Back

More like this

Recommendations from Medial

Neelakanth Chavan

Analytics and Data s... • 1y

What are the taxation rules in india on investments in stocks. As per my knowledge, gains on stocks more than 1 lakh are taxed at 10% for long term gains(>1year) & 15% for short term gains(<1year). How can someone escape from this. One method that

See More1 Reply

3

Pulakit Bararia

Founder Snippetz Lab... • 11m

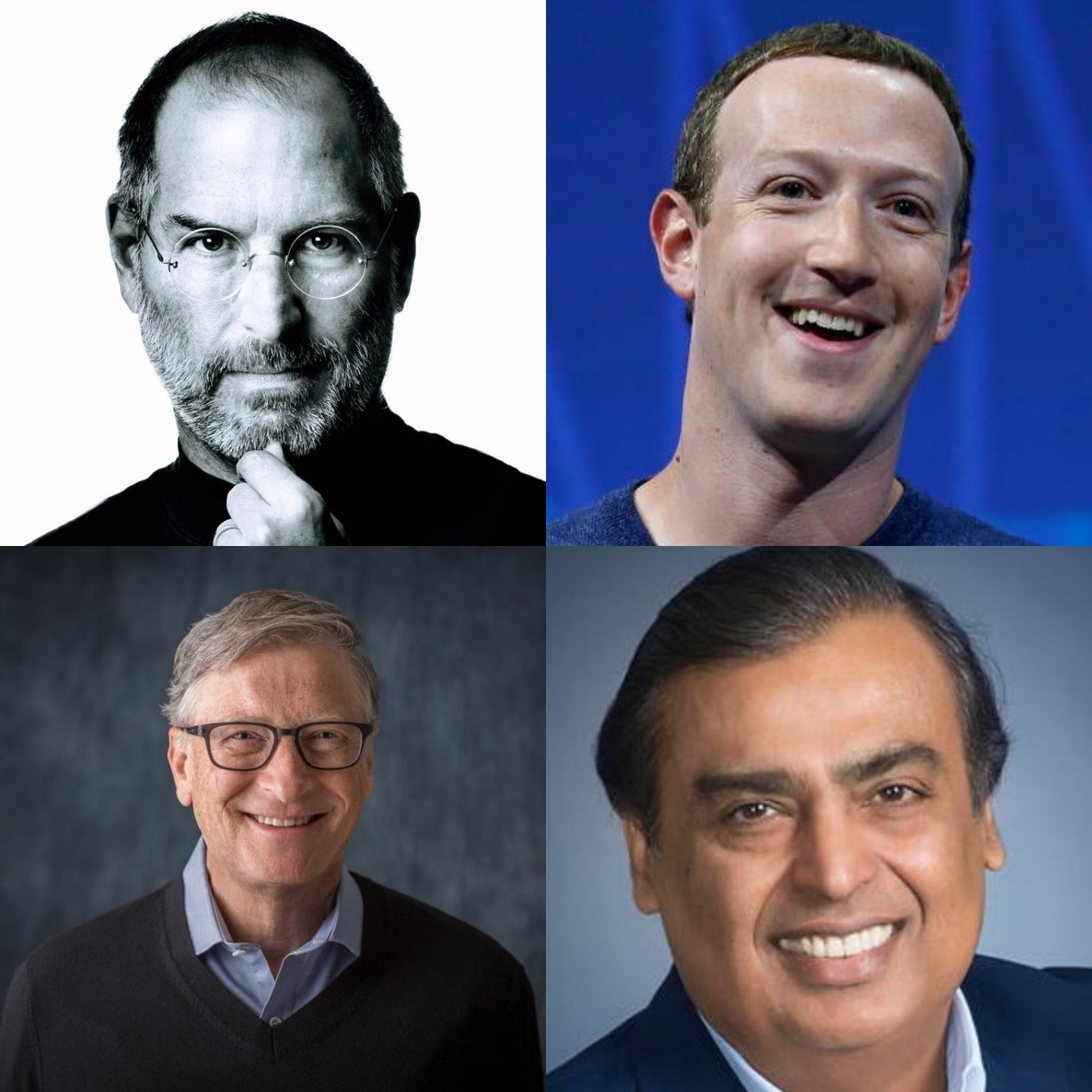

Most people obsess over rapid growth, chasing quick wins and short-term spikes. But the smartest entrepreneurs focus on endurance—building businesses that last, brands that compound, and systems that scale sustainably. In the long run, longevity

See More10 Replies

2

15

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)