Back

Vivek Joshi

Director & CEO @ Exc... • 5m

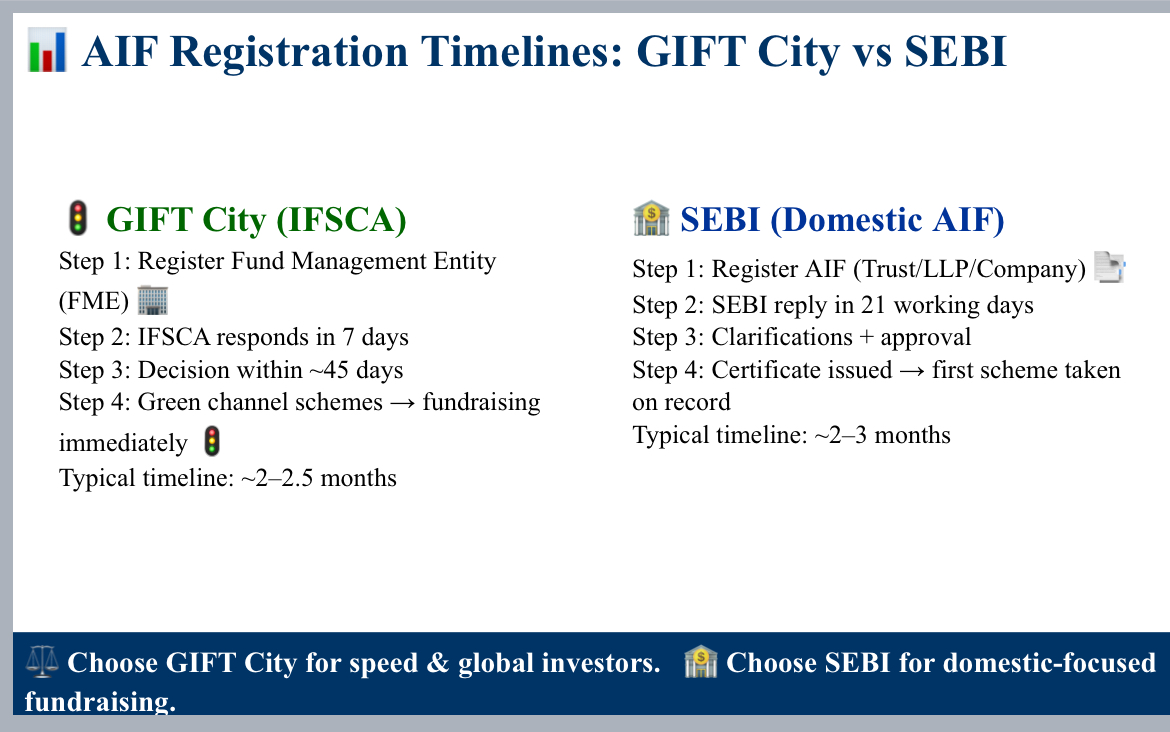

Quick 1-minute breakdown: How long does AIF registration take in GIFT City (IFSCA) vs onshore India (SEBI)? Learn the stepwise process, timelines and practical market expectations — FME-first approach in GIFT City with a 7-day acknowledgement and decision within 45 days (green-channel for VC/restricted schemes), versus SEBI’s Form A route with ~21 working day replies and overall 2–3 month approval. Ideal for fund managers deciding between faster global access (GIFT City) or onshore domestic focus (SEBI). Like and share if this helped you make the choice faster! #AIF #GIFTcity #IFSCA #SEBI #FundRegistration #AlternativeInvestmentFund #VC #FundLaunch #entrepreneurship #excessedgeexperts #excessedgeexpertsconsulting #business

Replies (2)

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-5 Who is Sponsor & Investment Manager in VC? 🎯Sponsors: Sponsor means a person who Setup AIF & Invests in. The Application to SEBI is made by the Sponsor.The sponsors should have to satisfy the criteria of Fit & Proper Person as pe

See MoreVCGuy

Believe me, it’s not... • 1y

Indian startups are Reverse Flipping. Many startups incorporate in countries like Singapore, Mauritius, the US (primarily for SaaS), or the Cayman Islands for several reasons: - Ease of doing business - Tax incentives - Better funding opportunities

See MoreVishwa Lingam

Founder of Simulatio... • 6m

Got my first Rejection email from a VC. IDK How many of them I have applied for are reviewing or ghosted me. But well, I knew that the Market I am entering is full of well funded and established incumbents and yes mine is early stage start-up. But t

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)