Back

Anonymous 2

•

slice • 1y

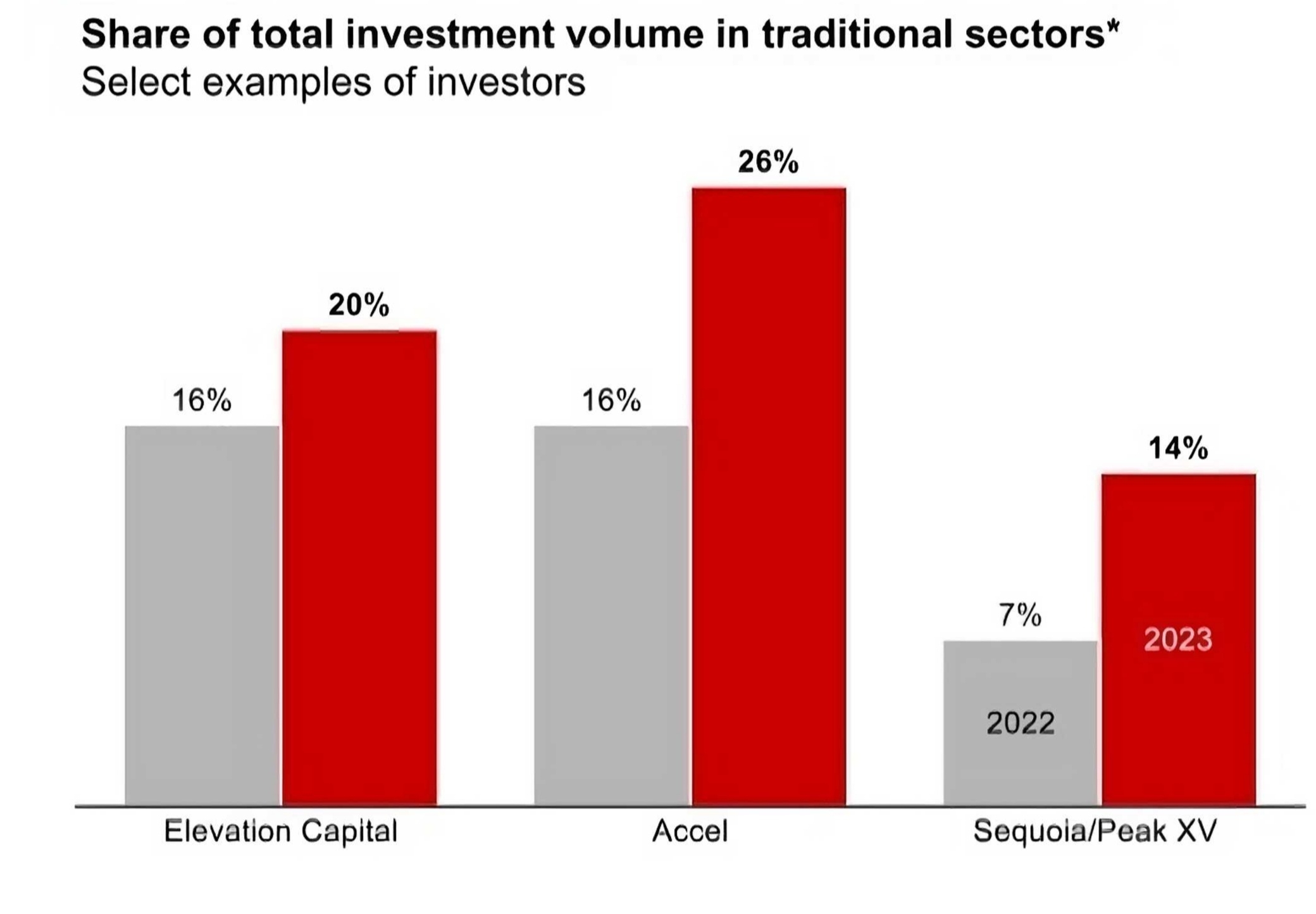

I personally think the funding winter has extended, and investors are becoming more cautious due to persistent inflation, elevated interest rates, and potential growth headwinds. This has led to a decline in deal volume and average deal size, with investors becoming more vigilant and raising their expectations.

More like this

Recommendations from Medial

Tejas

Digital Marketer & E... • 10m

In recent years, there has been a notable increase in startup closures in India, with over 28,000 startups shutting down in the past two years. This surge can be attributed to various factors, including a "funding winter," where investors become more

See More

Sajan Kashyap

Hey I am on Medial • 1y

i want to be finding extended my mashroom farm invest 1 lakh and i will get you 1.5 in three month after production of button mashroom its aa very good chance forn mashroom farming because now is winter session and high demand in market rupees 20

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Dhiraj Karalkar

•

PremitiveKey • 11m

The game has changed! There was a time when investors used to take big risks on just an idea. They believed in the vision, backed early-stage startups, and took chances. But today? Things are different. Investors have become more cautious. They wan

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)