Back

Karnivesh

Simplifying finance.... • 2m

When I analyse company performance, execution is only part of the story. What shapes outcomes more consistently are macroeconomic cycles. Interest rates, currency movements, commodity prices, and capital flows influence results long before strategy can adapt. I’ve seen the same business model perform exceptionally in one phase and struggle in another, without any internal change. What I now look for 👇 • How rate cycles affect leverage and cash strength • How currency shifts change competitiveness overnight • How commodity swings impact margins beyond efficiency • How capital flows decide sector leadership 📌 Key insight: Macro trends don’t affect all companies equally. They reveal balance-sheet resilience, pricing power, and adaptability. 👉 For a deeper, example-led breakdown, refer to the attached blog link for more details.

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 1m

When I started tracking export focused companies, I used to celebrate every rupee depreciation. A weaker rupee felt like instant good news. Dollar revenues would translate into bigger numbers. I noticed that reported revenue often jumped, but cash f

See More

Jewelpik App

House of jewellery b... • 6m

How Photography Angles Change Perception of Jewelry Weight & Size The way you photograph jewelry can drastically change how customers perceive size, weight, and value. Here's how angles affect perception: Top-down shots can make pieces look bigger

See MoreKarnivesh

Simplifying finance.... • 1m

When I look at the EV industry today, the story feels less about sustainability hype and more about balance sheets. Demand is real, policies are supportive, and adoption is rising but profitability is still uneven. • EVs are capital-intensive with l

See MoreKarnivesh

Simplifying finance.... • 1m

When I look at today’s market, higher-for-longer rates no longer feel temporary. They feel like the new backdrop. Borrowing feels heavier. Growth decisions take more thought. And strategies that thrived when capital was easy are now being tested. In

See More

Sairaj Kadam

Student & Financial ... • 1y

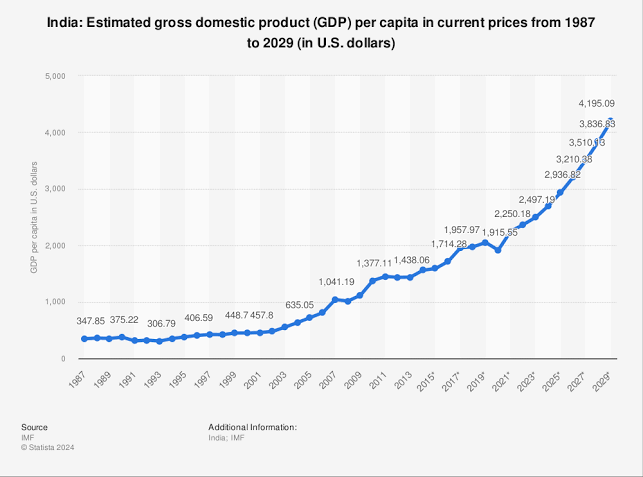

Does India Have the Capability? Does India Have a Market as Strong as the USA or Other Countries? Probably Not. This is where Price Power Parity (PPP) comes in. PPP compares the purchasing power of currencies by analyzing how much a basket of goods

See More

Karnivesh

Simplifying finance.... • 28d

Not all capital spending creates growth. Some of it simply keeps a business from slipping backwards. This became clear to me after a conversation where a company proudly announced a large CapEx plan. It sounded impressive, until the question came up

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)