Back

Karnivesh

Simplifying finance.... • 2m

For years, Japan quietly ran one of the most unusual monetary experiments in history. Near 'zero' interest rates for decades. I used to see it as a Japan-only story. Looking closer, I realised how global the impact really was. Cheap yen didn’t just stay in Japan. It flowed across markets, shaping bond yields, currencies, and risk appetite worldwide. That era is now slowly ending. 𝗪𝗵𝗮𝘁 𝘀𝘁𝗼𝗼𝗱 𝗼𝘂𝘁 𝘁𝗼 𝗺𝗲 👇 🇯🇵 Japan was a major source of cheap global capital 💱 Carry trades shaped liquidity for years 📉 Policy normalisation changes how money moves 🌍 Ripple effects extend far beyond Japan This shift won’t cause instant shock, but it changes long-term assumptions markets relied on. 👉 For deeper insights and visuals explaining this transition, refer to the attached link.

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 1m

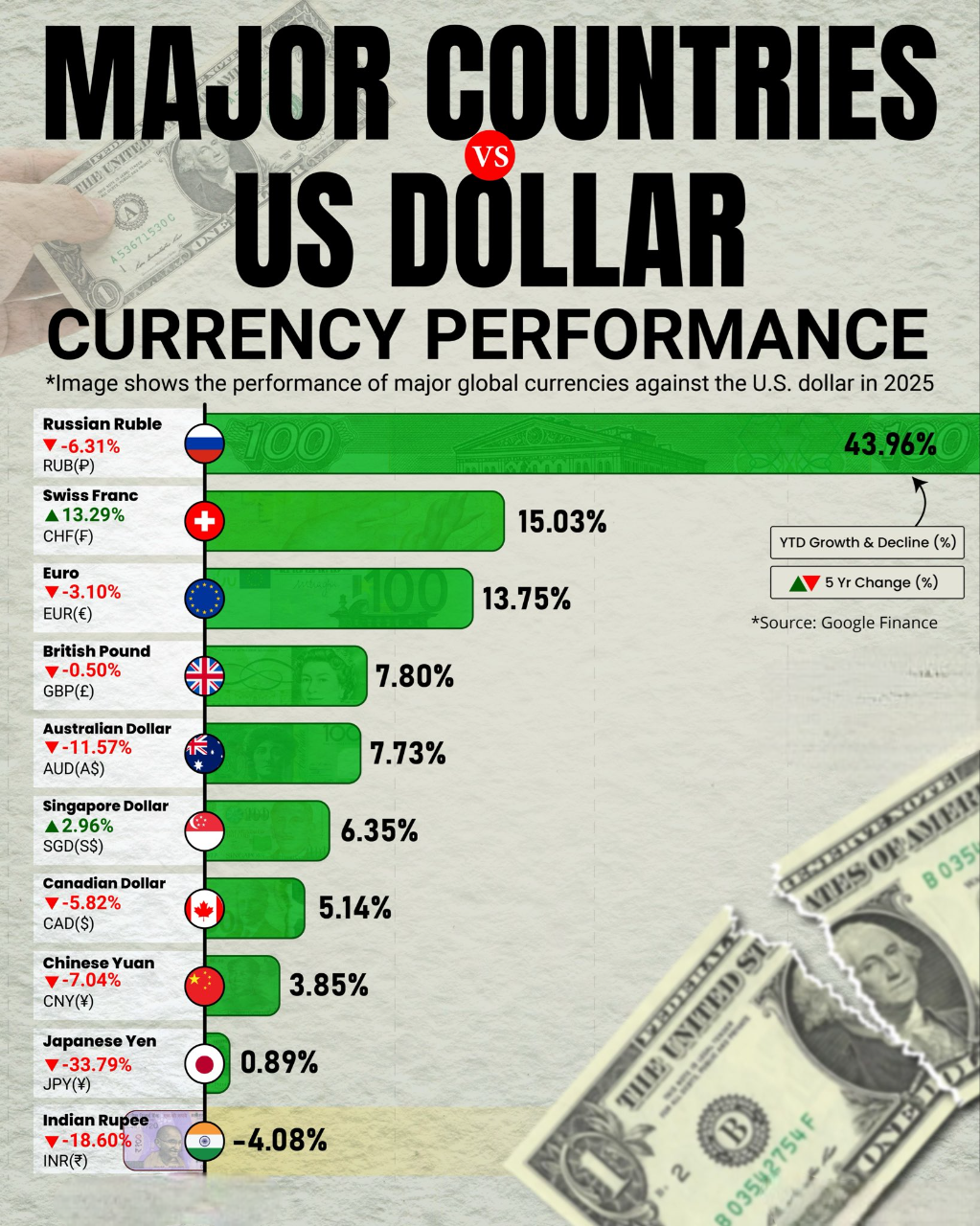

Major Countries vs US Dollar Currency Performance 2025 📊 The U.S. Dollar continues to dominate global markets in 2025. While some currencies like the Swiss Franc and Euro show resilience, others—including the Indian Rupee (₹) and Japanese Yen (¥)

See More

Madhur Achanta

Aspiring Entrepreneu... • 1y

Global Markets fell drastically today and some people are calling it "Crash". Here are few reasons why it happened. 1. The unemployment rate in US stood at 4.3% and most of the US based companies either it be Tech or Consumer company saw a dip in

See More

Anonymous

Hey I am on Medial • 1y

A brief summary of "Black Monday" on global markets for those who missed everything or don't want to scroll through their feed. You're welcome (or not): 1. The U.S. Federal Reserve previously refused to lower the key interest rate until September. T

See More

Harsh lambhate

We are just human • 1y

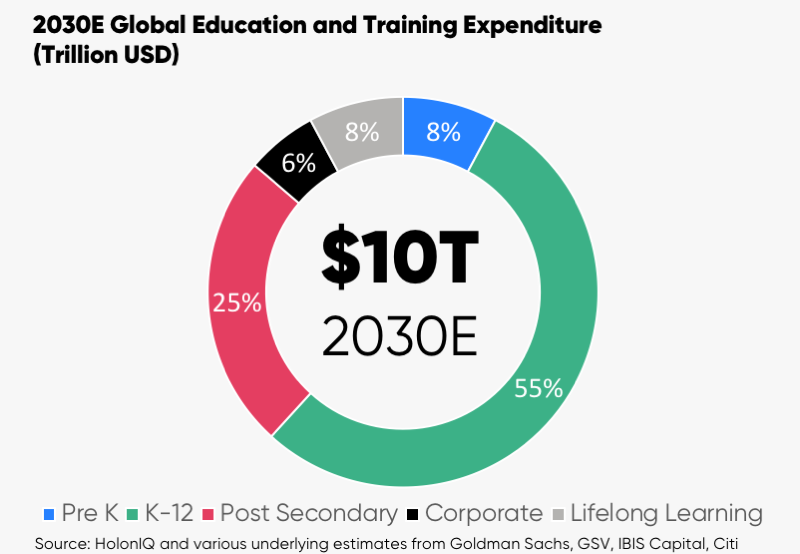

The global education market is expected to reach $10 trillion by 2030, up from $6 trillion in 2022. This growth is due to a number of factors, including: Population growth Developing markets are seeing population growth, which will drive expansion. T

See More

Poosarla Sai Karthik

Tech guy with a busi... • 10m

Recession ahead? Or just another overreaction? With global markets reacting to a fresh wave of tariffs, even the strongest stocks are tumbling. Suddenly, everyone’s talking about recession, portfolio crashes, and global meltdowns. But is it really

See MoreThujori Phesao

OURI: Choises, Not T... • 6m

• Failed Startup Ecosystems India has one of the highest Startup failure rates globally at 90% within a span of 5 years. Even though we are the third largest startup ecosystem. • Export ≠ Global Brand. We are struggling to place consumer brands or p

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)