Back

Vivek Joshi

Director & CEO @ Exc... • 2m

actively sourcing acquisition opportunities for our key investors. If you or your clients match either of the following high-priority mandates: Mandate 1: Mid-Sized Profitable Entity (Sale) seeking a profitable entity for a complete buyout. Key Metric: EBITDA in the range of INR 3 - 5 Cr. Target Asking Price: INR25 - 30 Cr (Negotiable based on due diligence). Location: Mumbai or surrounding areas. Mandate 2: Distress Sale/Loss-Making Entity (100% Buyout) A unique opportunity for a distressed asset sale. The key requirement is a demonstrable loss on the books. This is a 100% buyout at a distress valuation. Key Metric: Must be a loss-making entity with losses clearly reflected in the books. Acceptable: Non-Performing Assets (NPA) will be considered, provided the loss criteria is met. Location/Price: Open on location and price; valuation will reflect a significant distress sale. Drop your detailed proposal, IM, or pitch deck to: info@excessedgeexperts.com www.excessedgeexperts.com

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 1m

Seeking Strategic Acquisitions: Distressed Assets & NBFCs Are you looking for a clean exit or a structured turnaround for a struggling entity? We are currently expanding our investors' portfolios and are mandate-driven to acquire the following: • Los

See More

Dipesh Pimpale

Data Analytics | 𝐀�... • 1y

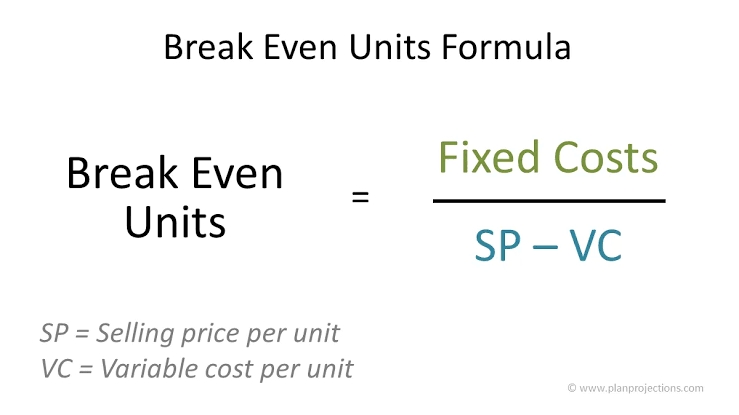

Imporant metric for Start-ups - Break Even Units Suppose we are a shoe brand and we want to calculate our units to be sold for break even (No profit No Loss) Fixed Cost - 4,00,000 Selling Price per Unit - 1200 Variable Cost per Unit - 800 Contributi

See More

Account Deleted

Hey I am on Medial • 1y

🤖 Named Entity Recognition (NER) plays a crucial role in Natural Language Processing by helping machines understand and categorize key information from text. Discover its significance and applications in our latest article! Read more: http://news.e

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)