Back

Jayant Mundhra

•

Dexter Capital Advisors • 4m

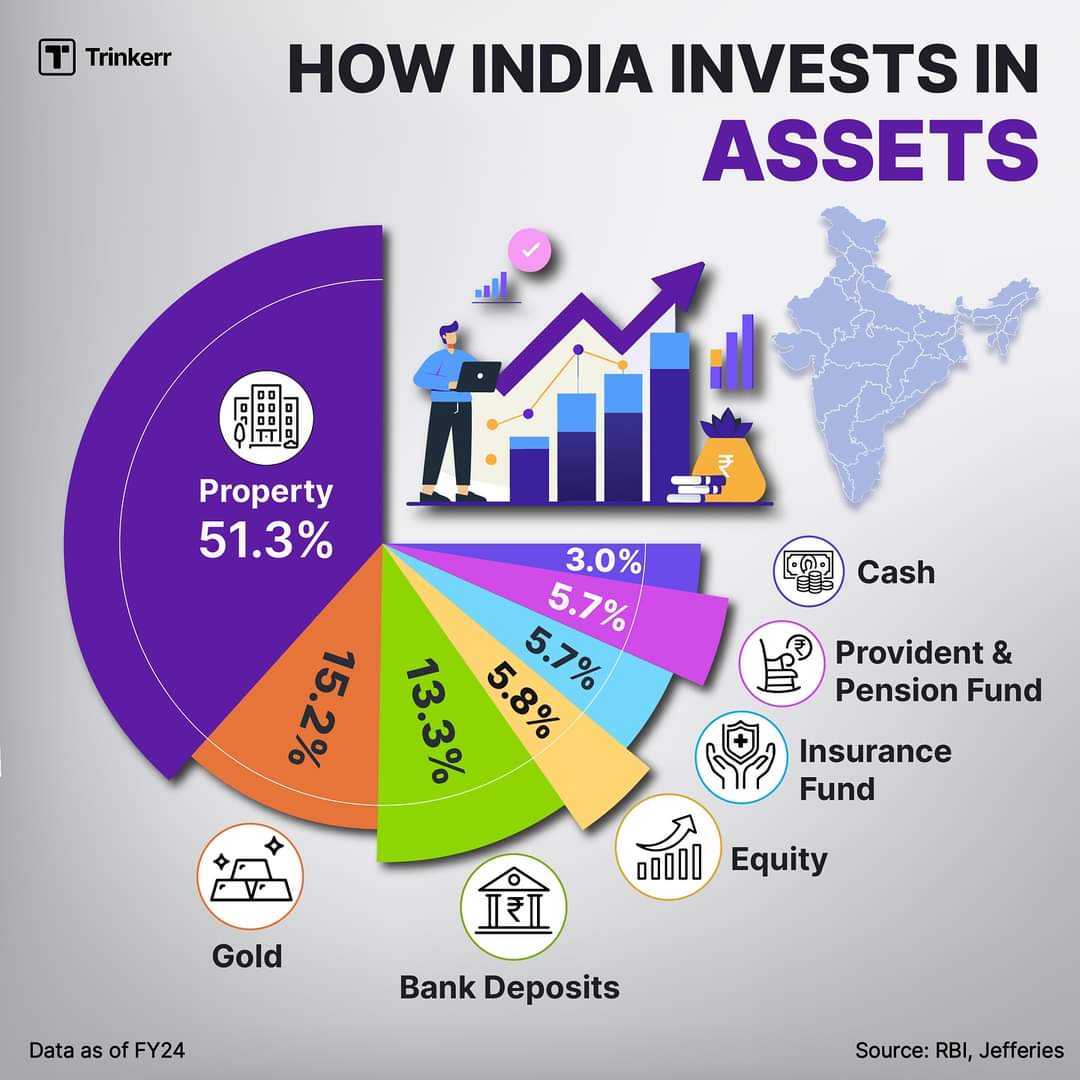

Not many know, but 1,549 people in India now have wealth over Rs 1k crore. That's a staggering 17% jump YoY! 🙌 - Mumbai just trumped Beijing as the Asian city with the most billionaires. Its billionaire count soared by over 39% in 2024 alone, while Delhi entered the global top 10. - And for every new billionaire, India is adding hundreds of new millionaires Result? The wealth management market is absolutely exploding. .. But here’s the big problem. A huge number of these new millionaires are from smaller cities like Faridabad, Ludhiana, Agra, Bhilai, Jodhpur etc. - These folks, often from traditional businesses, have historically parked their wealth in gold or real estate - Very few have meaningful allocations to equities. Even fewer touch private equity like Alternative Investment Funds (AIFs) or venture capital. This is purely due to a lack of awareness and quality access This is why I’m pretty excited about Groww acquiring wealth-tech major Fisdom to support its new dedicated wealth-tech platform called ‘W’. .. Think this way: In just 6 years, Groww has won nearly 25% of all new demat and SIP accounts in the country. It brings a massive, trusted B2C tech platform. - Fisdom, in contrast, brings the missing piece of the puzzle. It has deep expertise in serving affluent clients, offering sophisticated products like Portfolio Management Services (PMS), AIFs, and even access to unlisted equities of pre-IPO companies - Plus, Fisdom also runs a B2B2C model by partnering with banks, giving it a massive reach. The synergy is perfect. Groww has the massive distribution funnel of retail investors, and Fisdom has the specialised wealth products and advisory know-how. .. And this becomes super important for one big reason. I’ve spoken to many seriously wealthy people, and almost every single one has numerous instances to share about how they have been misled by wealth managers chasing commissions. With that respect, Groww's W + Fisdom offering starts with a clean slate. Thus, they have a serious opportunity to make a dent here. And I say that as someone invested in a listed competing major (Centrum). What do you think?

Replies (1)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 9m

INDmoney Acquires Fisdom Wealth management startup INDmoney has acquired Fisdom in a cash and stock deal. This marks INDmoney’s push to strengthen its mutual funds and insurance stack. Fisdom brings 4M+ users, partnerships with 50+ banks, and deep

See More

Account Deleted

Hey I am on Medial • 1y

The Year of Indian Startups' IPOs Series : 1. Groww -> • Groww is planning an IPO to raise approximately ₹6,000 crore, aiming for a valuation between $6 billion and $8 billion. • In FY24, Groww reported ₹3,145 crore in revenue from operations, do

See More

Cards Wala

One stop shop for ev... • 3m

#Groww IPO is up for subscription. Although the company is very good but I am going to pass on it. Not great GMPs. Also, the space has become very cluttered. Lot of people fighting in the brokerage and wealth management space. Hope I don't regret

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)