Back

Suraj

CEO & Chairman • 1y

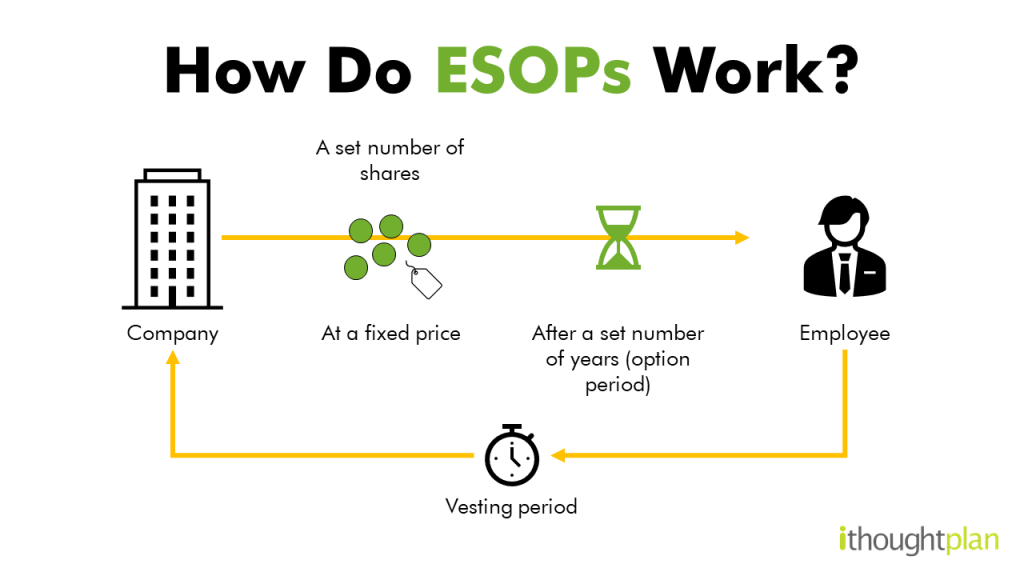

Dear All, Since I told you that I am a CEO of a stealth org who is currently making polices for equity/RSU/ESPP/401K grants for the employees, What all considerations besides the following intuitive ones should be incorporated in the umbrella org to ensure proper pay for value generated ? 1. 0.1% of Employee stock pool derived from float that excludes locked in and promoter shares. 2.Early exit plans carved out for employees near gratuity period which clearly communicates to the accounts team & investment team to refrain from bullish practices of the stock pool since if one denomination of the stock is made to go under bullish phase, the rest employees may never get the sought early exit since it will require inspection of P&L. Consider it for Indian tech ecosystem comprising of engineers, accountants, Business development execs, Investment consultants, Management consultants etc. I acknowledge that ChatGPT can suggest an idealistic one but I still wish to leverage the community.

Replies (2)

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

Nvidia has seen incredible growth in recent years. Since the beginning of 2024, the company’s stock has jumped 167%. Over the past five years, it has surged by an impressive 3,450%. The stock jump is so much that many employees are now choosing reti

See More

The next billionaire

Unfiltered and real ... • 1y

First-time founders chase headcount. Seasoned founders chase output. Many of the best startups weren’t built by bloated org charts. They were built by lean teams: YouTube: 65 employees → Acquired for $𝟏.𝟔𝟓𝐁 Instagram: 13 employees → Acquired

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Commonly used Jargons 1)Bull Market:-If you expect the stock prices to go up,you are bullish on the stock price. 2)Bear Market:-If you expect the stock prices to go down,you are bearish on the stock price. 3)Trend:-The term ‘trend’ usually refers

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)