Back

Anonymous

Hey I am on Medial • 1y

A brief summary of "Black Monday" on global markets for those who missed everything or don't want to scroll through their feed. You're welcome (or not): 1. The U.S. Federal Reserve previously refused to lower the key interest rate until September. The next day, poor employment and economic data were released, indicating that the economy is cooling. Many believe that the Fed delayed the rate cut too long. Traders are on edge. 😬 2. The Bank of Japan unexpectedly raised its key interest rate from 0.1% to 0.25%. The yen's exchange rate plummeted along with government debt. The central bank tried to stabilize the situation, and the yen responded by rising from 160 to 140 yen per dollar. But traders were spooked, as the export-oriented economy is not prepared for such a strong yen. 💹 3. The Japanese market opened with a steep dive of -12.40%. This is the largest drop since 1987. 📉 4. The shockwaves hit Asian markets—South Korea and the rest of Asia tumbled by 10%. In some places, trading was even halted. 🌩️ 5. Europe woke up next and fell by 3-6%. They got off relatively lightly. 😓 6. But the U.S. didn't fare as well—$2 trillion in market capitalization was wiped out in the first 15 minutes of trading. Fears of a recession are high. 😨 7. The U.S. Treasury denied the start of a recession but noted that the country is "uncomfortably close" to one. This reassurance didn't help—S&P 500 dropped by 3.18%. It might not seem like much, but it has been falling all last week as well. 🚨 8. The market heatmap—everything is red, and there's no end in sight. 🔥 9. Intel's CEO, facing a 36% drop in stock prices, prayed openly on Twitter. 🙏 10. The Fed refused to convene an emergency meeting to lower the rate. This means—it’s not over yet. Tomorrow will be crucial. 😬

Replies (7)

More like this

Recommendations from Medial

RootDotAi

From the ROOT to the... • 1y

Here's a Summary of the FED decision on March 20, 2024: 1. The Federal Reserve keeps interest rates steady at 5.50% for the fifth consecutive meeting. 2. The Fed maintains its anticipation of three interest rate reductions in 2024. 3. The proje

See More

Anonymous

Hey I am on Medial • 1y

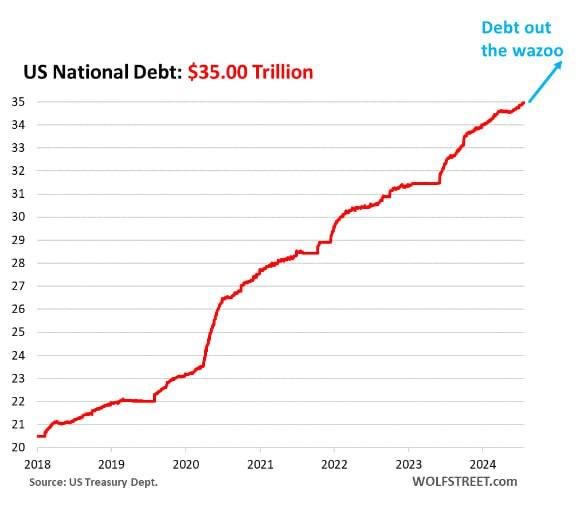

We Have a Breakthrough - The U.S. National Debt Has Surpassed $35 Trillion. 📉 Since January 2020, the U.S. economy has grown by 31%, while the debt has increased by 50%. The borrowing rate exceeds the real economic growth, and the U.S. is clearly l

See More

Tushar Aher Patil

Trying to do better • 5m

SUMMARY OF FED CHAIR POWELL'S SPEECH (9/17/25): 1. Unemployment rate has risen along with downside risks to employment 2. Inflation has risen and remains "somewhat elevated" 3. Growth in economic activity has "moderated" 4. Job creation rate is "bel

See Morefinancialnews

Founder And CEO Of F... • 1y

"Fed Meeting Insights, Bitcoin Hits Record High, and Chinese Economic Data Shake Global Markets" Wall Street Holds Steady Ahead of Fed Meeting, Bitcoin Hits Record High, and Mixed Chinese Data Spurs Stimulus Hopes 1. Federal Reserve Poised for Rate

See MoreAccount Deleted

Hey I am on Medial • 10m

Back in 2022, under Biden, the U.S. saw two consecutive quarters of negative GDP growth- which, by the textbook definition, is a recession. But suddenly, the definition got blurry. Experts started backpedaling, and the media followed suit without muc

See MoreRajan Paswan

Building for idea gu... • 1y

What If the USA Filed for Bankruptcy Today? If the United States declared bankruptcy today, the immediate effect would be catastrophic. The value of the U.S. dollar would plummet, triggering a global financial crisis. Banks worldwide would face inso

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)