Back

Priyadarshi M

𝗦𝘁𝗮𝗿𝘁𝘂𝗽 𝗖𝗮�... • 4m

𝗦𝗲𝗲𝗱 𝗦𝘁𝗮𝗿𝘁𝘂𝗽𝘀 𝗙𝗮𝗰𝗲 𝗢𝘂𝘁𝘀𝗶𝘇𝗲 𝗥𝗲𝘃𝗲𝗻𝘂𝗲 𝗗𝗲𝗺𝗮𝗻𝗱𝘀 Early-stage startups often dream big, but today’s investors expect concrete results before committing. 𝗧𝗵𝗲 𝗗𝗲𝗺𝗮𝗻𝗱𝘀 • High Traction Expectations: Investors now seek strong user adoption, even at the pre-seed stage. • Revenue Pressure: Seed funding often depends on early revenue or proof of monetisation. • Metrics Over Ideas: Simply having an MVP or concept rarely secures funding anymore. • Competitive Market: With more founders than ever, traction and evidence matter most. 𝗞𝗲𝘆 𝗔𝗰𝘁𝗶𝗼𝗻𝘀 • Prioritise Early Wins: Launch pilots to gain initial users and revenue. • Track Metrics: Measure growth through engagement, retention, and conversions. • Validate Market Fit: Use feedback, surveys, and tests to confirm genuine demand. • Communicate Progress: Provide investors with clear updates showing measurable growth. 𝙎𝙩𝙧𝙪𝙜𝙜𝙡𝙞𝙣𝙜 𝙬𝙞𝙩𝙝 𝙄𝙙𝙚𝙖, 𝙀𝙭𝙚𝙘𝙪𝙩𝙞𝙣𝙜 𝙤𝙧 𝙩𝙧𝙖𝙘𝙩𝙞𝙤𝙣? 𝘿𝙈 𝙪𝙨 𝙛𝙤𝙧 𝙜𝙪𝙞𝙙𝙖𝙣𝙘𝙚 𝙖𝙣𝙙 𝙨𝙪𝙥𝙥𝙤𝙧𝙩. #StartupFunding #SeedStage #PreSeed #InvestorExpectations #EarlyStageStartups #StartupGrowth #MVP #PilotRevenue #TractionMatters #FounderTips #StartupAdvice #JeeTaaConsulting

More like this

Recommendations from Medial

Swapnil gupta

Founder startupsunio... • 9m

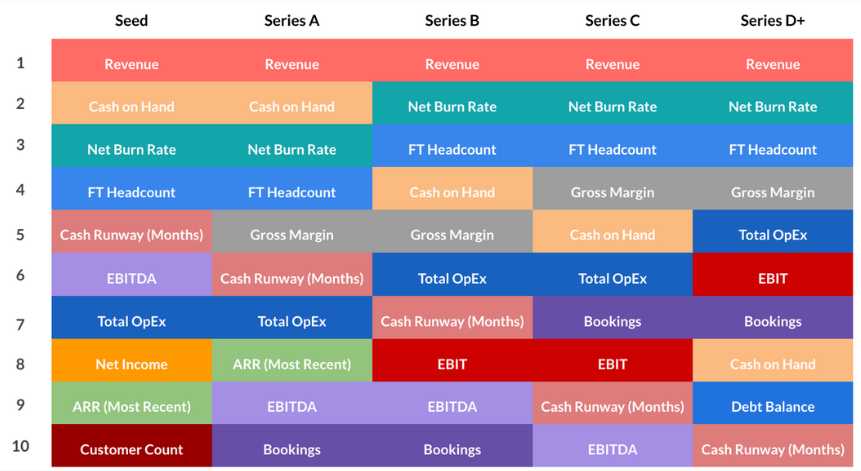

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreSwapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreRakshit Bondwal

Startup Founder • 4m

Every time I open Twitter or LinkedIn, I see startups raising $1M–$2M. But when it’s your turn, investors say, “You’re pre-revenue, come back later.” But seriously, where are the investors who fund early-stage startups? Niket Raj Dwivedi Man Please

See MoreVivek Joshi

Director & CEO @ Exc... • 10m

Discover the incredible journeys of 10 successful startups that shattered traditional VC metrics! From Uber to Airbnb and Instagram, explore how these companies thrived despite unconventional revenue models. Learn why venture capitalists often priori

See MoreKashish

Just one of you with... • 10m

I'm Kashish, currently building a SaaS product aimed at simplifying an Investors delima of whether to invest in a business or not . I’ve compiled a few key areas that I believe investors focus on: 1)Founders & team strength 2)Revenue model & prici

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)