Back

Priyadarshi M

•

JeeTaa • 2m

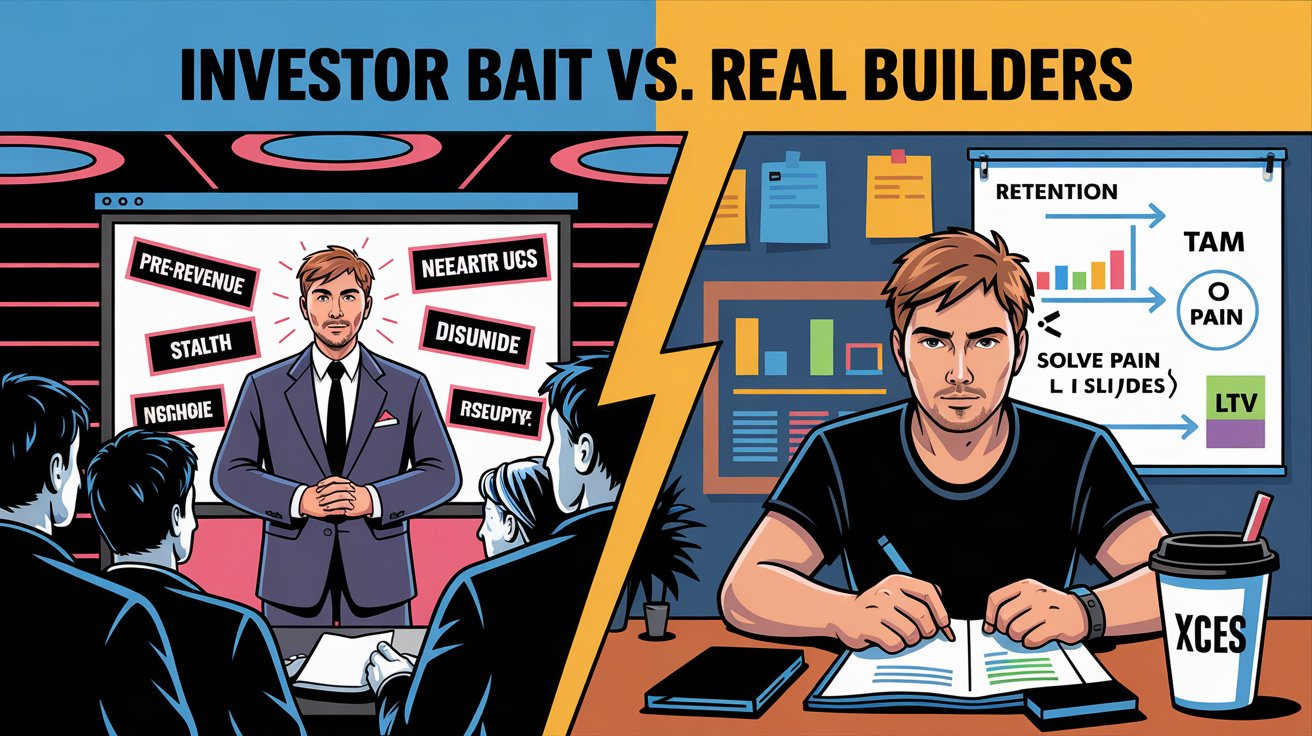

𝗜𝗳 𝗬𝗼𝘂 𝗡𝗲𝗲𝗱 𝗦𝗹𝗶𝗱𝗲𝘀 𝘁𝗼 𝗘𝘅𝗽𝗹𝗮𝗶𝗻 𝗬𝗼𝘂𝗿 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀, 𝗜𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀 𝗔𝗹𝗿𝗲𝗮𝗱𝘆 𝗗𝗼𝘂𝗯𝘁 𝗜𝘁 𝙄𝙛 𝙬𝙤𝙧𝙙𝙨 𝙛𝙖𝙞𝙡, 𝙛𝙪𝙣𝙙𝙞𝙣𝙜 𝙬𝙞𝙡𝙡 𝙖𝙡𝙬𝙖𝙮𝙨 𝙬𝙖𝙡𝙠 𝙖𝙬𝙖𝙮 In my work with many founders who reach out for support and guidance, they always ask for a Pitching session. Before we begin, I ask, “Tell me the summary of your venture.” 80% never able to give convincing answers. Capital doesn’t fund decks—it funds conviction. And conviction only shows up when your business is clear without props. In strategic consulting, one truth repeats across startups and growth-stage companies: Founders who can’t explain what they do, who it’s for, and why it wins, aren’t ready for capital. Slides should support clarity, not create it. 𝗛𝗲𝗿𝗲’𝘀 𝘄𝗵𝗮𝘁 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝗶𝗰 𝗳𝗶𝘅𝗲𝘀 𝗯𝗲𝗳𝗼𝗿𝗲 𝗳𝘂𝗻𝗱𝗿𝗮𝗶𝘀𝗶𝗻𝗴: • Sharp problem definition investors instantly recognise • A clear value proposition, explained in one breath • Obvious Differentiation, not exaggerated • Business logic that stands without charts • A narrative that sounds inevitable, not hopeful When clarity exists, decks become powerful. Without clarity, even perfect slides fail. Investors don’t back presentations. They back leaders who understand their business well enough to explain it simply. Before you raise capital, invest in clarity. Choose Strategic Consulting to pressure-test your thinking, before investors do. #StrategicConsulting #StartupClarity #FounderMindset #CapitalReadiness #BusinessStrategy #InvestorThinking #StartupGrowth #LeadershipClarity #FundraisingReality #BuildBeforePitch

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 7m

Most startup advice sounds smart. Few actually survived. What truly matters: • Speed is nothing without clarity • Revenue hides weak retention • Vanity metrics kill conviction • No PMF? Nothing else matters • Burn is silent until it burns everythin

See MoreNawal

Entrepreneur | Build... • 10m

Most Indian Founders Don’t Build Startups. They Build Investor Bait. Let’s be honest: → You’re not building for users. → You’re building for pitch decks. → You’re designing “TAM” not “Retention.” We’ve glamorized funding so hard, we forgot: VCs f

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)