Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

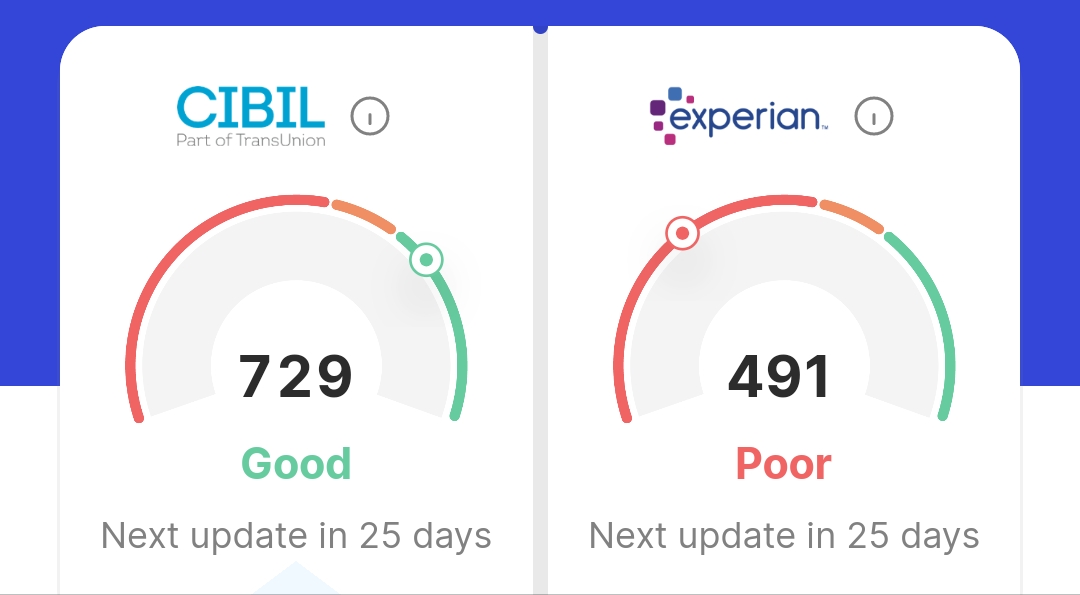

does co ownership works in real estate. people will likely to have a loan of 10 lakhs instead, from banks. and the annuity of loan can be paid through rent received on real eastate. if the CIBIL score of person is low then it might be helpful.

More like this

Recommendations from Medial

Praveen Kumar

Start now or Regret ... • 1y

hii , At the age of 19 I have unfortunately taken a loan for my friend in mpocket and the loan was never paid.I have neglected that time because I don't have money .Now I am salaried with 5.2 lpa but I have less credit scores , so no credit card are

See More

Pranjal Majumdar

Hey I am on Medial • 1y

"Big Changes in Credit Score Rules by RBI – Here’s How It Affects You!" Starting January 1, 2025, the RBI has introduced new rules that will make credit score updates faster and more accurate. Here’s what you need to know: ✅ Credit Score Updates Ev

See MoreKaamar Thakur

Real estate and fina... • 5m

Who has -1 CIBIL means they never took a loan but today they need a loan, then all people can contact us but only for employees or business owners from 1lacs to 5lacs.Those who do not need it, please do not waste your time.Everyone has a need, but no

See More

Santhosh

Don't Giveup when yo... • 1y

Hey guys Here's a detailed business explanation. Challenges faced by MSMEs in loan application : 1)time-consuming and complex loan application process. 2)lack of awareness about various government loan schemes. 3)difficulty documentation and applicat

See MoreVansh Dahiya

"Beyond Credit Score... • 1y

Tired of CIBIL scores and high interest rates? We’re about to do something different! A platform where trust is the foundation, and everyone gets a fair shot. Instead of relying on your CIBIL score, we’re using alternative metrics that focus on YOU

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)