Back

Priyank

•

Money • 7m

SAFE Notes in India - What Founders Get Wrong SAFEs are simple. But not harmless. A lot of founders assume “It’s just a note. We’ll figure things out later.” That’s where problems start. 3 common mistakes with SAFEs in India: 1. No valuation cap or discount Investors end up owning way more later than expected. 2. Multiple SAFEs with different terms Makes conversion messy at the priced round. Good investors walk away. 3. No clarity on conversion triggers Some notes never convert because the next round doesn't meet “qualified financing” terms. If you’re doing a SAFE round - make it clean, capped, and consistent. If you are raising funds for your startup and need help, DM me.

More like this

Recommendations from Medial

Saurabh Singhavi

Assisting Early-Stag... • 11m

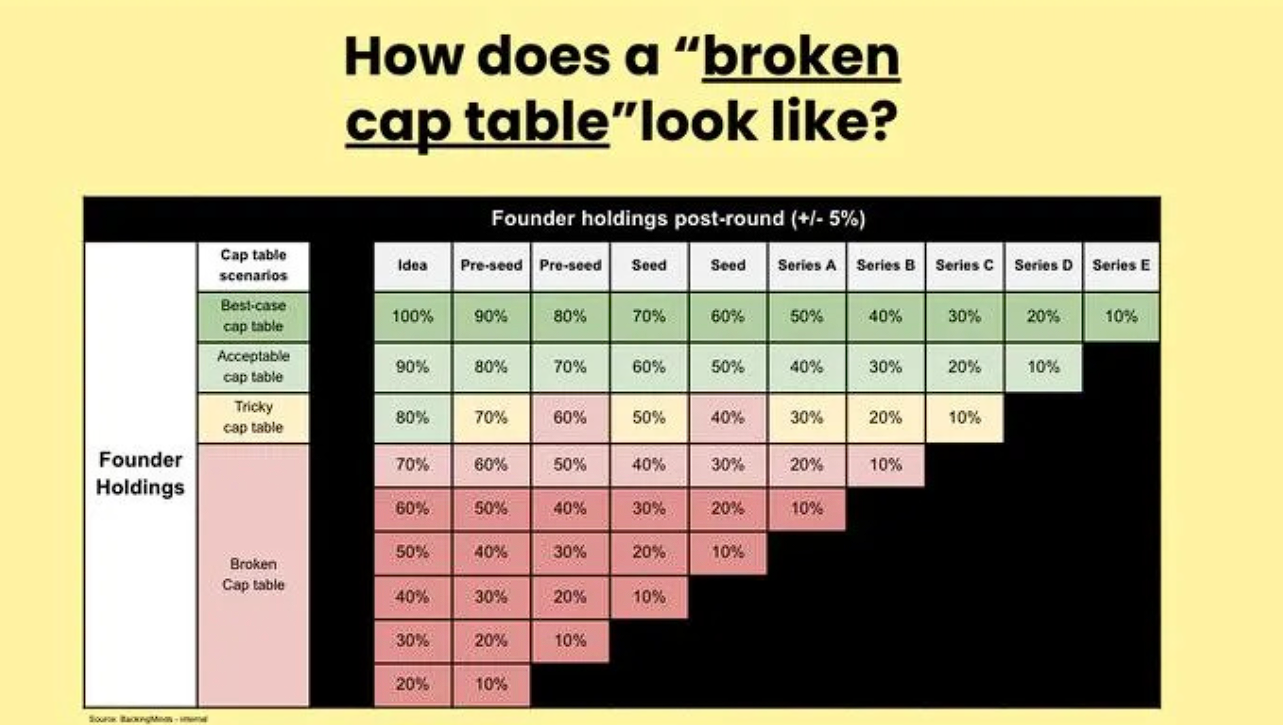

The Hidden Power of the Cap Table! I have seen many entreprenueurs struggling with their cap table just before the funding round and at that point, its not easy to cleanup the mess! Cap Table is the DNA of your startup’s ownership and if you’re not

See More

Account Deleted

Hey I am on Medial • 6m

Smallest Things Founders Overlook (But Shouldn’t) Email handles & domain trust Using founder123@gmail.com for investor/partner communication instantly kills credibility. A proper custom domain email builds subconscious trust. Investor update subje

See More

Aditya Malur

AI-Powered Product C... • 12m

How a Broken Cap Table Turns Founders Into Employees of Their Own Company? Founded in 2009, Quid raised over $108M in funding and reached a peak valuation of $300M+ by 2016. Yet when the company was acquired by Netbase in 2020, founder and CEO Bob G

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)