Back

Ketan Sojitra SMEDOST

•

Gujarathi Empire Group • 2m

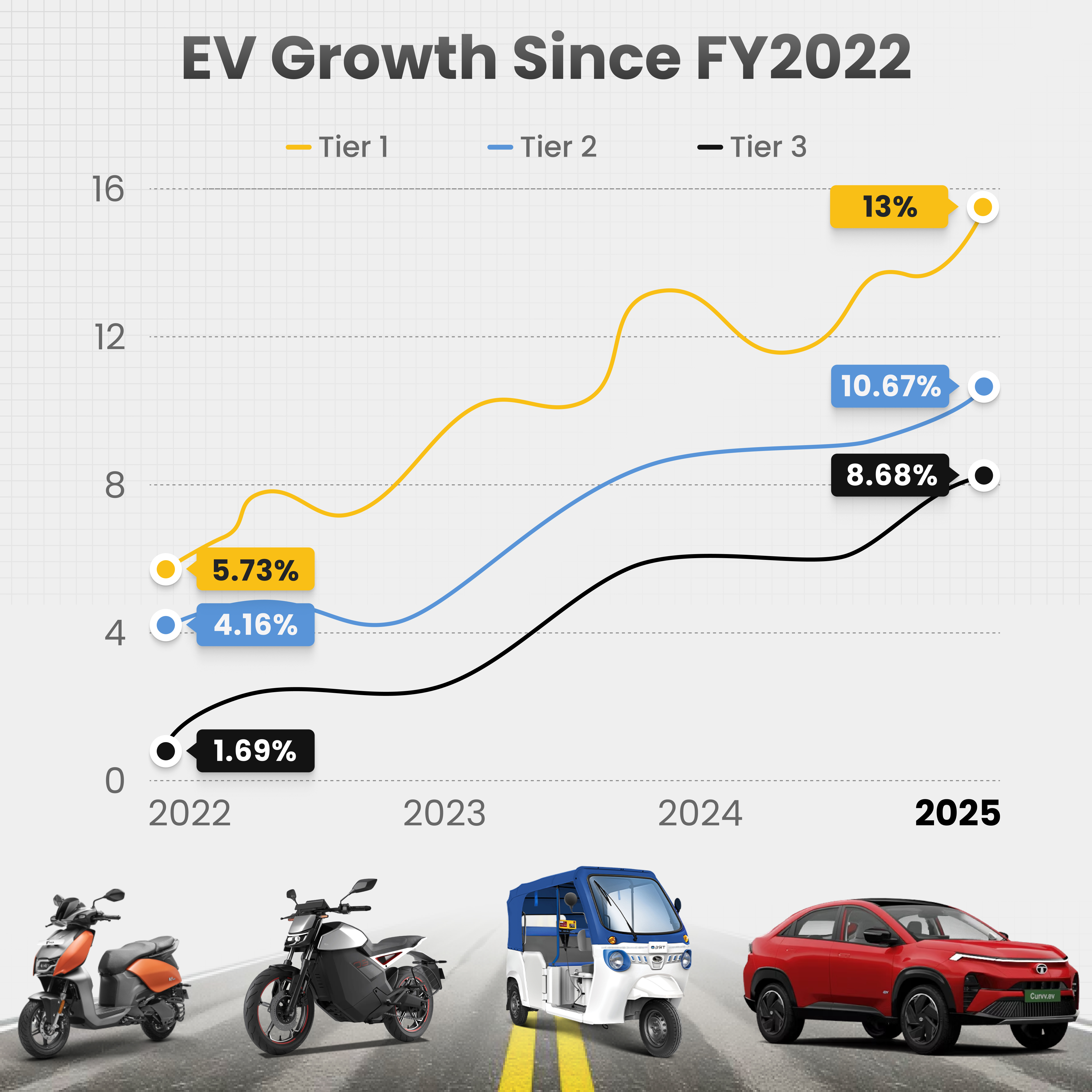

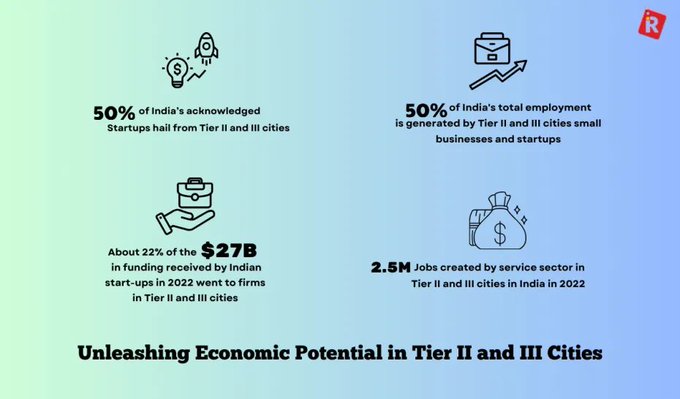

✴️ Why Tier-2 India Will Drive the Next Decade More Than You Think? - Evidence from City Intelligence and Country Reports! 🚀 PART-1 💡 MSME & Cluster Investment Brief: Where PE Can Deploy Smart Capital in Ahmedabad, Pune, Surat, Vadodara, Coimbatore, Ludhiana, Jaipur, Indore, Bhopal & Nashik? ✳️ The Quiet Centres of Gravity: Where India’s Future Is Being Built It is oddly fitting that the next chapter of India’s economic playbook is not unfolding in glass towers overlooking Marine Drive or corporate campuses orbiting Outer Ring Road. Instead, the heartbeat of tomorrow’s growth pulses through cities where the world rarely points its compass: Coimbatore’s engineering lanes, Surat’s diamond alleys, Indore’s food-processing clusters, Jaipur’s design corridors, Ludhiana’s manufacturing parks, Nashik’s agritech pockets. 🌈 Foreign investors, overwhelmed by Tier-1 noise, often miss the unmistakable clues: Tier-2 India has quietly become the country’s most investible geography. 🟪 Why here, and why now? Three forces have converged, almost like tectonic plates shifting gently beneath India’s economic landscape: ✅ 1. Demand has decentralised. Bharat’s middle-income households are no longer “aspirants”—they are active buyers shaping Consumer trends. Their purchasing logic is neither frugal nor extravagant; it is deliberate. ✅ 2. Supply chains have become localised. Post-pandemic disruptions pushed industries—textiles, auto components, 3PL logistics, chemicals—to create smaller, distributed clusters. Tier-2 became the logical destination. ✅ 3. Capital efficiency improved. Operational costs in Tier-1 cities continue to suffocate MSMEs. Meanwhile, Tier-2 cities offer 22–40% lower operating expenditure, 25–30% faster talent retention, and better access to decision-makers. 📌 In this increasingly complex landscape, private equity no longer asks: “How big is India’s TAM?” but rather, “Which cluster will yield the fastest, safest, most replicable outcomes?” 📌 This is where industry intelligence reports India, Consumer insights India, and fine-grained Market intelligence - produced by the Best market research companies in India - become essential. And firms have emerged as quiet but decisive enablers of this strategic shift, providing city- and cluster-level intelligence that even the Top Five market research companies in India often overlook. PART-2 ON -13Dec.2025

More like this

Recommendations from Medial

Ketan Sojitra SMEDOST

•

Gujarathi Empire Group • 2m

✴️ Why Tier-2 India Will Drive the Next Decade More Than You Think? - Evidence from City Intelligence and Country Reports! 🚀 PART-4 💡 Strategy Blueprint: How PE Should Enter Tier-2 India 🚀 ☑️ 1. Start with TAM–SAM–SOM That Is “Cluster-Specific,”

See More

Rohan Saha

Founder - Burn Inves... • 1y

Just as we look at India’s second-hand car market, we can similarly look at India’s second-hand mobile market. There is still a significant gap here, especially in Tier 3 and Tier 4 cities. While there are some startups in Tier 1 cities, no one is cu

See MoreRUSHABH HARARI

One big thing start ... • 1y

🚀 Startups Are Missing Out on a Goldmine! 🌍 Everyone’s chasing the Tier-1 city customers, but what about Tier-2 & Tier-3 cities? 🤔 📊 The Reality: 65%+ of India’s population lives in Tier-2 & 3 cities. Rising disposable income 💰, increasing i

See MoreSoma Sekher

Business Development... • 1y

Soma’s View | Post #1 🚀 How India’s Postal Network Can Disrupt Quick Commerce Quick commerce is growing rapidly, but it has challenges: ❌ High last-mile delivery costs ❌ Limited reach beyond metro & Tier-1 cities ❌ Struggles with profitability 💡

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)