Back

VIJAY PANJWANI

Learning is a key to... • 26d

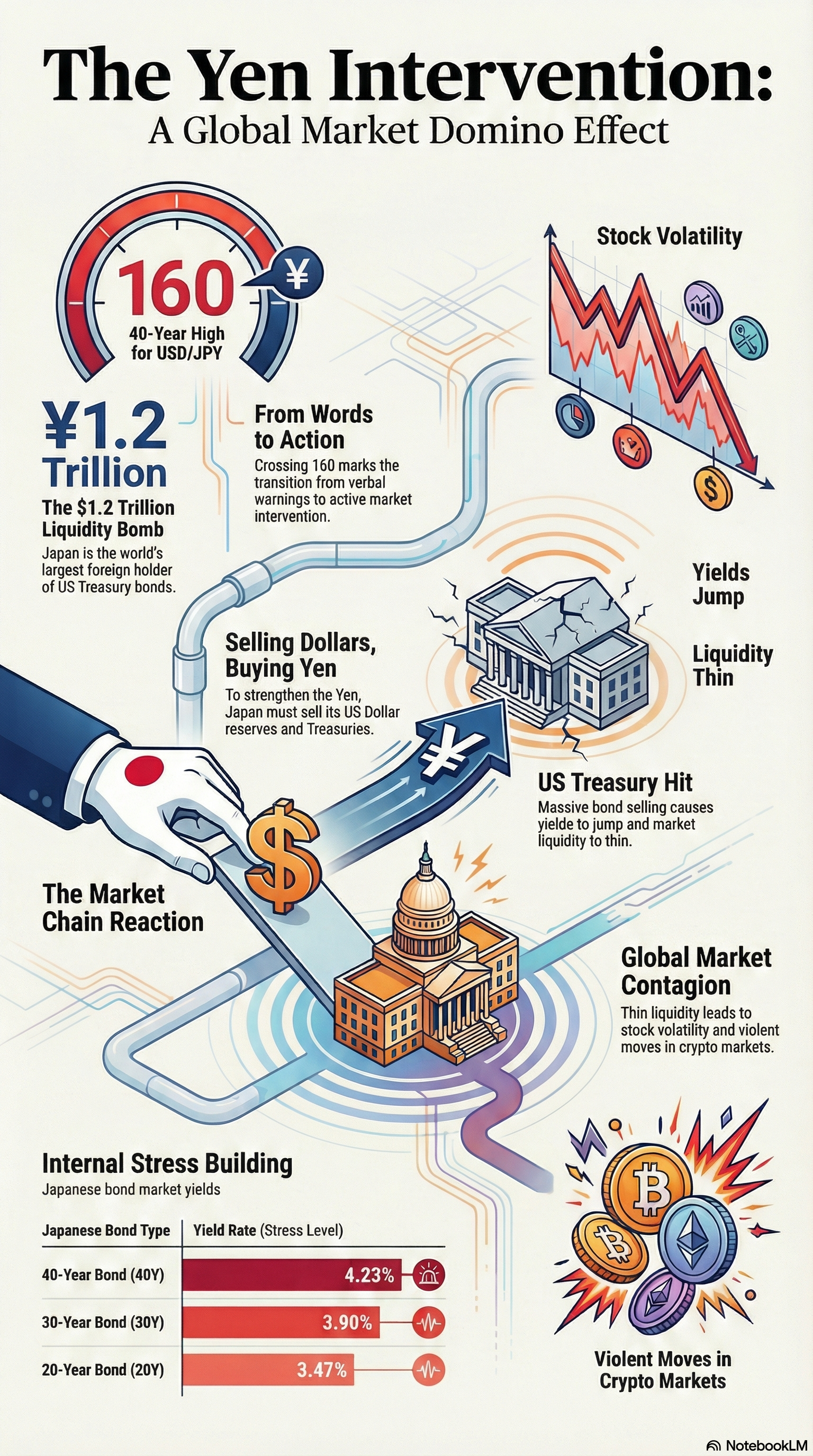

🚨 JAPAN JUST ANNOUNCED THE MARKET COLLAPSE IN THE NEXT 24 HOURS!! The Bank of Japan just started currency intervention. USD/JPY is trading near 160, the HIGHEST level in 40 years. The Yen is in a real DANGER zone. Let me explain this in simple words. 160 matters because it is the pain level. It is the number where Tokyo stops talking about actions, it ACT. It is also the zone where Japan stepped in before, so every market maker has it marked. Now connect the dots. Japan is the biggest foreign holder of US Treasuries. Around $1.2 TRILLION. That one fact explains a lot. Because intervention is simple. If they want a stronger yen, they need to sell dollars and buy yen. Those dollars sit inside reserves. A big part of reserves is US bonds. So this is not just an FX headline. It becomes a US Treasury headline. THIS IS SUPER BAD.

Replies (1)

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 1m

For years, Japan quietly ran one of the most unusual monetary experiments in history. Near 'zero' interest rates for decades. I used to see it as a Japan-only story. Looking closer, I realised how global the impact really was. Cheap yen didn’t just

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

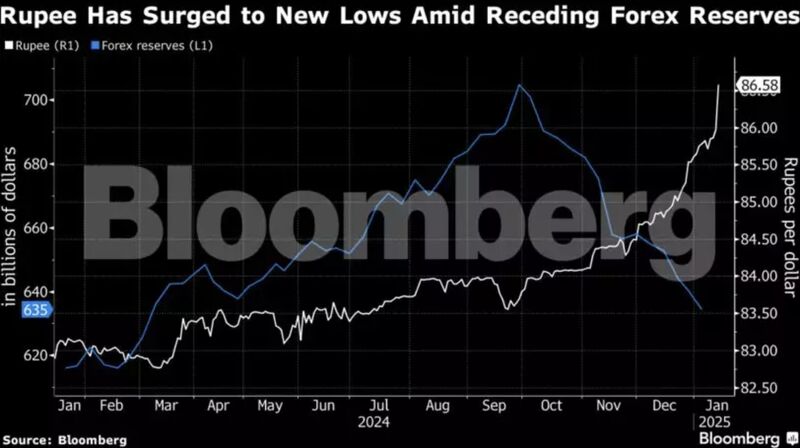

’m a bit surprised by how everyone’s in a tizzy over Indian Rupee's slide against the Dollar, and how Govt and RBI are being bashed over it. It makes it amply clear that much of people don’t understand how & why currency markets move 🙏🙏 And, the

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)