Back

Tushar Aher Patil

Trying to do better • 8m

📍 Day 1 – Startup World Surprise: The Unicorn Illusion When we hear the word "unicorn startup", we instantly think of success — billion-dollar valuation, flashy media coverage, and a seemingly unstoppable growth story. But here's a surprising truth that rarely makes headlines: nearly 95% of unicorn startups are not profitable. That’s right. Most of these companies — valued at £1 billion or more — are still running on massive financial losses. Their business model is often focused on capturing market share at any cost, relying heavily on investor funding to survive. Instead of generating profits, their goal is usually rapid growth, user acquisition, and market dominance — all in the hope that profits might come later. Let’s take some real-world examples: • Uber, despite being a global household name and a publicly listed company, continues to report operational losses. • Zomato, one of India’s leading food delivery platforms, has consistently faced pressure from investors due to its cash burn and delayed path to profitability. • BYJU’S, once the poster child of India’s edtech boom, is now battling funding crunches, governance issues, and operational losses — despite its past valuation of over £20 billion. So what’s going on here? The core reason is the "growth-first, profits-later" model that dominates venture capital thinking. Startups are encouraged to scale fast, burn capital aggressively, and focus on expanding their user base — often at the expense of building a sustainable business. This approach can create a bubble where valuation is driven by hype and investor sentiment rather than solid fundamentals. For aspiring entrepreneurs and curious investors, this raises a critical question: Are we celebrating businesses that are actually losing money, just because they look successful? The truth is, valuation ≠ profitability. A high valuation might earn media attention, but without a clear path to profits, a startup’s long-term survival is at serious risk. As you follow this “Startup World Surprises” series, we’ll continue to explore these lesser-known truths that exist behind the shiny headlines — because the world of startups is as risky and unpredictable as it is inspiring.

Replies (4)

More like this

Recommendations from Medial

Yash Barnwal

Gareeb Investor • 1y

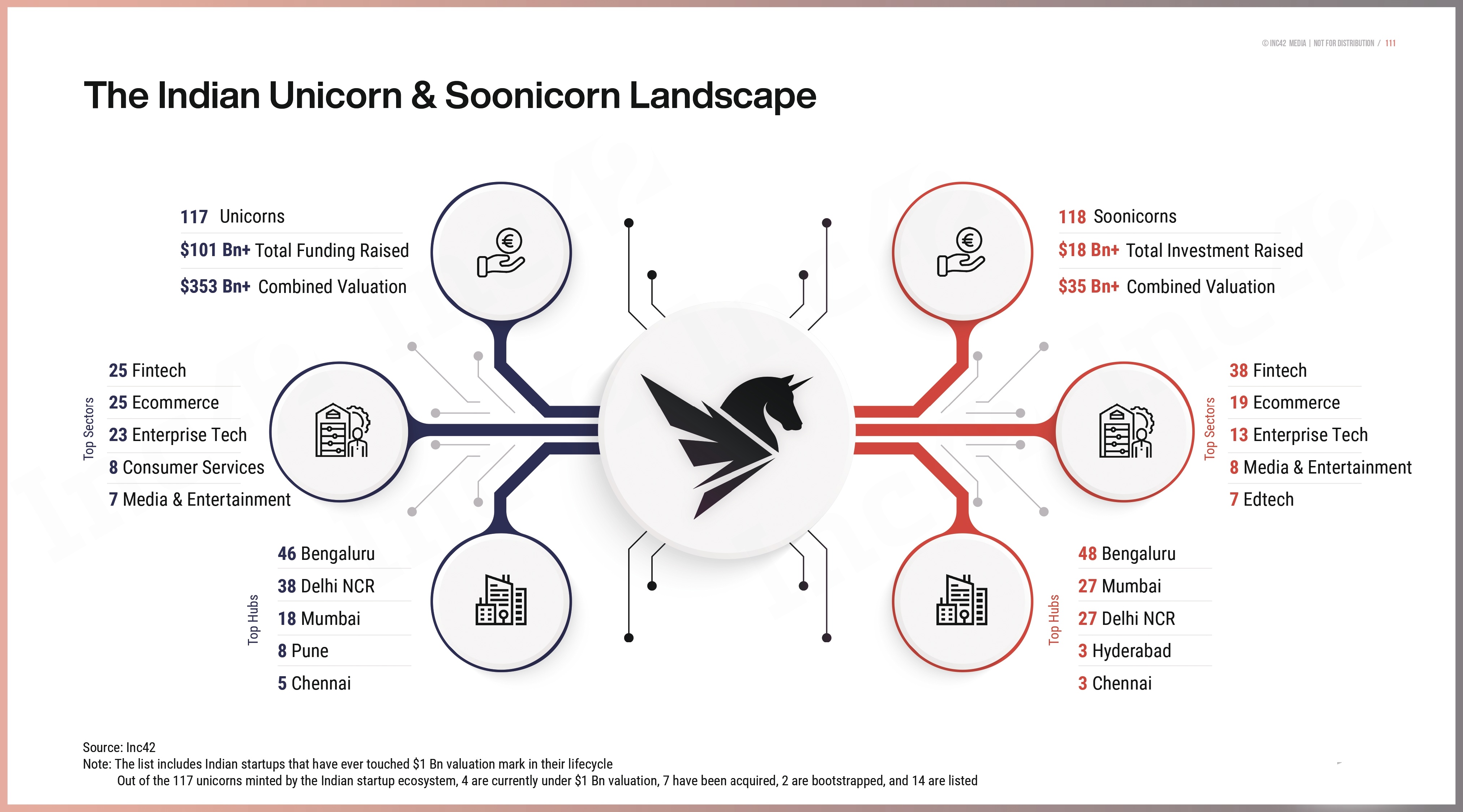

The Indian startup ecosystem is thriving with 117 unicorns and 118 soonicorns as of 2023. Unicorns have raised over $101 billion in funding with a combined valuation of $353 billion, while soonicorns have raised $18 billion with a $35 billion valuati

See More

Kishan Kabra

Founder & CEO • 1y

What's the reason behind of OYO valuation crash? They were struggling to get approval from SEBI for IPO back in 2021, Finally got a approval but they withdrew their application and looking to raise from private investors at $2.3 Billion which was $9

See MoreAccount Deleted

Hey I am on Medial • 11m

Meesho Is Planning For $10 Billion IPO! • Meesho is planning to file its IPO papers in the second half of 2025, with a potential listing in 2026. • The company is planning to raise $1 billion at a $10 billion valuation and appointed Morgan Stanley,

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)