Back

Jayant Mundhra

•

Dexter Capital Advisors • 3m

Turns out, Lenskart's entire international play is at risk due to an ED investigation 🚨🚨 So much hype was built around the IPO and founder's controversy, that real red flags did not even get any coverage. Makes me wonder, founder created the controversy to maybe divert the attention from the real issues? Details shared below such that even a layman would get it all. .. Lenskart is currently under an investigation from the Directorate of Enforcement, or the ED. The document says this is for "procedural delays" and FEMA violations. But, what’s the impact? Because Lenskart is under this scrutiny, it is required to get a "No-Objection Certificate," or NOC, from the ED every single time it wants to make an "overseas direct investment.” Let me translate this from complex legal language to simple English. - To buy ANY foreign company, Lenskart must get a permission slip. From the very agency that is actively investigating it - Same holds even if it wants to invest in Owndays/Meller which it already owns .. And it gets worse. ED has denied its requests for this NOC. Twice. This is a massive red flag. The company’s core growth strategy was directly blocked by the Govt. So how are they still expanding? How did they buy Meller in Spain? Management has been using a legal loophole. - A "deemed granted" provision - This rule means that if the company applies for the NOC and the ED does not respond within a set time, the permission is just... "deemed" to be granted. They just go ahead with the deal This is the fragile foundation for their entire global ambition. A regulatory grey area. .. Lenskart is VERY aware of this risk. The DRHP explicitly warns investors: "While our Company has availed this provision in the past, we cannot assure you that we will be able to continue doing so in the future" This is the central risk. - The Bull case is that this is just a procedural headache. A fine will be paid, and it all goes away - The Bear case is that the company's most important strategy is operating entirely at the discretion of the ED And any which way, the commands a premium valuation for an international play which rests on a "deemed granted" clause against ED? Ideally, that should have led to a valuation discount, and not a premium - No? Or well, whatever do I know. None of this is an investment/trading advisory or recomendation anyway. It’s just my analysis - which can entirely be wrong.

Replies (1)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

Need advice! I recently got selected for internship in a prestigious company , it’s a remote internship. The company is asking for NOC from college (I am in 3rd yr) but the college is not ready to issue NOC , what shall I do ? Someone said - go for a

See MoreRohan Saha

Founder - Burn Inves... • 9m

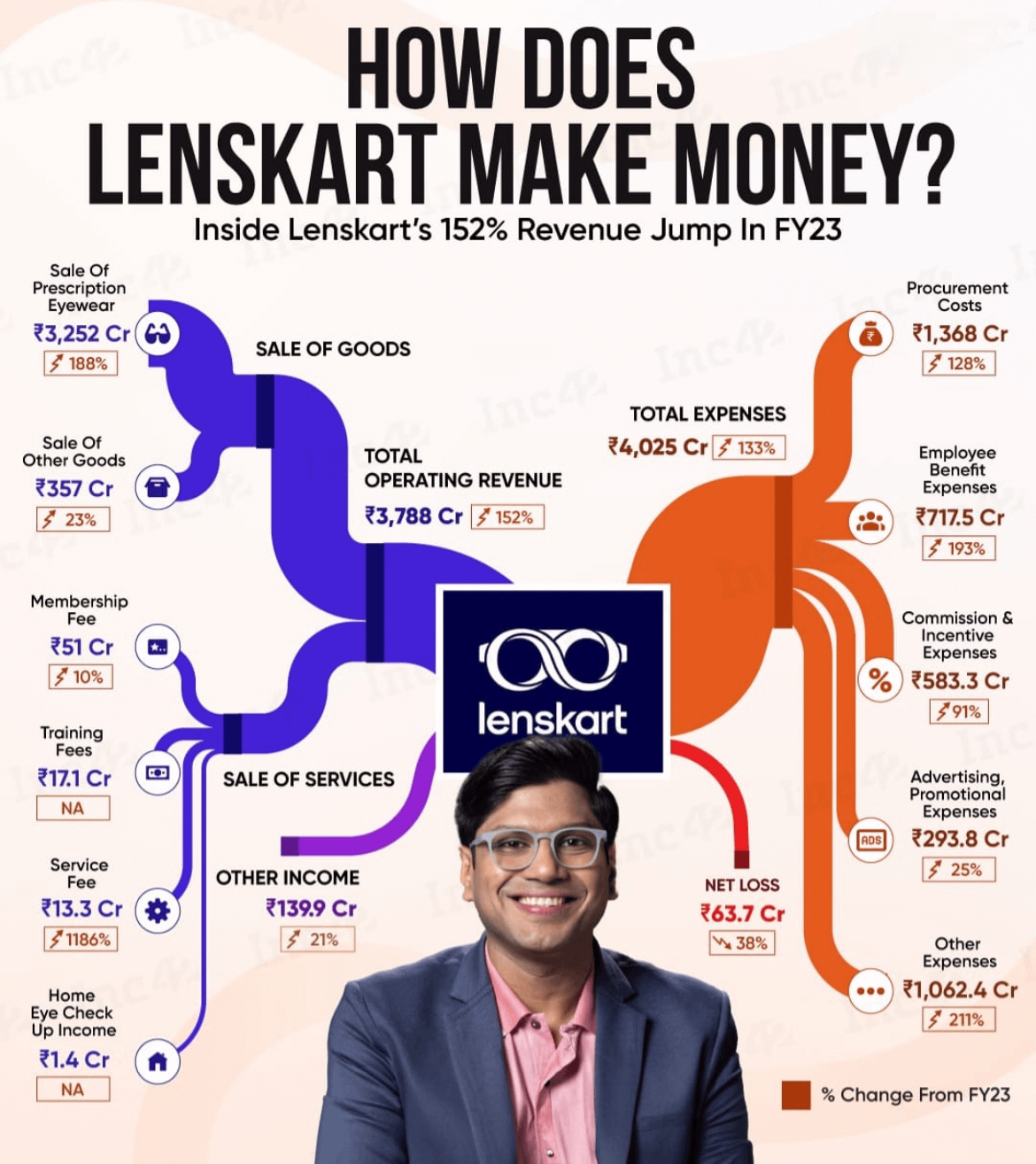

Lenskart has now registered itself as a public company. Earlier, it was known as Lenskart Solutions Private Limited, but the name has been changed to Lenskart Solutions Limited. The IPO announcement could come any time now. A few months ago there wer

See MoreAccount Deleted

Hey I am on Medial • 1y

Lenskart IPO Also Coming Soon! • Lenskart.com is also planning an IPO to raise between $750 million to $1 billion, with a valuation of $7-8 billion. • In FY24, Lenskart generated ₹5,427 crores in revenue, a 23% increase from the last financial year

See More

Jayant Mundhra

•

Dexter Capital Advisors • 8m

I’ve been saying this for Lenskart & Peyush Bansal for 1.5+ years now: THEY ARE AN ANOMALY (in a super positive way)! And with founder Peyush Bansal’s latest move, that assertion only strengthens. What move? - The company is set to go for a Big Ban

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)