Back

Akash Koli

Experienced Financia... • 1y

Budgeting vs. Forecasting: Key Differences & Why Both Matter Budgeting involves setting a fixed financial plan for a specific period, guiding resource allocation and setting targets. It’s static and used to measure performance. Forecasting predicts future financial outcomes based on current data and trends. It’s dynamic and updated regularly to reflect real-time changes, helping businesses adapt and make informed decisions. Differences: 1. Time Frame: Fixed (budget) vs. ongoing (forecast) 2. Flexibility: Static (budget) vs. adaptable (forecast) 3. Purpose: Planning (budget) vs. predicting (forecast) Why Both? Budgeting ensures financial discipline, while forecasting offers adaptability and real-time insights. Need help with budgeting and forecasting? Visit our website vittArena. Do you prioritize budgeting or forecasting? Share in the comments! #Budgeting #Forecasting #FP&A

More like this

Recommendations from Medial

Akash Koli

Experienced Financia... • 1y

Budget variance analysis is like financial detective work. It compares your budgeted figures with actual performance to uncover differences and understand where you’re succeeding or falling short. Curious to learn more? Check out our Financial Planni

See MoreCA Sumit Chandwani

The New way of Compl... • 11m

🚀 The Role of Financial Strategy in Business Growth Managing a business involves countless decisions—budgeting, fundraising, compliance, and financial planning. One common challenge I’ve observed is that many startups and SMEs struggle with financi

See MoreAkash Koli

Experienced Financia... • 1y

Financial Analysis: The Espresso Shot for Your Business! ☕📊 Just like a strong cup of coffee, financial analysis gives your business the boost it needs! It helps you spot where profits are brewing ☕, where costs are too bitter, and keeps your cash

See MoreDataSpace Academy

Learn, Secure & Earn • 10m

What is SEO vs AEO vs GEO: Key Difference & Approach Explained Gone are the days when finding exposure over the web was solely about securing a top rank in the SERPs. As of 2025, when online search patterns are constantly evolving, brands need more

See More

Ankush Sharma

Business Consultant ... • 7m

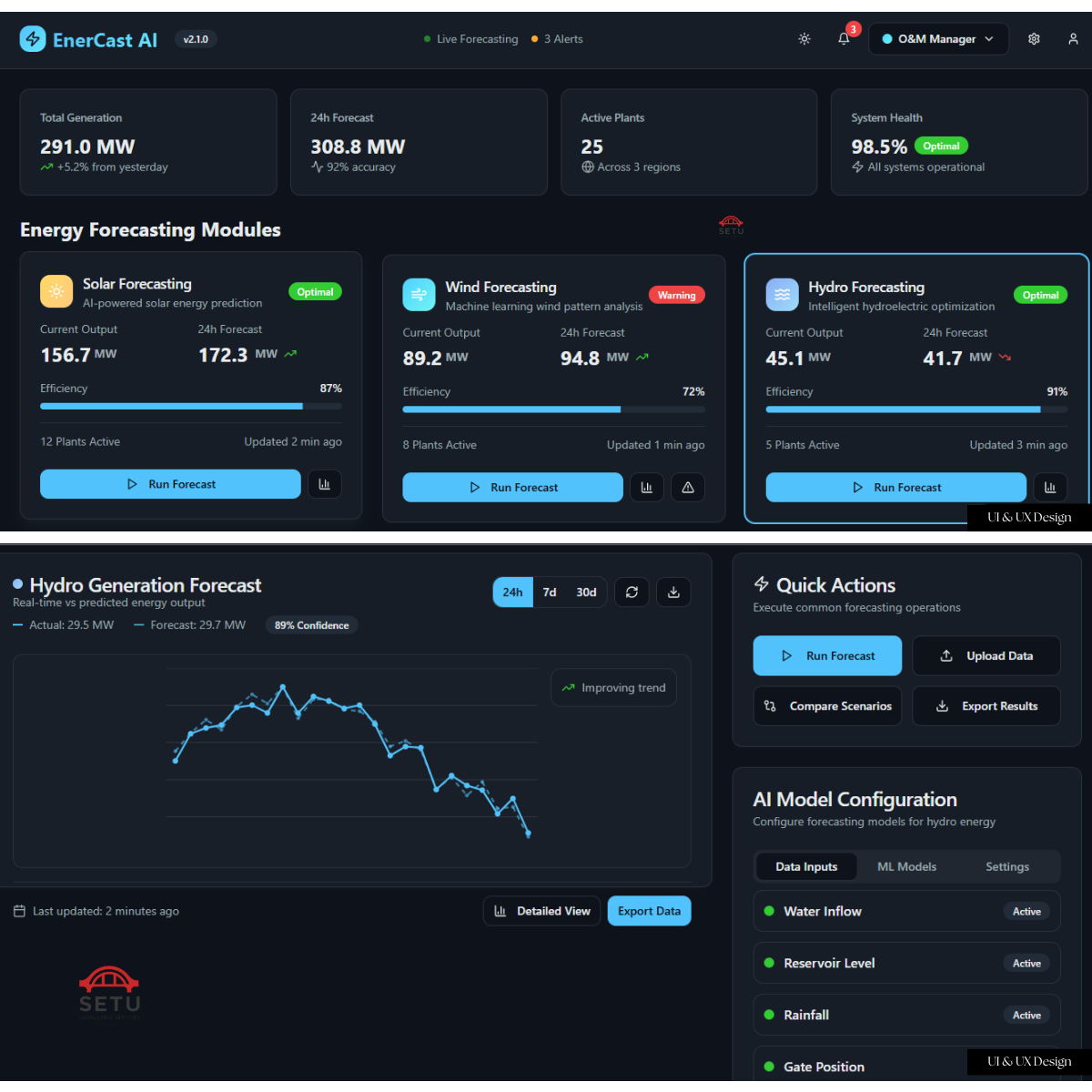

Finalizing the UI/UX for Our Energy Forecasting Platform: Feedback Wanted! Here’s a sneak peek at our latest EnerCast AI dashboard—designed to bring real-time clarity and control to solar, wind, and hydro forecasting operations across multi-regio

See More

PCHANDRA SHEKHER REDDY

builder • 1y

hi guys, I am about to launch my app, moneysplit -Moneysplit is a smart financial app that helps you split and release money systematically. It ensures controlled spending by automating payouts on a daily, weekly, or fixed-date basis—perfect for budg

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)