Back

Vikram

¯\_(ツ)_/¯ • 1m

Is Fiat Currency Headed for Collapse? When the Backbone Weakens For decades, the global financial system has relied on one pillar: trust in the United States and its markets. Global capital flows, pensions, institutions, emerging markets, and reserves have shared one belief: if the U.S. is stable, the system is stable. But history shows systems don’t fail due to numbers alone they fail when trust erodes. 🌍 Fiat currency & trust Fiat money has no intrinsic value; it’s backed by confidence in governments and discipline.Countries like Iran show how rising debt, money printing, and eroding trust drive inflation and destroy savings—step by step. 📉 Why it matters now Even the global backbone is under pressure. In the U.S., debt keeps rising, liquidity creation is historic, markets lean on easy money over productivity, and prices often reflect narratives more than fundamentals. 🪙 Return to real assets:- Gold/Silver. ❓ Should wealth be measured only in fiat—or more in real assets?

More like this

Recommendations from Medial

Rajan Paswan

Building for idea gu... • 1y

What If the USA Filed for Bankruptcy Today? If the United States declared bankruptcy today, the immediate effect would be catastrophic. The value of the U.S. dollar would plummet, triggering a global financial crisis. Banks worldwide would face inso

See MoreVIJAY PANJWANI

Learning is a key to... • 2m

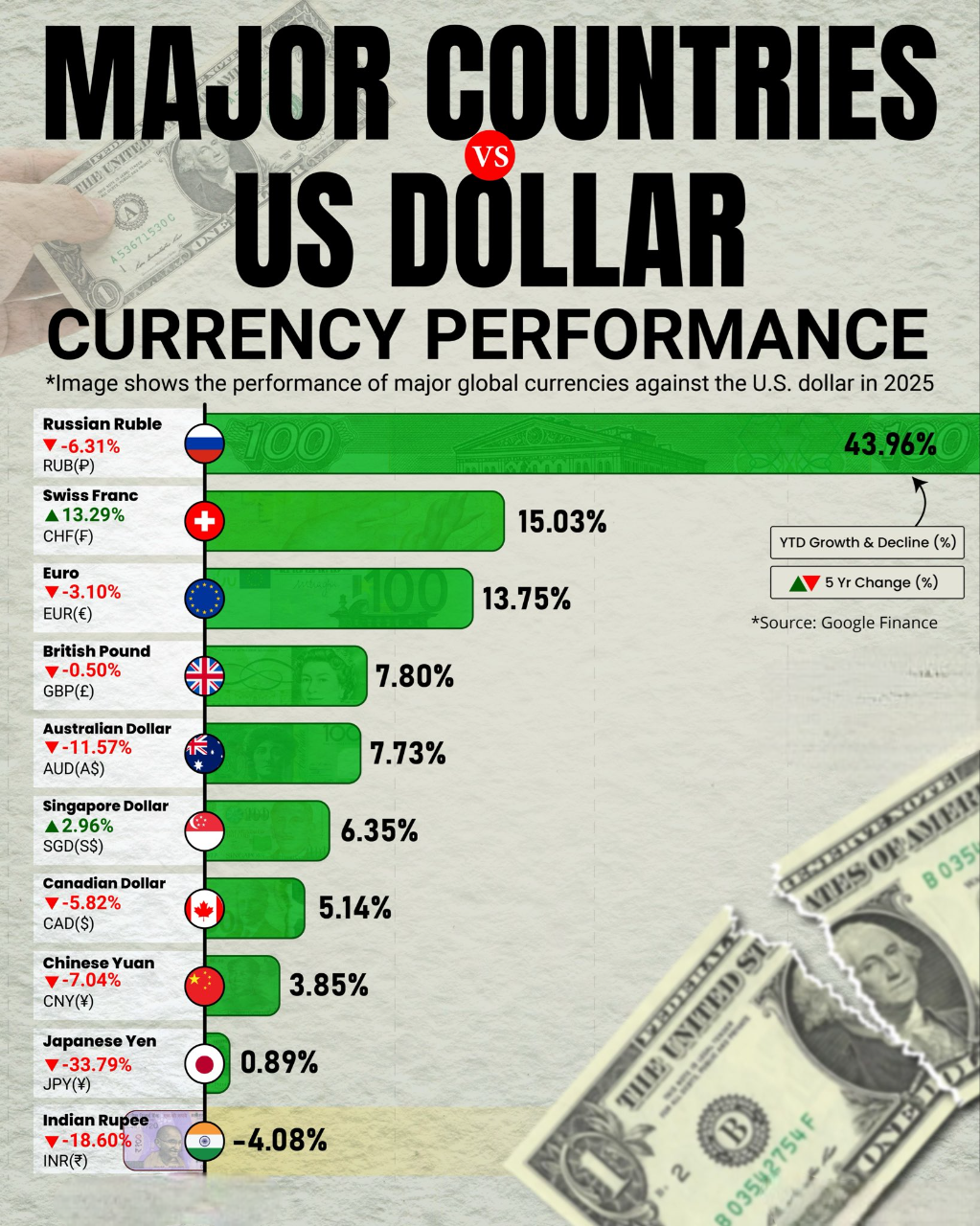

Major Countries vs US Dollar Currency Performance 2025 📊 The U.S. Dollar continues to dominate global markets in 2025. While some currencies like the Swiss Franc and Euro show resilience, others—including the Indian Rupee (₹) and Japanese Yen (¥)

See More

ProgrammerKR

Founder & CEO of Pro... • 10m

Trump Imposes Heavy Tariffs, China and EU Retaliate Former U.S. President Donald Trump has introduced a 104% tariff on Chinese imports and new duties on electronics, leading to retaliation from China and the European Union. Global markets responded

See MorePRATHAM

Experimenting On lea... • 6m

The U.S. market is overvalued, with a Buffett Indicator at 217% and P/E near 37–38, close to dot-com bubble levels (P/E - 44). Global markets ( India or China) may outperform the U.S. in the next 5–10 years. FIIs should flow some cash in India as we

See MoreSairaj Kadam

Student & Financial ... • 1y

The Truth of the Rupee’s All-Time Low & Actionable Insights (5 Minute Read) The Indian Rupee (INR) recently fell to an all-time low of 84.1950 against the U.S. Dollar (USD). This decline follows a stronger USD, driven by early U.S. presidential ele

See More

Sairaj Kadam

Student & Financial ... • 9m

Moody’s just downgraded the U.S. credit rating from AAA to AA1 huge blow to confidence. Last week, Nasdaq surged 7%, S&P 500 5%, Dow 3% on tariff truce. But today? Futures drop: Dow -0.9%, S&P -1.2%, Nasdaq -1.6%. Debt fears now shaking markets hard.

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)