Back

Poosarla Sai Karthik

Tech guy with a busi... • 5m

Oversubscribed 103x – strong market trust ₹854 Cr from anchor investors – institutional backing Valuation at ~₹14,790 Cr – growth story priced in Turned profitable in Q1 FY25 – scalability in action High valuation – long-term play, not a quick flip It’s not just about getting new customers. What matters more is whether customers keep using the service and how much profit the company makes from each booking. Without repeat customers and good margins, growth can turn into a loss-making game.

Replies (2)

More like this

Recommendations from Medial

Business karo India

Business karo India ... • 7m

Do you agree **Two types of startups dominate India today:** 1. **Profit-focused startups** – They grow steadily, solve real problems, and build sustainable models. 2. **Valuation-focused startups** – They chase funding, burn cash on discounts, an

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Our Latest Mandate As part of growth strategy of one of our clients they are actively exploring acquisition opportunities across the following areas: • Specialty Chemicals (EBITDA ≥ ₹25 Cr, export-ready, asset-backed) • Food Processing (EBITDA ≥ ₹10

See More

Aditya Arora

•

Faad Network • 5m

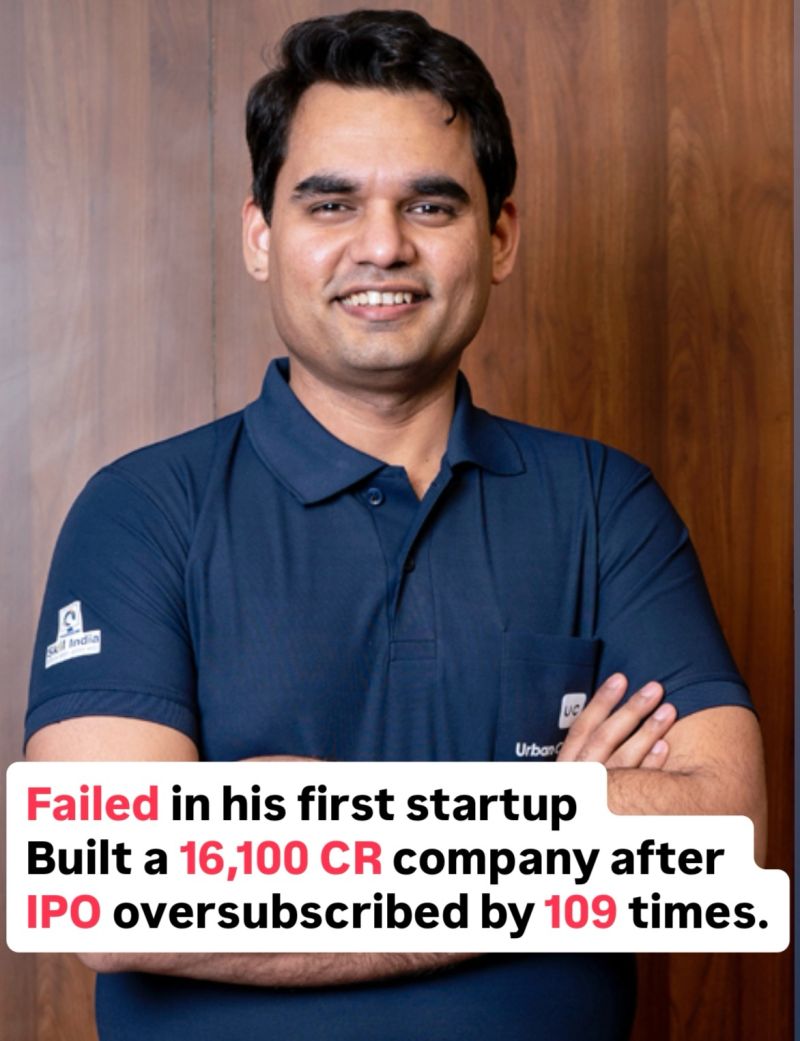

Failed in his first startup, built a 16,100 CR company after, IPO oversubscribed by 109 times. 1. After completing his electrical engineering at IIT Kanpur and an MBA from IIM Ahmedabad, Abhiraj Singh Bahl began his career as a strategic consultant

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 6m

Antfin, an affiliate of Alibaba Group, is reportedly set to sell 18.8 Cr shares of foodtech major Eternal in a block deal worth around INR 5,375 Cr (about $613 Mn). This comes a day after the investor exited fintech major Paytm. Citing sources, CNBC

See More

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

From ₹51 Cr to ₹1,272 Cr in a year—this Indian biotech’s revenue chart is insane. 💰 Molbio is going public targeting ₹22,000–24,000 Cr valuation. IPO expected in November 2025, raising ₹2,200–2,400 Cr. 🔬 Their Truenat platform, is a battery-power

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Our Latest Mandate As part of growth strategy of one of our clients they are actively exploring acquisition opportunities across the following areas: • Specialty Chemicals (EBITDA ≥ ₹25 Cr, export-ready, asset-backed) • Food Processing (EBITDA ≥ ₹10

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)