Back

Tushar Aher Patil

Trying to do better • 8m

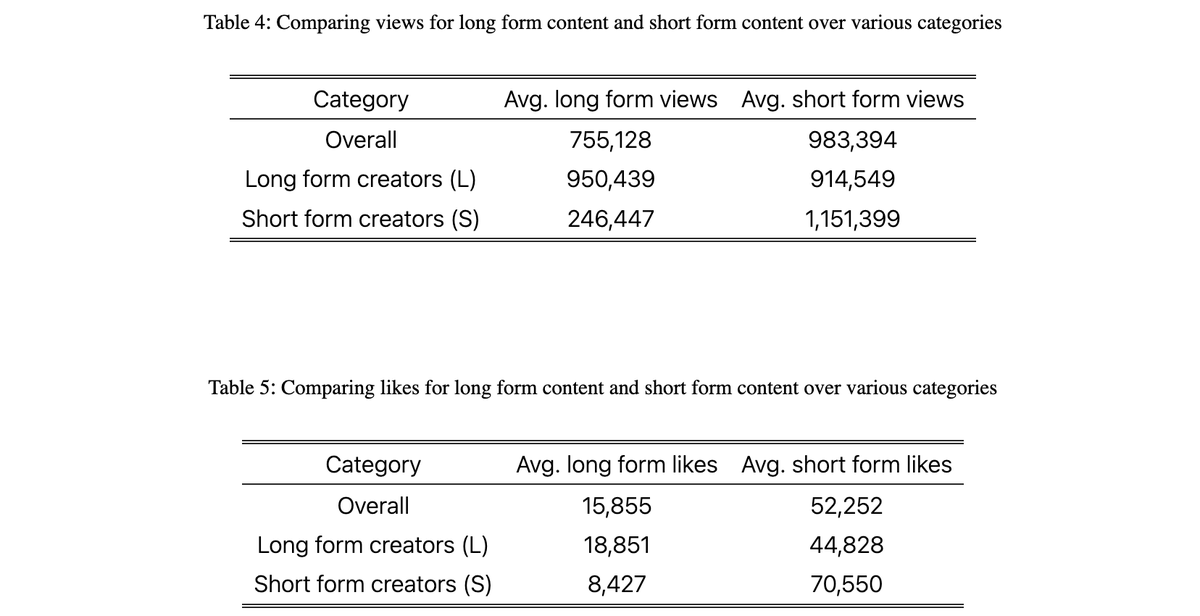

Unpacking 'Value Migration': A strategic framework for today's dynamic markets. Understanding how economic value shifts is crucial for identifying opportunities and risks. Here are 9 key insights from the sources: 1. Core Concept: Value Migration is the fundamental flow of economic and shareholder value from outdated business models to new, more effective designs that better satisfy customers' evolving priorities [P1, P4]. 2. Driving Catalysts: This shift is instigated by factors like cost, technology, convenience, and innovation [P4]. In India, catalysts like the GST Amendment Bill and demonetisation have accelerated these changes [P3, P47]. 3. Three Phases: Any business model typically experiences Value Inflow (gains in market share, expanding margins), Stability (competitive equilibrium), or Value Outflow (declining share, contracting margins for incumbents) [P4, P8]. 4. Measurement: For listed entities, it's often measured by the price-to-sales ratio (above two indicates inflow, below one indicates outflow) [P20]. For unlisted players, market share movement is key [P4, P27]. 5. Duration of Trends: Value Migration trends are typically long-lived, lasting for years or even decades [P5, P7, P28]. This offers sustained opportunities, even if identified somewhat later in the cycle [P7, P28]. 6. India's Unorganised to Organised Shift: A multi-year theme in India, hastened by GST, benefiting players like Titan (Jewellery), Pidilite (Adhesives), and Crompton Greaves Consumer (Light Electricals) [P4, P47, P5, P6]. 7. Public to Private Sector Migration: A multi-decadal trend in India, particularly in Banking and Insurance [P4, P13]. Private players like HDFC Bank and HDFCLIFE have gained significant market share due to superior customer convenience, technology, and efficiency [P9, P13]. 8. Technology & Lifestyle-Driven Shifts: Technology fosters new models like Payment Banks/SFBs (e.g., Paytm) [P10, P11], and shifted telecom value from voice to data (e.g., Reliance Jio [P7, P8]). Lifestyle changes also drive shifts in sectors like Diagnostics (e.g., Dr. Lal Pathlabs) [P6]. 9. Investment Implications & Reverse Migration: The framework is crucial for investors to identify potential winners and avoid declining business models [P4, P26, P45]. It also recognises Reverse Value Migration, where a company can reinvent itself to regain value [P2, P4, P33, P36]. #ValueMigration #MarketTrends #InvestmentStrategy #Disruption #IndiaBusiness #EconomicValue

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 7m

Environmental scanning isn't a luxury; it's survival Think PESTLE: Political/Legal: Policy shifts (e.g., green initiatives, data privacy laws) can open new markets or create compliance needs for innovative solutions Economic: Recessions might seem da

See More

VCGuy

Believe me, it’s not... • 8m

'Click, watch, shop: The Consumer Opportunity in India' → Bessemer’s report is a good read on India’s next digital decade. Two shifts really stood out to me - 🥘 Wellness, lifestyle & clean eating → now essentials - Across my friend group and colle

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)