Back

Account Deleted

Hey I am on Medial • 1y

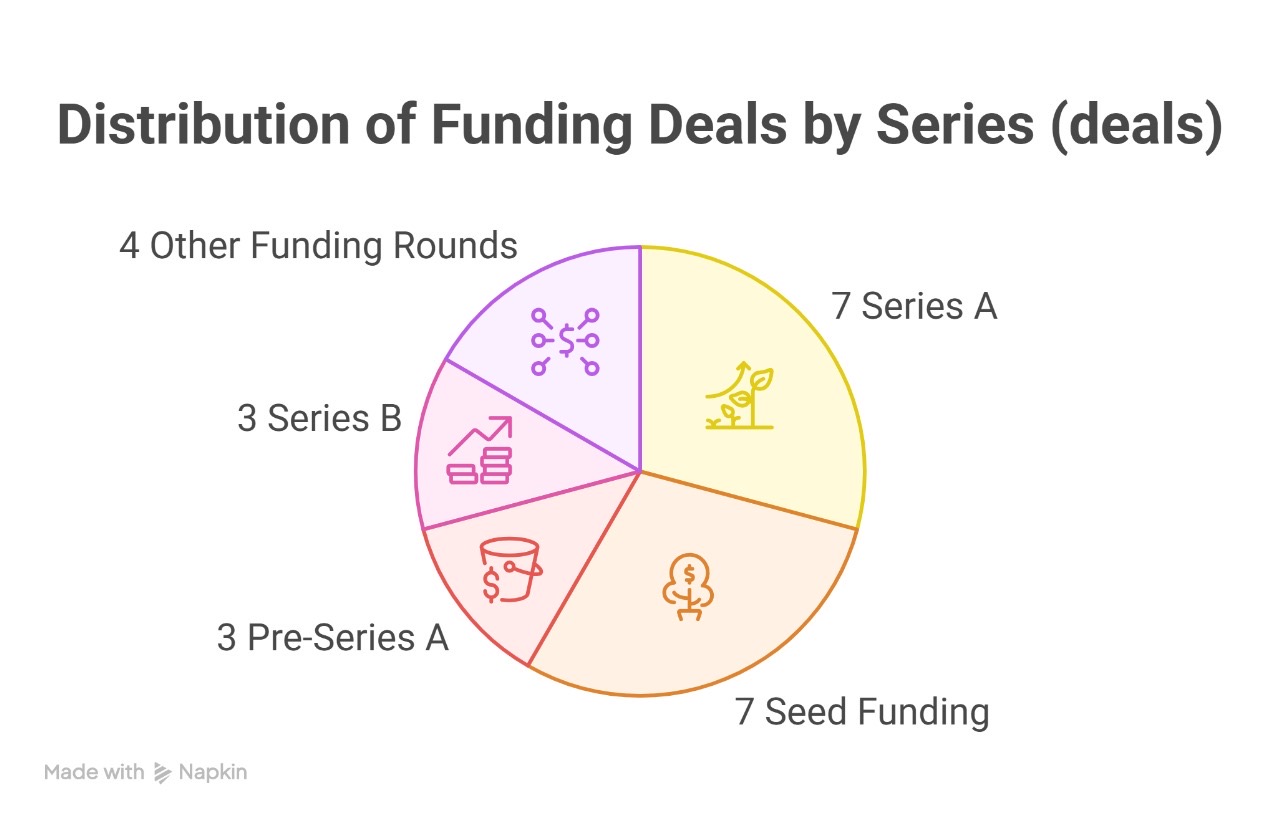

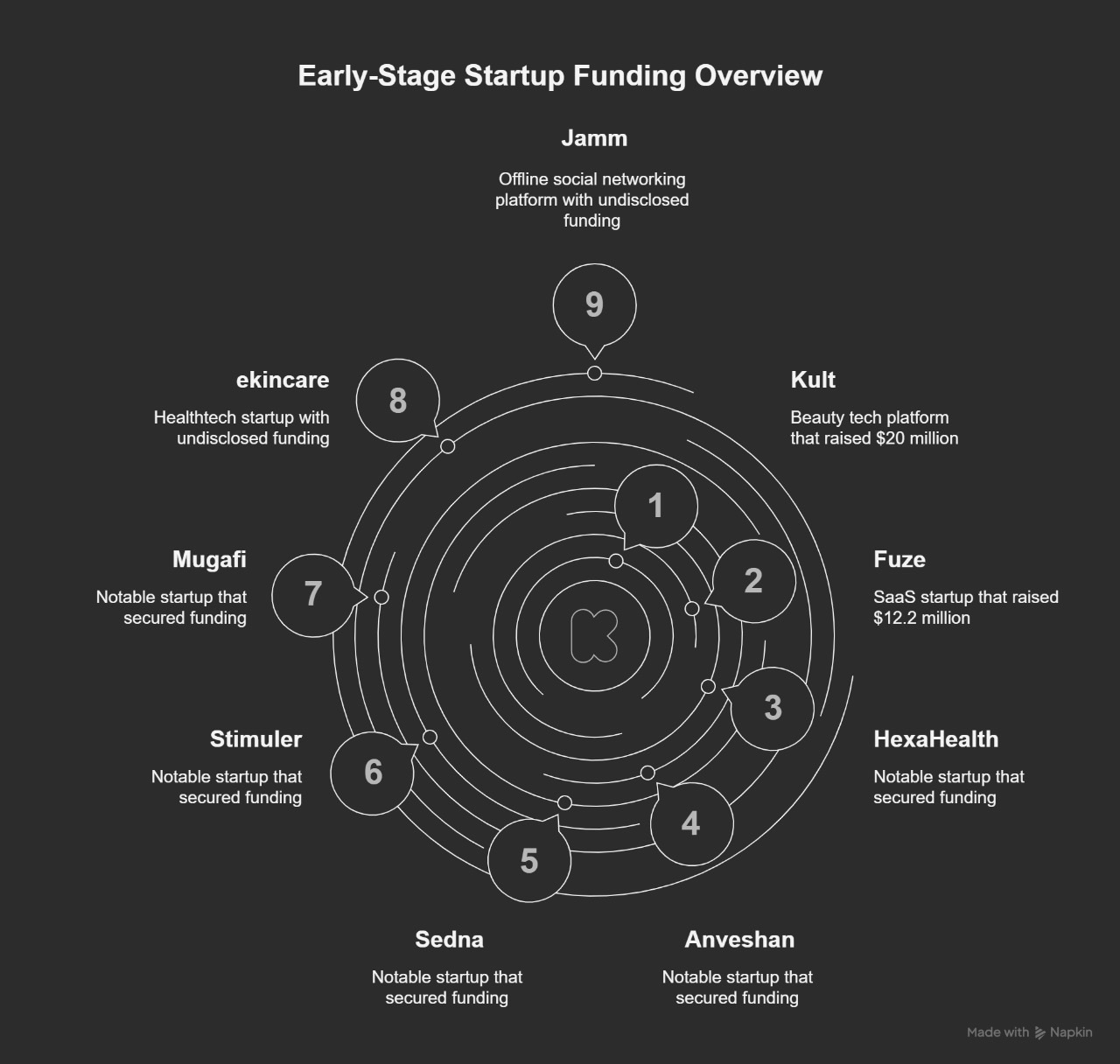

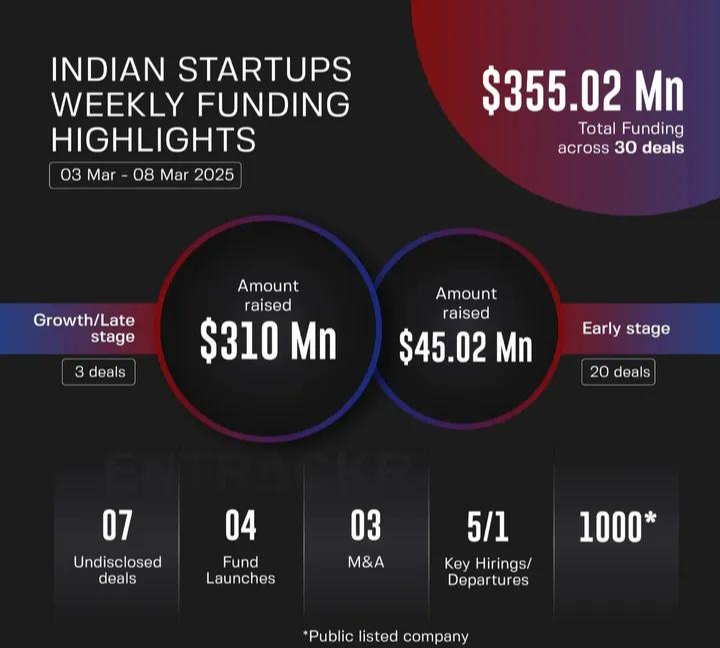

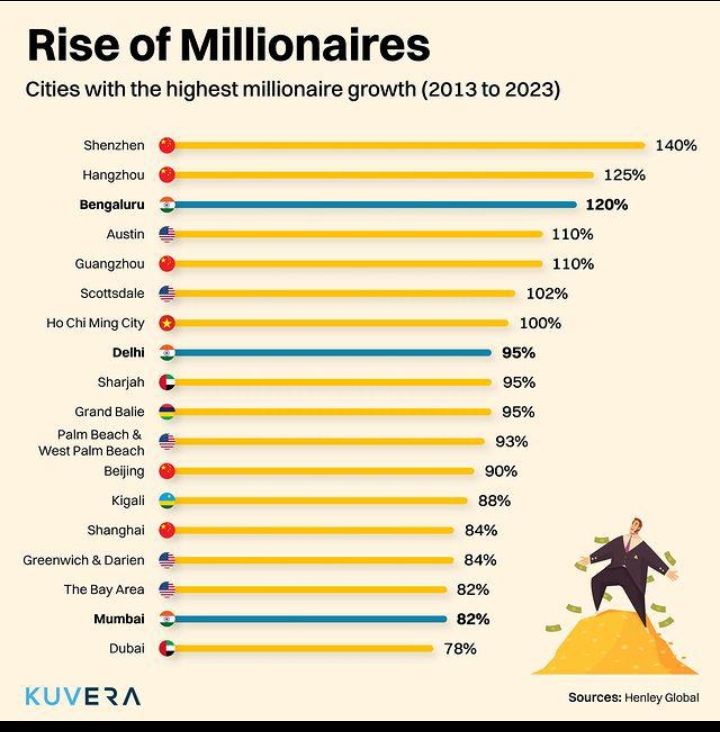

Indian Startups Raise $1.76 Billion in January 2025 The Indian startup ecosystem kicked off 2025 on a high note, securing $1.76 billion across 128 deals—the highest in six months. Growth and late-stage startups led the way, while early-stage investments also gained traction. Key Highlights Funding Breakdown: Growth & late-stage: $1.5B (32 deals) Early-stage: $261M (80 deals) 16 undisclosed rounds Top Deals: Growth-stage: Impetus Technologies ($350M), Innovaccer ($275M), Infra.Market ($125M) Early-stage: Atomicwork ($25M), Geri Care ($13M), MicroMitti ($10.3M) Major Acquisitions: Minimalist acquired by HUL ($350M) Wingify acquired by Everstone ($200M) Amazon to acquire Axio (formerly Capital Float) Funding Trends City-wise: Delhi-NCR led with $525M, followed by Bengaluru ($397M) and Mumbai ($145M) Sector-wise: Healthtech dominated with $404M, followed by AI ($355M) and Proptech ($278M) Stage-wise: Seed funding had the highest volume (36 deals), while Series D raised the most capital ($441M) Other Developments Layoffs & Shutdowns: Minimal layoffs (~200 employees), Coca-Cola-backed Thrive shut down Leadership Changes: Over 17 senior executives resigned, while 48 key hires were made Upcoming IPOs: Co-working sector sees traction with Awfis going public, Smartworks, Indiqube, and WeWork India in the pipeline Looking Ahead With healthcare and deeptech gaining momentum, 2025 could be a landmark year for Indian startups. While the gap between private and public markets persists, investor confidence remains strong, setting the stage for sustained growth.

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 8m

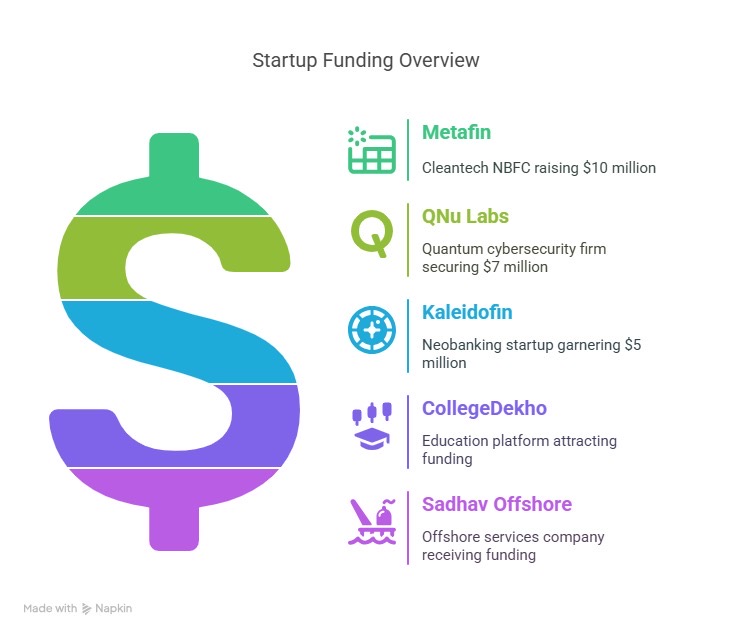

Breakdown of where Indian startup money moved on week June 09 to June 14 1) Growth-Stage Deals CRED - $72M FlexiLoans - $44M Series C Vecmocon Technologies - $8M (part of $18M Series A) Wow! Momo - $1M Series B Garuda Aerospace Private Limited - un

See MoreAccount Deleted

Hey I am on Medial • 8m

Navigating the 2025 Fundraising Landscape Breaks down how early-stage founders should approach raising money in 2025 — with real strategies, pitfalls to avoid, and investor psychology. Link: https://www.rightsidecapital.com/blog/navigating-the-202

See More

Account Deleted

Hey I am on Medial • 9m

This past week, India’s startup ecosystem continued to show resilience and momentum, with 25 startups collectively raising approximately $102.93 million, despite a marginal dip from the previous week’s total of $112.35 million. The funding activity

See More

Ashish Singh

Finding my self 😶�... • 10m

🚀Here are 10 Indian startups likely to have received the highest funding in March 2025, based on Q1 2025 trends: 1. Impetus Technologies - $350M (Enterprise Solutions) 2. Innovaccer - $275M (Health Tech) 3. Zolve - $251M (FinTech) 4. Zepto -

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)