Back

Poosarla Sai Karthik

Tech guy with a busi... • 7m

1. What is a moat really: A moat is a company’s ability to earn returns well above its cost of capital and keep doing it for years. Two things matter. One is how large those returns are. The other is how long they’ll last before competition catches up. A company earning high returns for one or two years may just be lucky. But if it can sustain those returns across cycles, it’s probably doing something others can’t match. That’s where the moat starts to show. 2. Understand the industry first: Start with the space the company plays in. Use tools like Porter’s Five Forces to evaluate how easy it is for new players to enter, how much bargaining power suppliers and customers have, and how much rivalry exists. Some industries are brutal. Others have natural tailwinds. Know the difference. A strong player in a weak industry is not as safe as it looks. 3. Then zoom in on the company’s edge: This is where most real moats lie. Is the company winning on cost, scale, brand, or distribution? Are users locked in because switching feels hard or expensive? Does the company benefit from a network that keeps compounding? You’re looking for something that cannot be easily copied or outspent. The less replicable the edge, the stronger the moat. 4. Study how the company behaves with others: Even the best businesses can lose ground if they misread their competitive landscape. Does the firm control pricing? Does it influence how customers or partners behave? Is it shaping the ecosystem or just reacting to it? Moats are not just about what you own. They’re also about how you play the game. 5. Quantify it with actual numbers: This part is non-negotiable. Measure return on invested capital and subtract the cost of capital. The bigger the gap, the better. But just as important is how fast that gap is closing. If returns are fading year after year, the moat might already be weakening. 6. Ask the hardest question, where is it priced in: Even if a moat is real, if the market already assumes ten more years of strong returns, there’s not much upside left. The best bets are companies where the edge is durable but the market expects it to fade early. That gap between perception and reality is where returns are made.

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

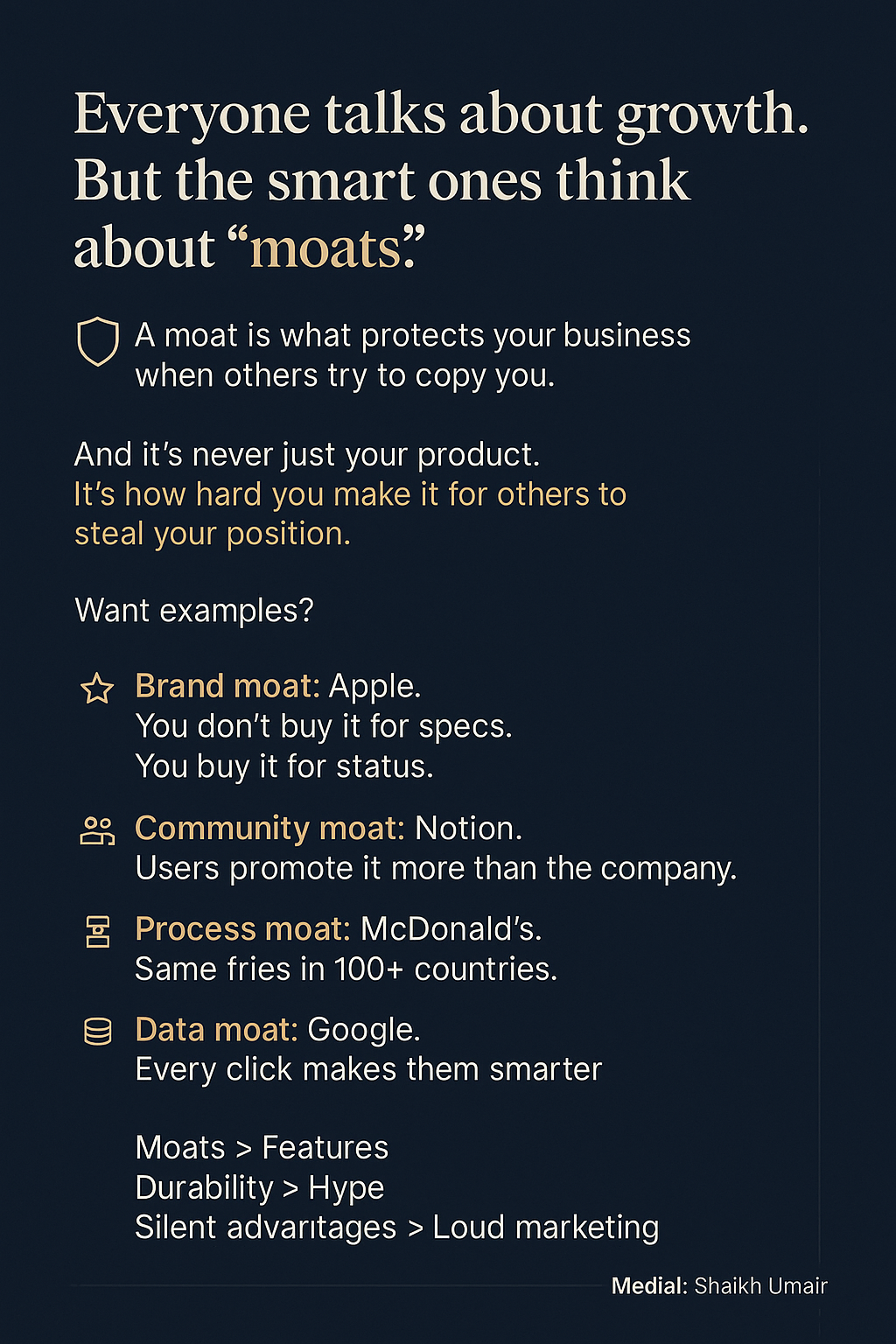

Everyone talks about growth. But the smart ones think about "moats". A moat is what protects your business when others try to copy you. And it’s never just your product. It’s how hard you make it for others to steal your position. Want examples? B

See More

Account Deleted

Hey I am on Medial • 9m

They can replicate the product not the person building it. Here’s how I think about Founder Moats: 1) Speed Moat - We move faster than anyone else. Execution is our unfair advantage. 2) Distribution Moat - We have direct access to the audience oth

See MoreAnkush Sharma

Business Consultant ... • 8m

MOATS IN BUSINESS: THE HIDDEN POWER BEHIND MARKET DOMINANCE 🛡️ In business, a moat refers to a company’s sustainable competitive advantage—the ability to fend off rivals, protect profits, and grow for the long term. Warren Buffett famously invests

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC- DAY-14 🎯What is Hurdle Rate? 🎯What is Carry Fees? 🎯The preferred returns are also called as “Hurdle Rate” in VC & P.E Funds. It is the threshold return that LP’S should receive prior GP’S receive. In developed markets, The hurdle

See MoreStartup Savvy

Entrepreneur is What... • 1y

MOAT is a thing which every business should have to protect themselves from competition Types of MOAT 1) Brand Moat :- Fevicol is synonym to the word glue 2) Taste Moat :- People who love Maggie will never change their habit 3) Network MOAT :- You

See MoreThakur Ambuj Singh

Entrepreneur & Creat... • 11m

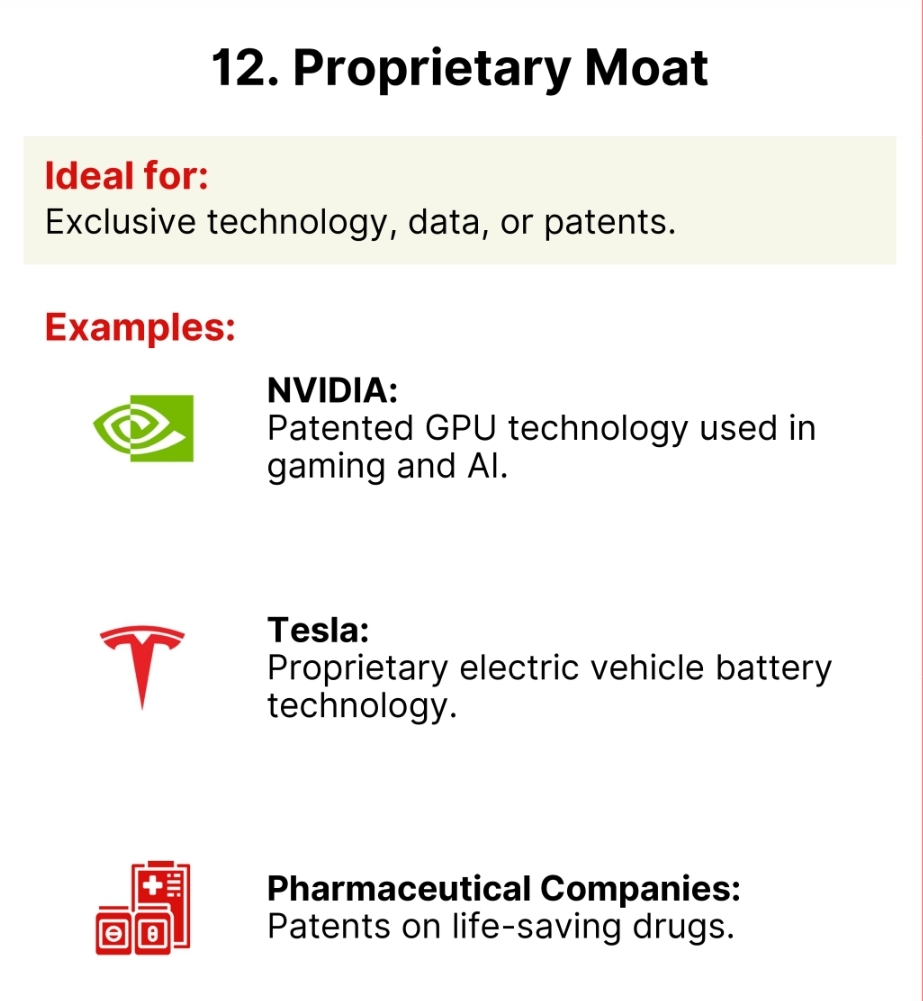

Owning the Edge! 🚀🔬 A Proprietary Moat is built on exclusive patents, data or technology that gives companies a unique advantage. Examples like NVIDIA’s GPU patents, Tesla’s battery technology and pharmaceutical companies' drug patents showcase how

See More

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-15 What are Additional Returns? What is the Catch-Up Clause? In Developed Markets, The structure is in 2-20% where 2 is Management Fees & 20 is Additional Returns.Additional Returns & 2-20 structure is not ideal in Indian AIF Market

See MoreKAVIT WAMANKAR

Hey I am on Medial • 1y

"We are looking for a person who is interested in agriculture-related projects. This project is for Farmers development, where our investment also yields high returns. Basically, it is a long-term investment with a 100% return, in the coming time, it

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)