Back

Sairaj Kadam

Student & Financial ... • 1y

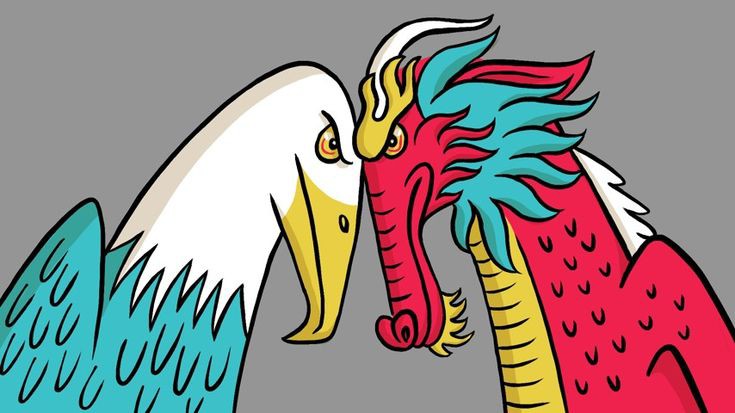

The Truth of the Rupee’s All-Time Low & Actionable Insights (5 Minute Read) The Indian Rupee (INR) recently fell to an all-time low of 84.1950 against the U.S. Dollar (USD). This decline follows a stronger USD, driven by early U.S. presidential election results showing Donald Trump ahead. As a result, the Reserve Bank of India (RBI) has stepped in, selling dollars to mitigate further depreciation. While the rupee weakened, it performed relatively better than other Asian currencies, which saw drops between 1% to 1.3%. Why Is the Rupee Weakening? U.S. Election Impact: The lead of Donald Trump in the U.S. presidential election has fueled a rally in the U.S. dollar. With Trump’s policies on trade tariffs and a stronger stance on global relations, the USD has gained momentum. Trump’s Trade Tariffs: Trump’s trade policies, including imposing tariffs on countries like China and India, have intensified market uncertainty. These policies have sparked a shift in investor sentiment, making the USD more attractive. Rising U.S. Treasury Yields: U.S. Treasury yields have surged, pushing up the value of the USD even further, which in turn puts pressure on global currencies, including the INR. What Can You Do in This Situation? Key Takeaways 1. Stay Informed on Global Events: Political events like the U.S. elections and Federal Reserve decisions can greatly influence global currencies. Understanding how these events impact the markets will help you stay ahead and make better financial decisions. 2. Keep an Eye on RBI Actions: The Reserve Bank of India frequently intervenes to stabilize the rupee during times of volatility. Monitoring these actions can give you insight into the possible limits of the rupee’s depreciation. 3. Diversify Your Investments: Given the current volatility, it’s wise to spread your investments across different asset classes—equities, bonds, or foreign assets. This will help mitigate the risks associated with currency fluctuations. 4. Understand the Impact of 'Trump Trades': With Trump’s proposed tariffs and his impact on global trade relations, the U.S. dollar could continue to strengthen. If you're considering currency trades, weigh the potential risks and rewards based on Trump’s policies. Conclusion: The Indian Rupee’s current weakness is influenced by global political and economic events, especially the U.S. presidential election and its aftermath. To navigate this volatility, it’s essential to stay informed, diversify investments, and understand the impact of U.S. policies on global markets. Remember: All financial decisions carry risks. This information is provided for educational purposes, so always do your own research and make informed choices.

Replies (7)

More like this

Recommendations from Medial

Three Commas Gang

Building Bharat • 1y

Trump victory could favor global oil prices, defense tech, and pharma, says PL Capital. The brokerage notes that the U.S. election may significantly impact India's stance amidst geopolitical tensions, leadership changes in Bangladesh, and regional in

See MoreAltamash Zia

Building Strategies ... • 1y

US President-elect Donald Trump has reiterated his plan to implement reciprocal tariffs on countries that impose high duties on American goods, specifically mentioning India and Brazil. At a press conference in Mar-a-Lago, Trump highlighted the dispa

See More

Three Commas Gang

Building Bharat • 1y

The Indian rupee hit an all-time low of 84.13 against the USD, marking its fourth consecutive drop. Monday saw a previous low of 84.11. This dip occurs as investors closely watch U.S. elections on Nov 5. #IndianRupee #Forex #USDElection #CurrencyUpda

See MoreProgrammerKR

Founder & CEO of Pro... • 11m

Trump Imposes Heavy Tariffs, China and EU Retaliate Former U.S. President Donald Trump has introduced a 104% tariff on Chinese imports and new duties on electronics, leading to retaliation from China and the European Union. Global markets responded

See MoreBharat Yadav

Betterment, Harmony ... • 1y

Donald Trump’s vision to reshape the world’s largest economy through protectionist policies that put ‘America First’ will damage growth, according to Financial Times economists’ polls. Surveys of more than 220 economists in the US, UK and Eurozone o

See More

VIKRAM VARAL

EXIM TRADE IN COMMOD... • 9m

🇺🇸 Trump’s 50% Tariffs on #Steel and #Aluminum Now in Effect 🔧 Key Changes Tariff Increase: Import tariffs on steel and aluminum (except from the U.K.) have doubled from 25% to 50%. U.K. Exempted: Due to an in-progress trade agreement, the U.K.

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)