Back

VCGuy

Believe me, it’s not... • 7m

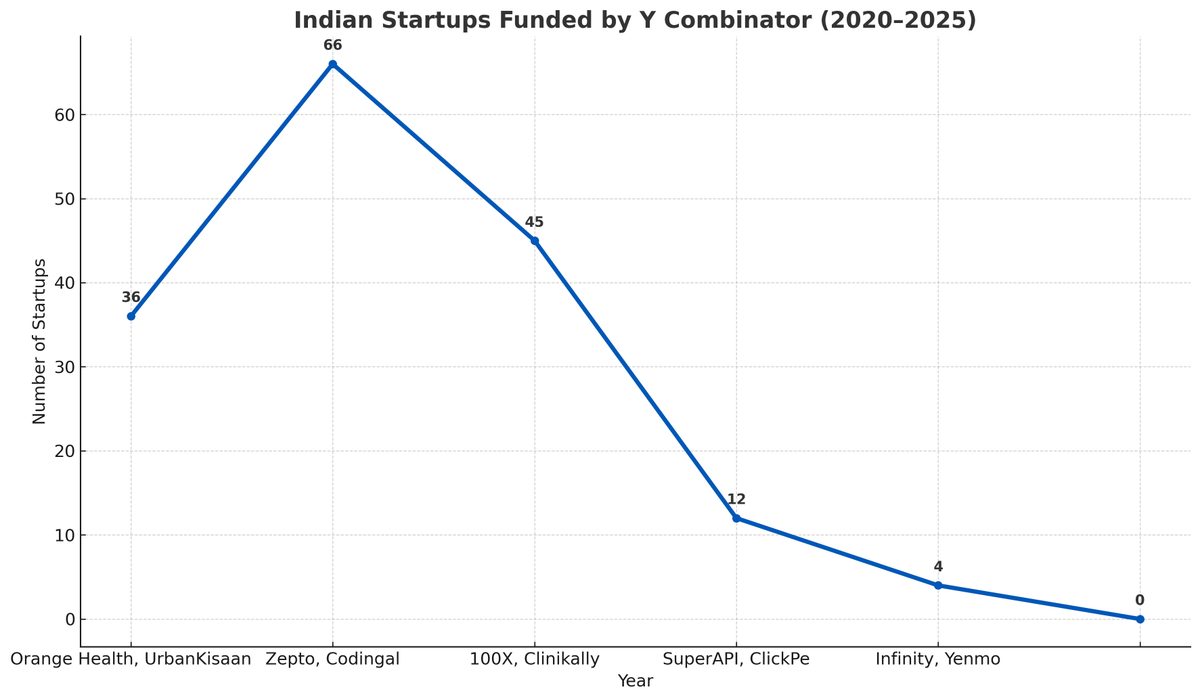

Indian startups funded by YC have fallen sharply over the years. Several reasons appear to be behind the drop - - Registration requirement in US, Canada, Singapore, or the Cayman Islands. - Increased access to capital via accelerator programs in India (WTFund, Accel Atoms, Antler India Residency, Incubation centres at colleges) - Reverse flipping entails heavy taxation to the US Gov (Razorpay ~$200 M, Meesho ~$280 M) ⏭️YC may have also become more selective → a growing preference for AI-first startups (in recent batches, as much as 30–50% of the cohort has been focused on or building around AI).

Replies (5)

More like this

Recommendations from Medial

Siddharth K Nair

Thatmoonemojiguy 🌝 • 7m

📉 From 66 to 4: What's happening with Y Combinator and Indian Startups? 🇮🇳 Y Combinator's backing of Indian startups significantly dropped in 2024, and it's a fascinating shift! Here's why: * "Reverse Flipping" Costs: YC's requirement for a U

See More

VCGuy

Believe me, it’s not... • 1y

Indian startups are Reverse Flipping. Many startups incorporate in countries like Singapore, Mauritius, the US (primarily for SaaS), or the Cayman Islands for several reasons: - Ease of doing business - Tax incentives - Better funding opportunities

See MoreVCGuy

Believe me, it’s not... • 1y

Swiggy's upcoming IPO will be a multibagger win for early VC investors. 🎯Detailed insights will be available once their DRHP is public, but if you look at the history - - Elevation Capital: Investment of $5.9 M turned into $61.8 M (~10x returns) -

See MoreVCGuy

Believe me, it’s not... • 1y

Building SaaS from India for the world - Rocketlane raises a $24 M Series B. ➡️Total Funding: $45 M (Seed at $3 M, Series A at $18 M) ⏫Lead investors: 8VC, Matrix Partners and Nexus VP. In recent years, many Indian startups are building SaaS compan

See MoreHavish Gupta

Figuring Out • 11m

Surge, The Y Combinator of India! So Surge is a seed-stage accelerator program launched in 2019 by Peak XV Partners (formerly Sequoia Capital India & SEA). It provides early-stage startups in India and Southeast Asia with funding, mentorship, and

See More

Tarun Suthar

CA Inter | CS Execut... • 6m

I have compiled all publicly available investor lists, YC founders lists, pitch deck collections, and other valuable fundraising resources available on the internet into one place. ✨️🚀 I will keep updating the folder with more stuff. This includes

See More

Jayant Mundhra

•

Dexter Capital Advisors • 8m

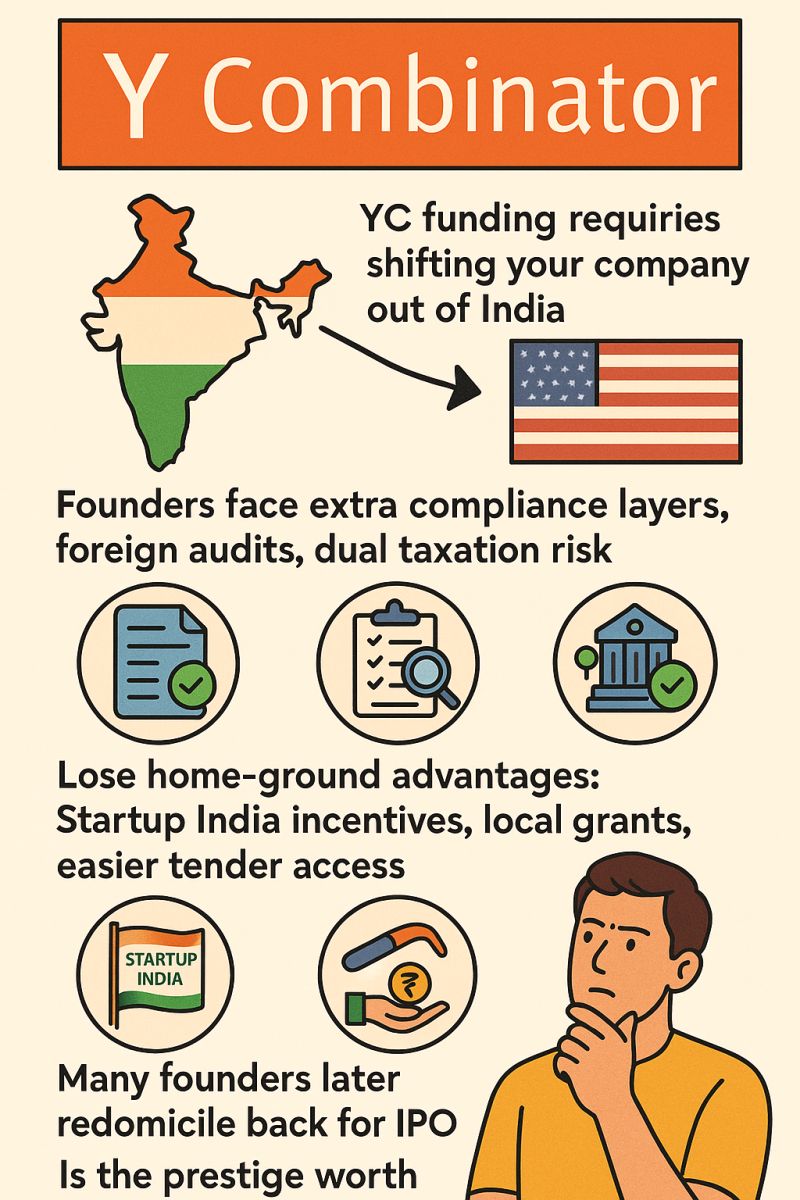

I genuinely feel sad when any Indian startup boasts about being funded by Y Combinator 🙏🙏 That is so because there is this unwritten rule that YC only invests in startups which are registered in the US, Singapore, Canada or Cayman Islands. So eve

See More

VCGuy

Believe me, it’s not... • 10m

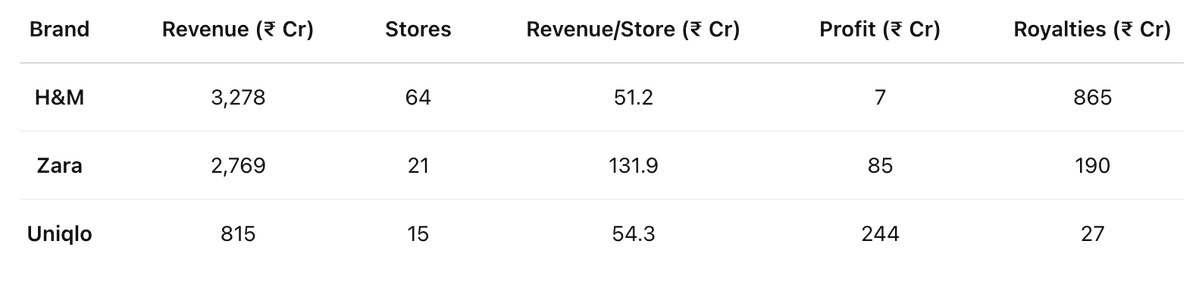

I assumed H&M’s lower price point would translate into healthier profits. H&M may lead in total sales, but it’s shelling out 4.5× what Zara pays in royalties — ₹865 Cr vs Zara’s ₹190 Cr, eating into margins⤵️ (source - Entrackr) From what I’ve seen

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)