Back

Ankush Sharma

Business Consultant ... • 7m

Why Renewable Power Producers Are Quietly Losing Money Every Day Solar and wind are booming. Open Access is thriving. But beneath the optimism, there's a silent revenue killer in the clean energy business: 👉 Forecasting failure. Most IPPs, EPCs, and aggregators are losing lakhs—sometimes crores—without realizing the root cause: poor visibility into future generation. The Hidden Impact Every time your day-ahead schedule misses actual generation, penalties hit. Every time you under- or over-bid in the real-time market, money’s left on the table. Every time a storm or cloud cover disrupts your estimate, you're reacting—not optimizing. The problem isn’t just bad luck. It’s a broken system. What's Not Working Most players rely on: Free weather APIs + Excel Static SCADA data Generic third-party forecasts These tools don’t learn. They don’t adapt. They don’t understand your site's performance curve, inverter behavior, or soiling losses. Worst of all—they don’t connect to your revenue model. Result? Conservative trading. Excess penalties. Lost opportunities. EPCs Are Suffering Too EPC firms under O&M or performance guarantees are being held accountable for yield without control over accurate forecasting. They get penalized for nature's variability without the tools to predict it. Forecasting Is Now Strategic This is no longer about compliance—it’s about cash flow and competitive advantage. Trading desks need forecast precision to bid confidently Operators need foresight to avoid curtailment EPCs need insights to meet SLAs and defend performance In a high-renewable grid, it’s not the largest who win. It’s those who see ahead, adapt fast, and act smart. Hard Questions You Should Be Asking What’s your current forecast deviation rate? How much are you paying in DSM or imbalance charges? Can your existing tools handle monsoon or volatile generation patterns? Do you make trading and scheduling decisions based on actual intelligence—or educated guesswork? If you’re not sure, you’re likely bleeding quietly. Forecasting isn’t a weather problem—it’s a revenue protection strategy. Those who embrace it today will lead the energy market tomorrow.

More like this

Recommendations from Medial

Akash Koli

Experienced Financia... • 1y

Budgeting vs. Forecasting: Key Differences & Why Both Matter Budgeting involves setting a fixed financial plan for a specific period, guiding resource allocation and setting targets. It’s static and used to measure performance. Forecasting predicts

See MoreAnkush Sharma

Business Consultant ... • 7m

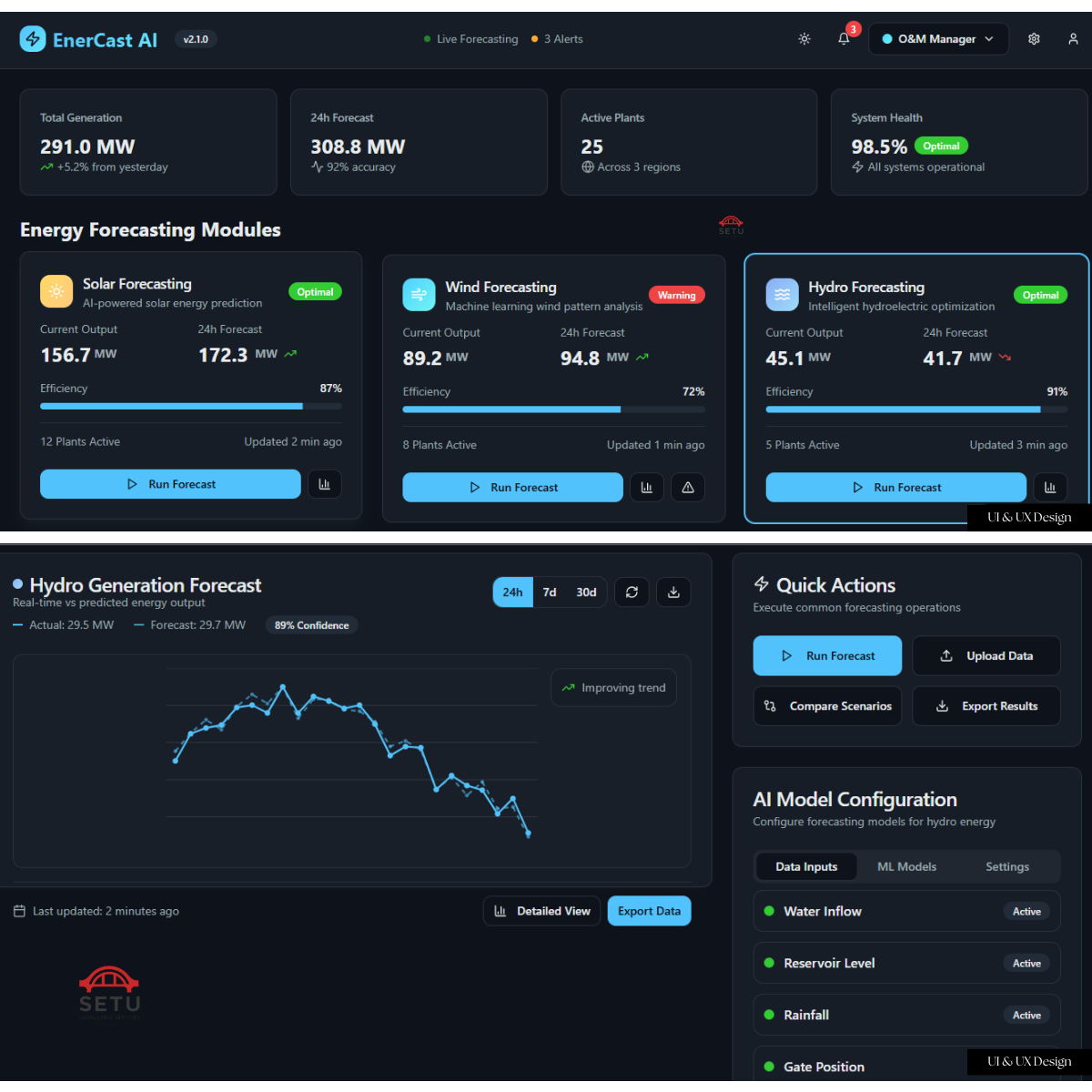

Finalizing the UI/UX for Our Energy Forecasting Platform: Feedback Wanted! Here’s a sneak peek at our latest EnerCast AI dashboard—designed to bring real-time clarity and control to solar, wind, and hydro forecasting operations across multi-regio

See More

CA Dipika Pathak

Partner at D P S A &... • 1y

Attention! 🚨 Got 10+ employees in your business or work for such a company? Don’t let gratuity rules slip through the cracks! Stay compliant, avoid penalties, and protect your rights. 💼✨ During audits, we often spot gratuity rules being overlooked

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)