Back

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

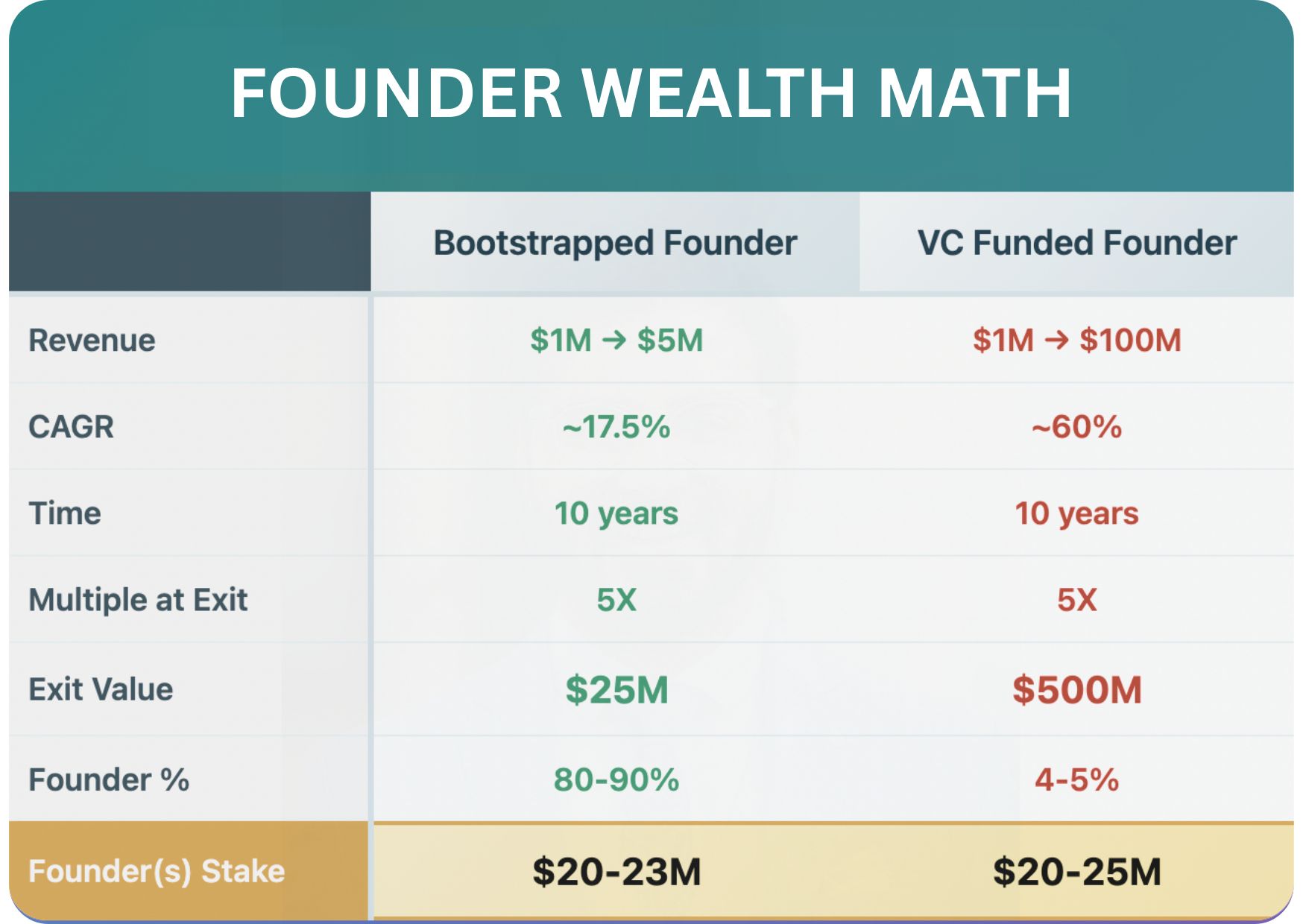

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreVivek Joshi

Director & CEO @ Exc... • 10m

Unlock the secrets to VC funding with our latest video, *Is Your Startup VC-Ready? Discover with the Startup Valuation Matrix!* 🚀 If you’re looking to raise venture capital, understanding your startup's value is crucial. In this video, we introduce

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Porter's Five Forces Analysis Porter's five forces framework is a method of analyzing the competitive environment of a business. The five forces are: 1] Competition: Intensity of rivalry among existing competitors, influencing pricing, profitabil

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Unlock the secrets to successful venture capital funding with Robert Merton’s Theory of Risk and Return! In this insightful video, we delve into how Merton’s principles can redefine your VC funding game plan. Discover the power of diversification, dy

See MoreVansh Khandelwal

Full Stack Web Devel... • 1y

Kredily, a standout in Human Resource Software, thrives on the principle "Great players do not compete, they dominate." Its success stems from five core strategies: the Free Forever Plan (FFP), which uses a freemium-to-premium model; the Pastry to Ca

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Level Up Your VC Fundraising with Consulting Pros 🚀 Cold outreach for VC funds? You're likely missing out! Partnering with a specialized consulting firm can transform your fundraising journey. Here's why they're essential: * Warm Introductions: For

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)