Back

financialnews

Founder And CEO Of F... • 1y

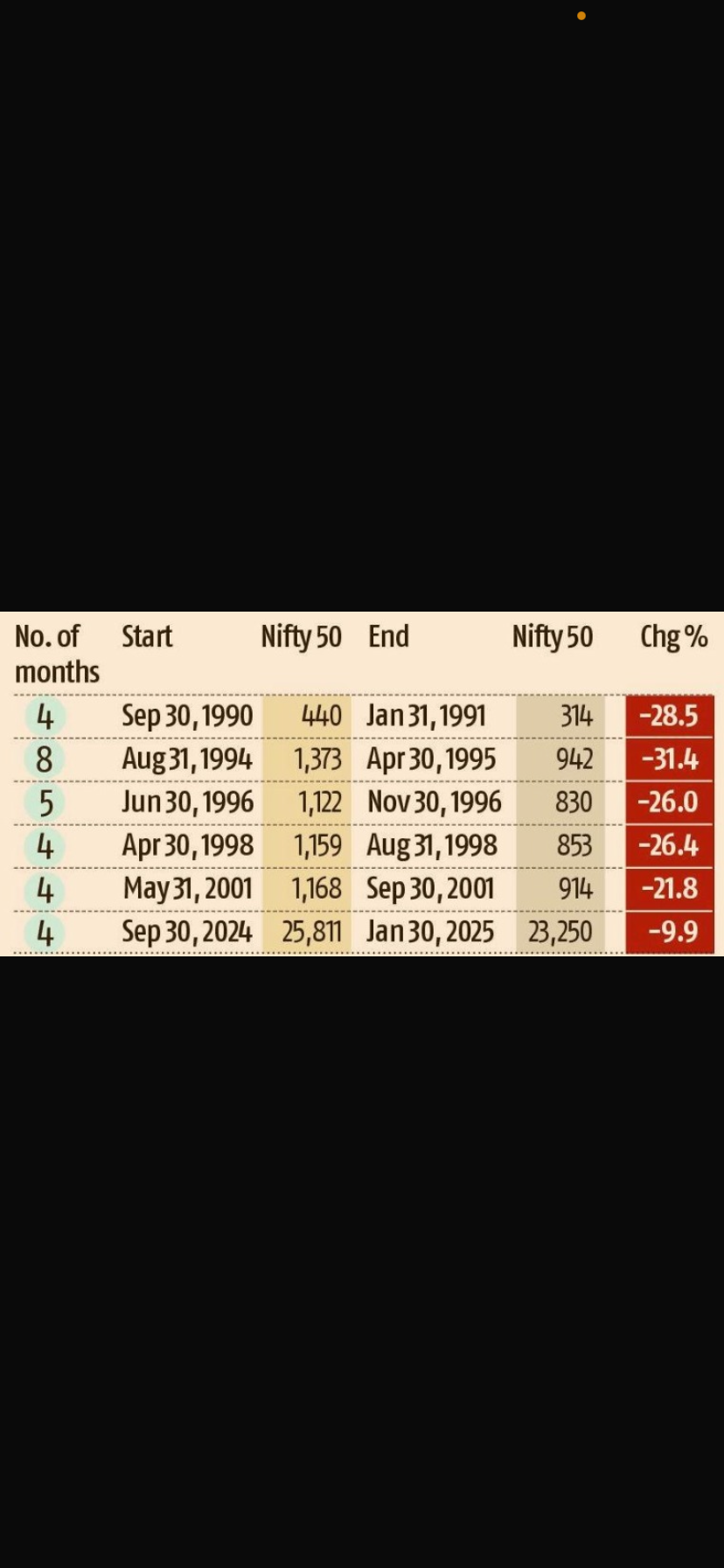

Nifty 50 Index: Signs of Reversal Amid Risky Patterns The Nifty 50 index is exhibiting patterns that signal potential market volatility and a possible reversal. Recent technical indicators, such as overbought levels and resistance zone challenges, suggest that traders should brace for potential shifts. Here's a closer look at key factors contributing to this scenario: Nifty 50 Index Slips Amid Economic Concerns: Signs of Reversal and Top Gainers The Nifty 50 index has faced significant pressure, falling to ₹24,130, marking a decline of 8.20% from its peak this year. Investors remain cautious as concerns around India’s economic performance grow. Here’s a detailed analysis of recent trends and insights into the Nifty 50's performance. Economic Slowdown Raises Red Flags India’s economic challenges have played a crucial role in the Nifty 50’s decline. According to data...if you want to know more click 👇 below the link

Replies (3)

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

"Nifty May See Further 1,000-Point Drop, Technical Charts Indicate Potential Market Decline" "If Nifty Fails to Hold Above 24,500, Charts Signal Potential Drop to 200-DMA at 23,365" Nifty 50 May Drop Another 1,000 Points, Technical Charts Indicate

See MoreAdarsh Km

Worked in startups a... • 1y

🚨Market Alert! #Nifty in continuous decline and all eyes are now at 200 EMA support, which is normally the last hope for any corrective reversal. Below this, a further deep correction will be seen.? Is this a dip that shall be bought, or should we

See More

Anonymous

Hey I am on Medial • 1y

The Nifty 50 ended the session with a 0.15% drop at 24,435 points, while the Sensex ended Wednesday's trade with a cut of 0.17% at ₹80,081 points. 32 constituents of the Nifty 50 closed in the negative territory, led by Mahindra & Mahindra, which exp

See Morefinancialnews

Founder And CEO Of F... • 1y

**Stock Market Decline: Nifty 50 Year-End Target Revised to 27,381 – Experts Suggest 'Buy on Dips' for Long-Term Gains** ### Stock Market Correction: Prabhudas Lilladher Revises Nifty 50 Target to 27,381, Recommends Selective Buying Amid the ongoin

See Morefinancialnews

Founder And CEO Of F... • 1y

Technical Analysis for Nifty and Bank Nifty: Key Support, Resistance, and Market Outlook Following a four-week decline, the Nifty index is approaching a critical support level near 24,000. Ajit Mishra, SVP of Research at Religare Broking Ltd, notes

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)