Back

Ankush Sharma

Business Consultant ... • 5m

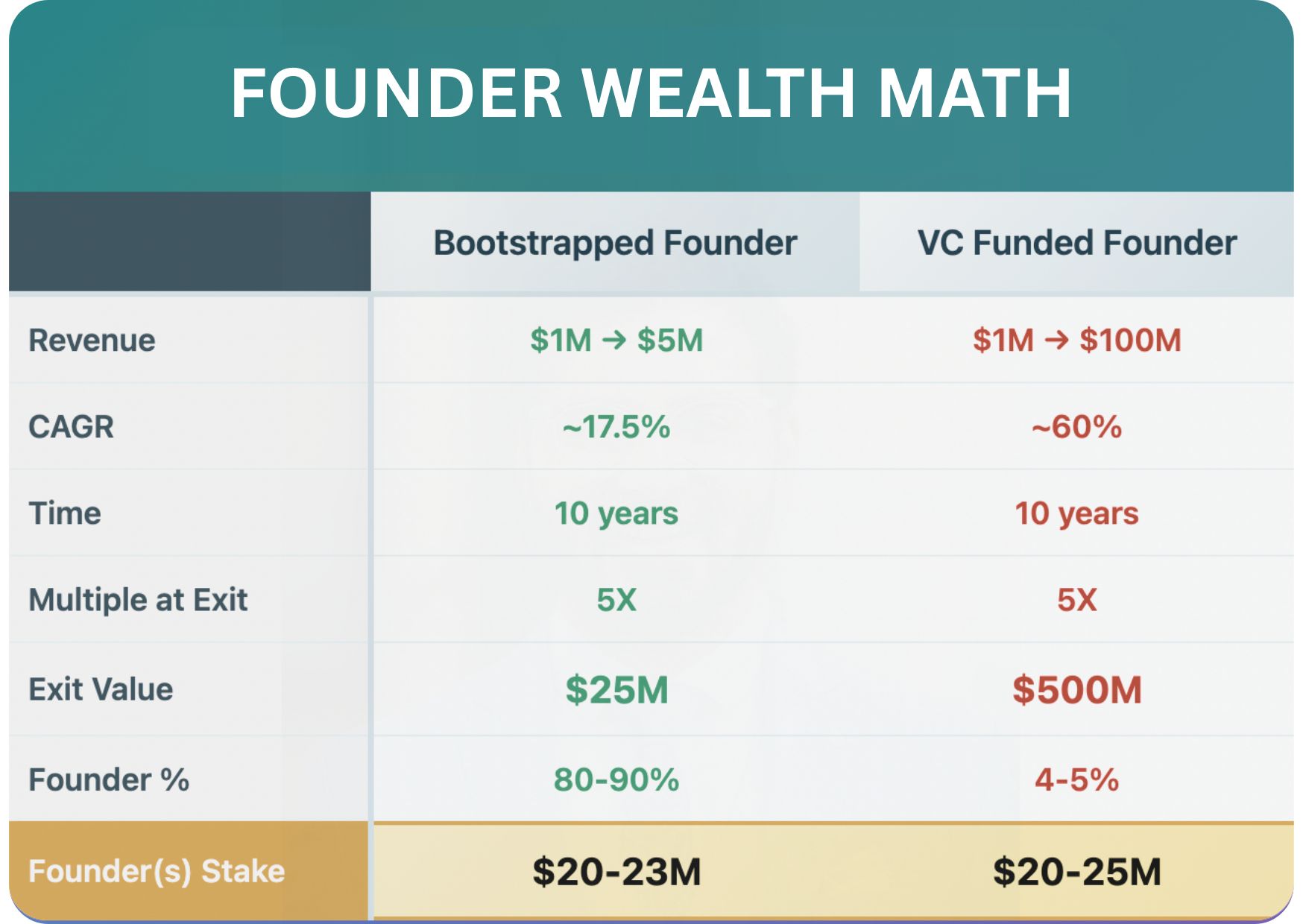

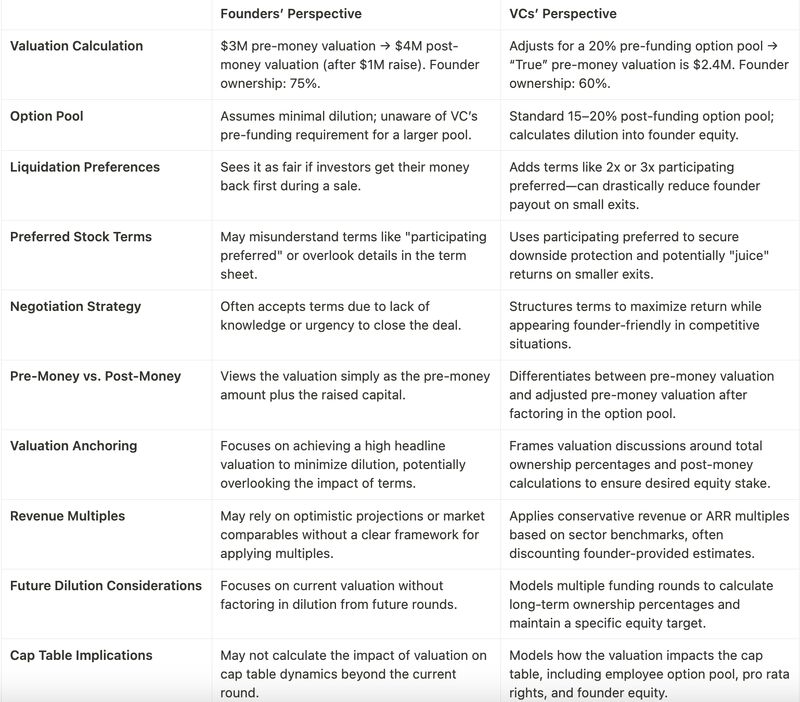

Founders who raise VC money do not become rich. VC money is a swift death march for most founders, and most should stick to bootstrapping. The traditional venture model doesn’t fit most businesses: 1. Most expensive form of money available (expecting ~30-50% IRR) 2. VCs need ~50-100x outcomes to make their portfolios work. 3. And it means working ~100 hrs week for founders 4. Building wealth (as a founder) also doesn’t work at < $500M exit E.g. (A) Bootstrapped founder $1M → $5M business in 10 years and then exit for a 5x multiple at $25Mn Founder(s) has 80-90% = makes $20-23M personal wealth (B) VC funded founder $1M → $100M business in 10 years and then exit for a 5x multiple at $500M Founder(s) has 4-5% at exit (in most cases) = makes $20-25M personal wealth (A) Bootstrapped founder has a relatively relaxed life, works 50hrs a weeks or 9-10 hrs / day mostly, enjoys weekends and vacations with family & friends (B) VC funded founder’s life revolves around the business, has long weeks ~100hrs works 6-7 days from 8am to 12am, struggles with any form of personal life. Ages significantly earlier, misses important family occasions etc. (A) or (B) financial outcome remains almost same in both cases ~$20-25M Given this what traits do founders best suited to raise VC money have: - They have burning passion to “build something” that will shape the world - Money is not their motivator; - They know they cannot become wealthy raising VC money ONLY +ve for the VC funded founder → he/she would have changed how an industry works by the time his/her startups is making $100M annually. They would “LEAVE FOOTPRINTS ON THE SANDS OF TIME” 𝘈 𝘗𝘴𝘢𝘭𝘮 𝘰𝘧 𝘓𝘪𝘧𝘦 𝘣𝘺 𝘏.𝘞. 𝘓𝘰𝘯𝘨𝘧𝘦𝘭𝘭𝘰𝘸

More like this

Recommendations from Medial

The next billionaire

Unfiltered and real ... • 1y

People think life on the founders side is green. But the reality is often disappointing. A bootstrap founder is in most cases working every day his ass off to keep up to the margins. A funded high growth startup knows deep down that it’s all a Fac

See MoreArcane

Hey, I'm on Medial • 1y

Even though 25% of all startups on Carta have just a solo founder, VCs hesitate to fund them. Having 2 to 3 founders seems to be the sweet spot if you were to raise VC money while building a startup. So, Is there a way to make VC funding easier as

See More

SamCtrlPlusAltMan

•

OpenAI • 7m

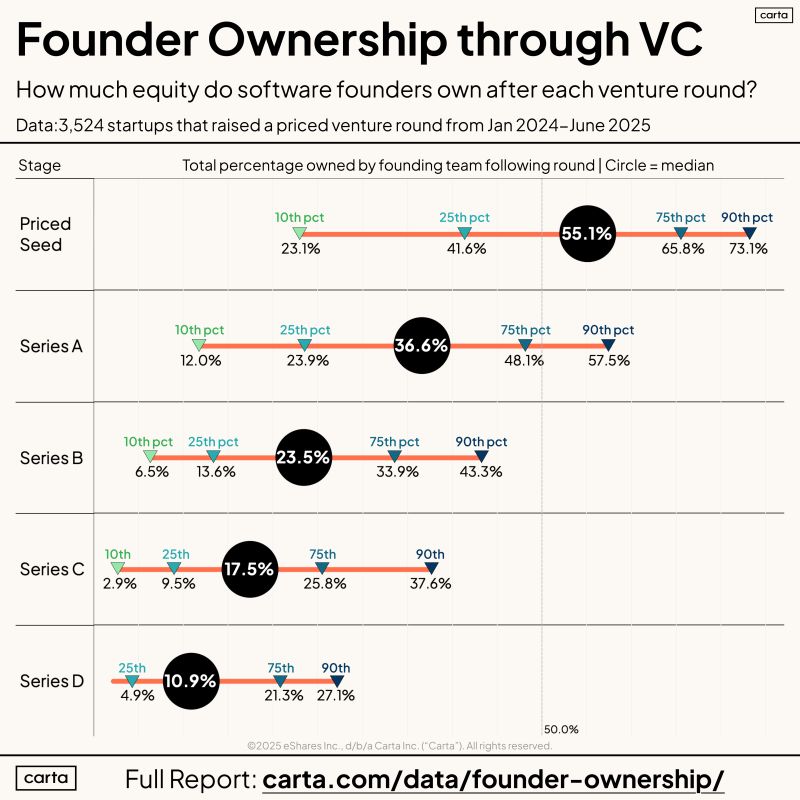

The Hidden Cost of Raising VC: Your Equity. Think raising a big round means you’ve made it? Check the fine print: Founder ownership drops fast as you climb the funding ladder. Median equity owned by founders after each round (2024–25 data from 3,52

See More

Business karo India

Business karo India ... • 7m

According to me Founder and Co-founder should not leave lavis life by investors money and valuation this exit game is very bad and giving wrong msg to society. there are founders who not taken salary and made buisness profitable. the current tech

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)