Back

Nawal

Entrepreneur | Build... • 10m

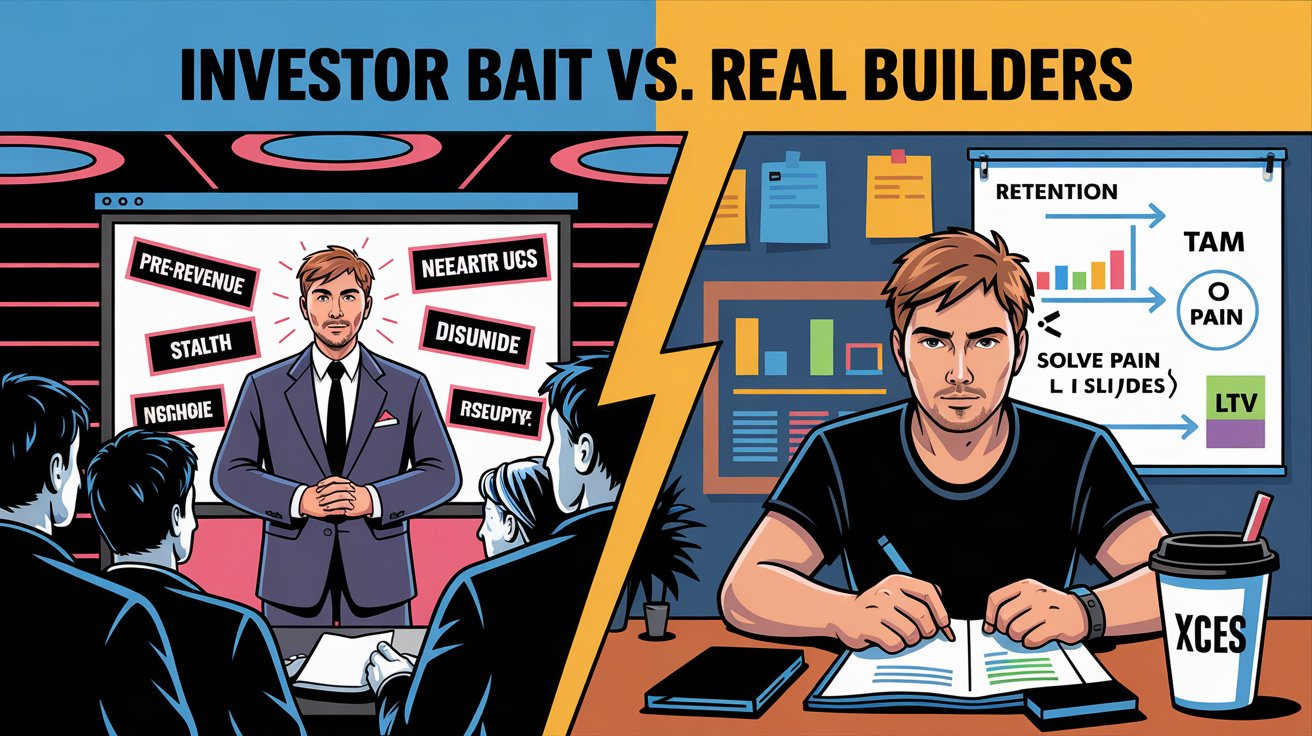

Most Indian Founders Don’t Build Startups. They Build Investor Bait. Let’s be honest: → You’re not building for users. → You’re building for pitch decks. → You’re designing “TAM” not “Retention.” We’ve glamorized funding so hard, we forgot: VCs follow traction. Not the other way around. And in India, where distribution is tough and CAC is deadly — Only two things matter: → Solve something painful → Make it repeatable The rest? → “Disruptive idea” = Buzzword → “Pre-revenue” = Pre-survival → “Stealth mode” = Nobody cares yet Real founders? → Talk to 100 customers before 1 investor → Build landing pages before pitch decks → Obsess over LTV, not “hockey stick slides” You want proof? → Zepto got brutal about ops before going viral → XCES fixed broken unit economics before shouting “growth” → boAt didn’t raise till it already dominated Amazon Learning 🔥 :- If you build for pitch decks, you’ll raise once. If you build for users, you’ll never stop raising.

Replies (2)

More like this

Recommendations from Medial

Sourav Mishra

•

Codestam Technologies • 10m

We’ve glamorized the wrong heroes. Startups raise $5M and celebrate. But they have no revenue. No profit. No product-market fit. Just a deck, a dream, and a burn rate. Meanwhile, there’s a quiet founder pulling $40k/month from a boring SaaS with 0

See MoreAanya Vashishtha

Drafting Airtight Ag... • 10m

Raising Pre-Seed Money? Here’s What No One Tells You Pre-seed funding’s brutal—investors want traction before you’ve barely started. Here’s the secret: strong personal branding can tip the scales. Early founders who share their vision online,

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)