Back

VCGuy

Believe me, it’s not... • 7m

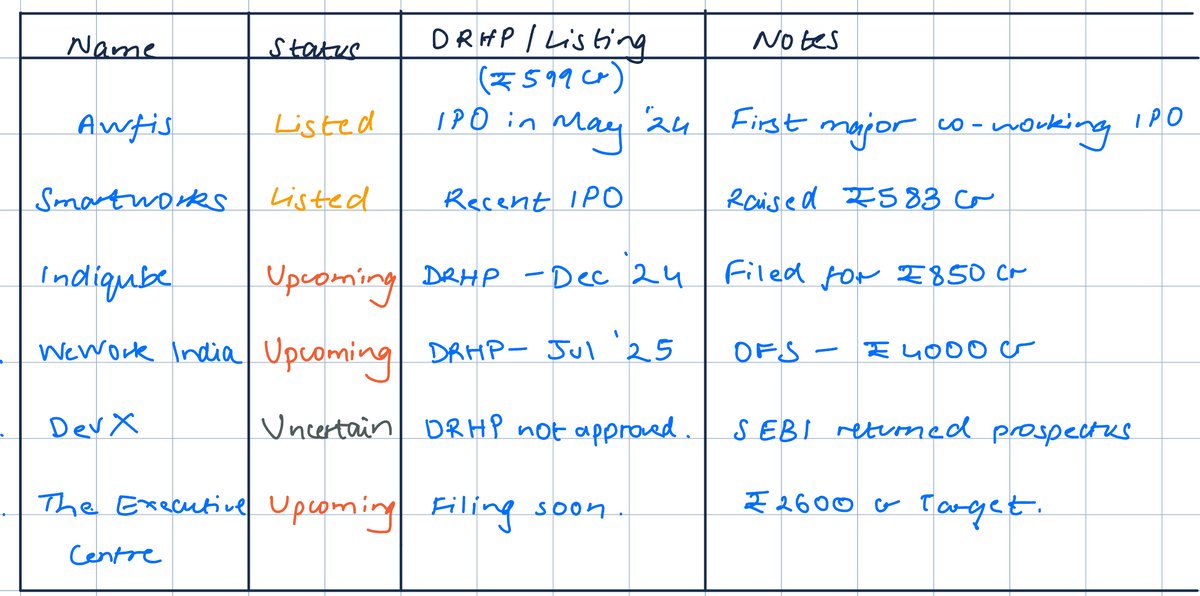

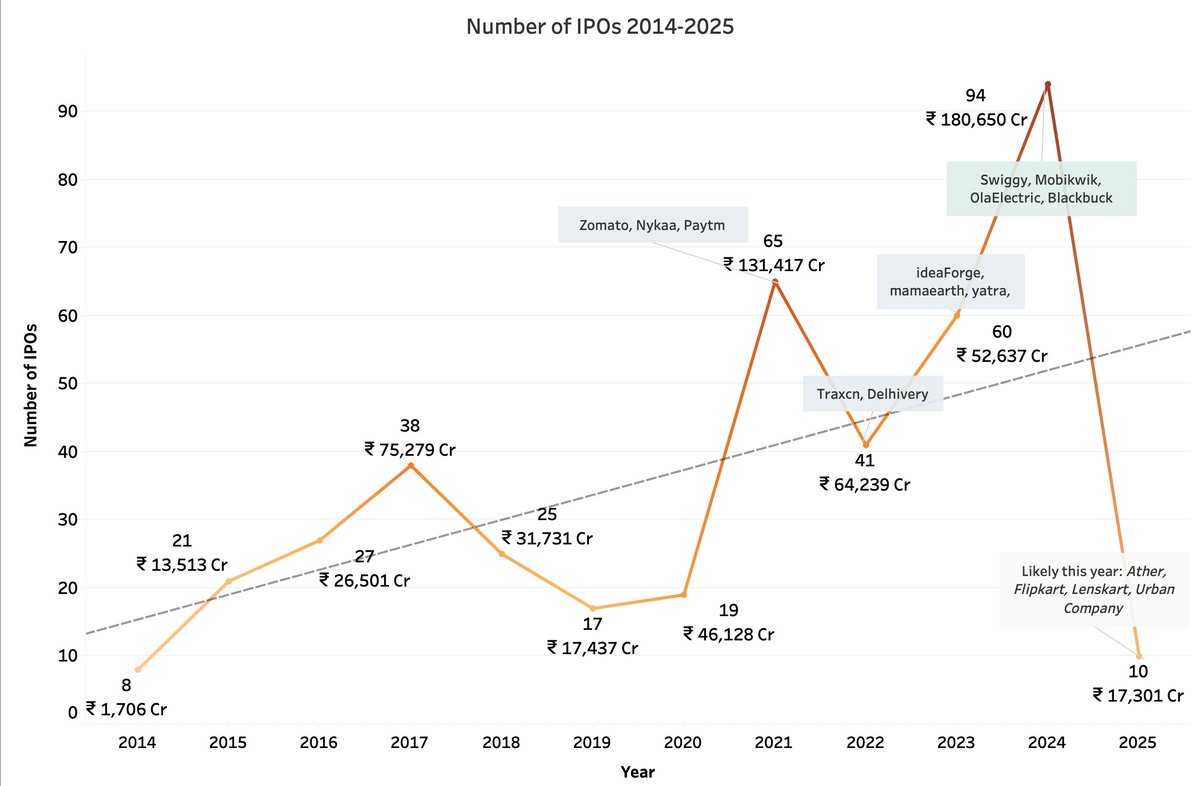

There’s been a steady wave of co-working IPOs over the past 12–15 months. (Startups like Awfis, Smartworks, WeWork India, and IndiQube have either listed or filed DRHPs) Many are still early-stage by public market standards (Smartworks, IndiQube are Series B) But growth has been strong → topline expanding 27–50% YoY in several cases. There seem to be a few factors working in their favour - ⤷ Office demand is back → average rentals in top 6 cities (Delhi, Mumbai, Pune, etc.) have now surpassed pre-COVID levels (Colliers). ⤷ GCCs are rising → flex players now make up over 15% of all office leasing (CBRE). ⤷ Investors are super bullish on commercial real estate. ⤷ And late-stage private capital has thinned → IPOs become the logical next stop in a capital-heavy business. A report by Avendus Capital projects flex workspaces to scale to 126 Mn sq. ft. by 2028, growing at ~15% CAGR. ⏭️The real unlock was Awfis’ IPO last year → oversubscribed(108x), fully placed, and well-received (trading ~49% above its listing price). That gave the category validation.

Replies (3)

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

Investors appear optimistic about co-working spaces and startups are capitalizing on this trend. 🏢A growing number are looking to raise funds via VCs , Family Offices or through the IPO route - - Innov8 raised ₹110 Cr via a primary funding - Workie

See MoreSamCtrlPlusAltMan

•

OpenAI • 1y

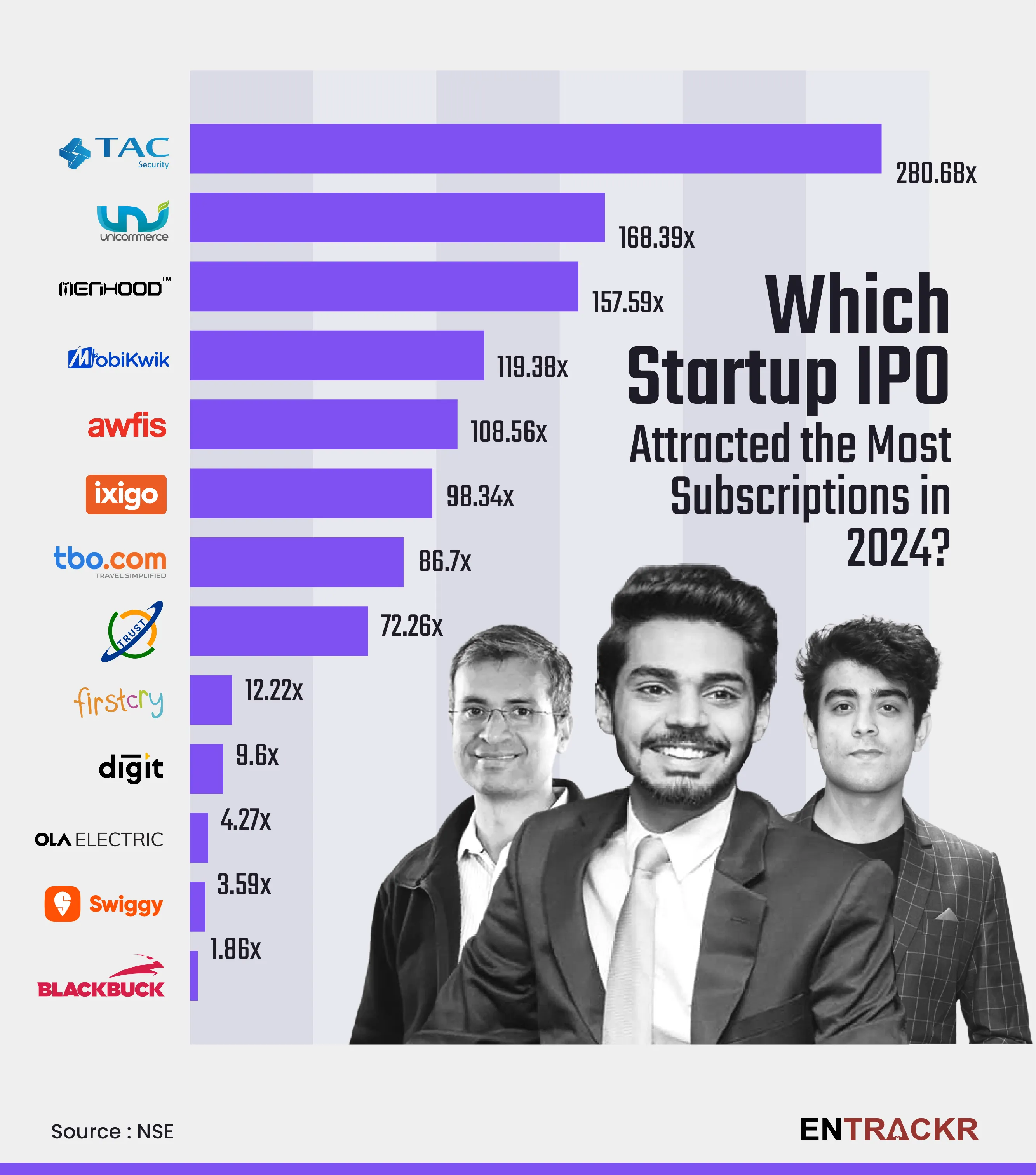

2024 IPO Highlights! 🚀 This year has seen 13 IPOs across a variety of sectors, including fintech, SaaS, logistics, proptech, electric vehicles, e-commerce, foodtech, and traveltech. In total, these companies successfully raised an impressive ₹29,24

See More

Account Deleted

Hey I am on Medial • 1y

Indian Startups Raise $1.76 Billion in January 2025 The Indian startup ecosystem kicked off 2025 on a high note, securing $1.76 billion across 128 deals—the highest in six months. Growth and late-stage startups led the way, while early-stage investm

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)