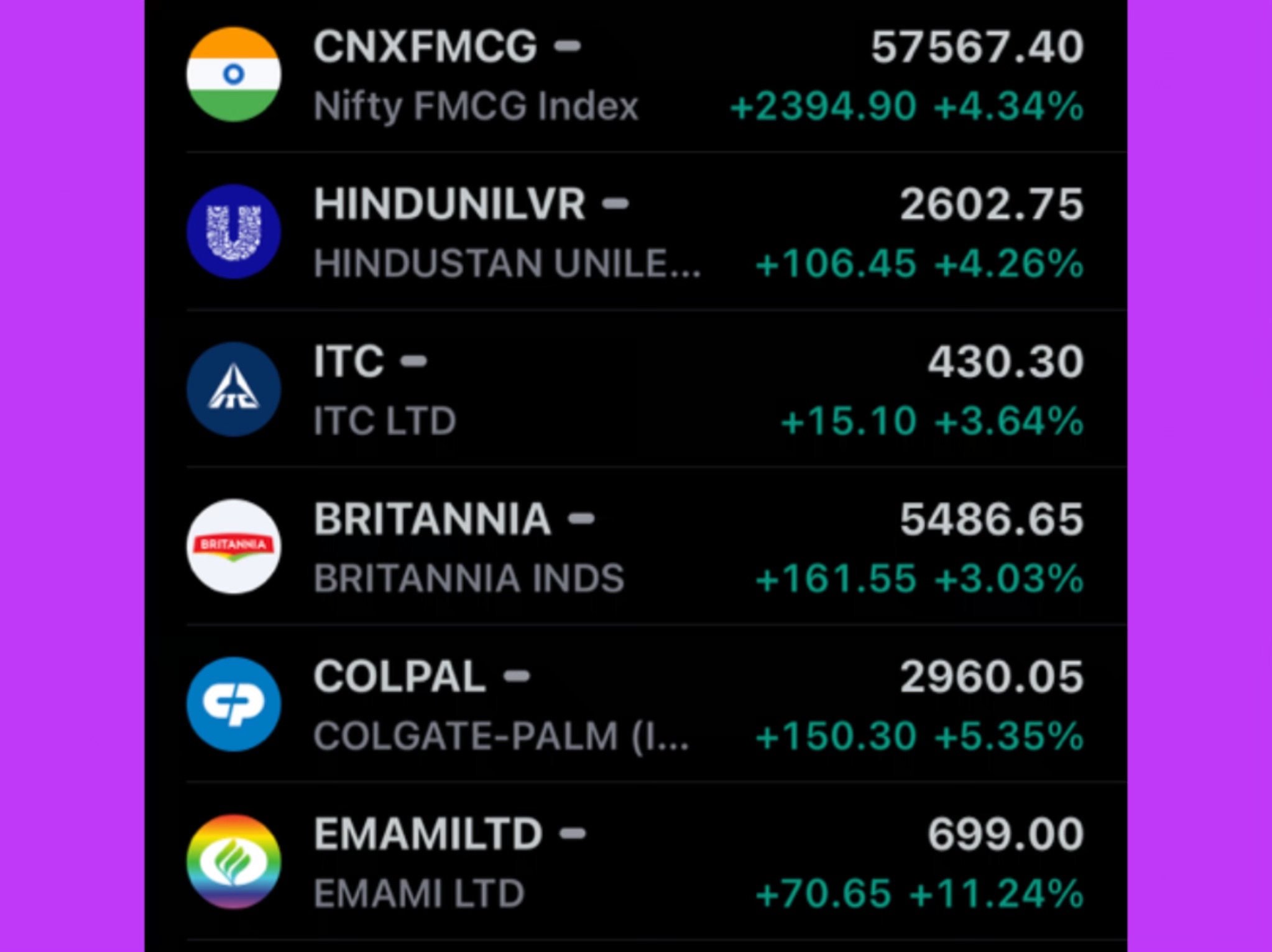

The Reason for strong uptrend seen in FMCG stocks in yesterday’s election uncertainty and today’s session is because People consider that FMCG is only SAFEST sector to park their funds in those uncertainty because Consumers put less thought into pu

See More

gray man

I'm just a normal gu... • 10m

Hindustan Unilever Ltd (HUL), a leading player in the FMCG sector, has announced the completion of its acquisition of a 90.5% stake in Uprising Science Private Ltd, the parent company of D2C personal care brand Minimalist. According to a regulatory

See More

Rohan Saha

Founder - Burn Inves... • 9m

While some companies in the auto sector are seen struggling, M&M is playing a different game altogether its tractor market share is at an all-time high now, and it is slightly ahead of its competition in SUV sales, EV sales, car deliveries, and inven

See MoreRonak Patel

Waiting for my idea ... • 9m

Hiring: Experienced Salesman for Asva & Co. – Mumbai Asva & Co., a fast-growing beverage brand based in Mumbai, is seeking a professional and driven salesman with strong FMCG experience, especially in the Carbonated Soft Drink (CSD) sector. Who we’

See MoreKishan Kabra

Founder & CEO • 1y

What's the reason behind of OYO valuation crash? They were struggling to get approval from SEBI for IPO back in 2021, Finally got a approval but they withdrew their application and looking to raise from private investors at $2.3 Billion which was $9

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)