Back

Vivek Joshi

Director & CEO @ Exc... • 8m

Call for Debt Funding: Middle East & South East Asia Businesses Excess Edge Experts invites established businesses in the Real Estate, Hospitality, AI, Manufacturing, & Packaged Foods sectors to explore debt funding opportunities up to USD 35 million. We understand the landscapes of these regions & the capital requirements to scale operations, innovate, & expand market reach. If your business has a strong track record & a clear vision for the future, we want to hear from you. We are actively seeking businesses that are: Established & revenue-generating. Demonstrating strong growth potential. Operating in the Real Estate, Hospitality, AI, Manufacturing, or Packaged Foods sectors. Based in the Middle East or South East Asia. Seeking debt funding up to USD 35 million. To learn more and be considered for funding, please share your comprehensive investor decks and detailed business plans with us at: info@excessedgeexperts.com Visit our website to know more: www.excessedgeexperts.com

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 6m

Grow Your Business with Debt Funding Is your established business in the Middle East or South East Asia ready for its next big leap? Excess Edge Experts provides debt funding opportunities up to $35 million to help you scale your operations, innovate

See More

Vivek Joshi

Director & CEO @ Exc... • 6m

Grow Your Business with Debt Funding Is your established business in the Middle East or South East Asia ready for its next big leap? Excess Edge Experts provides debt funding opportunities up to $35 million to help you scale your operations, innovate

See More

Vivek Joshi

Director & CEO @ Exc... • 6m

Grow Your Business with Debt Funding Is your established business in the Middle East or South East Asia ready for its next big leap? Excess Edge Experts provides debt funding opportunities up to $35 million to help you scale your operations, innovate

See More

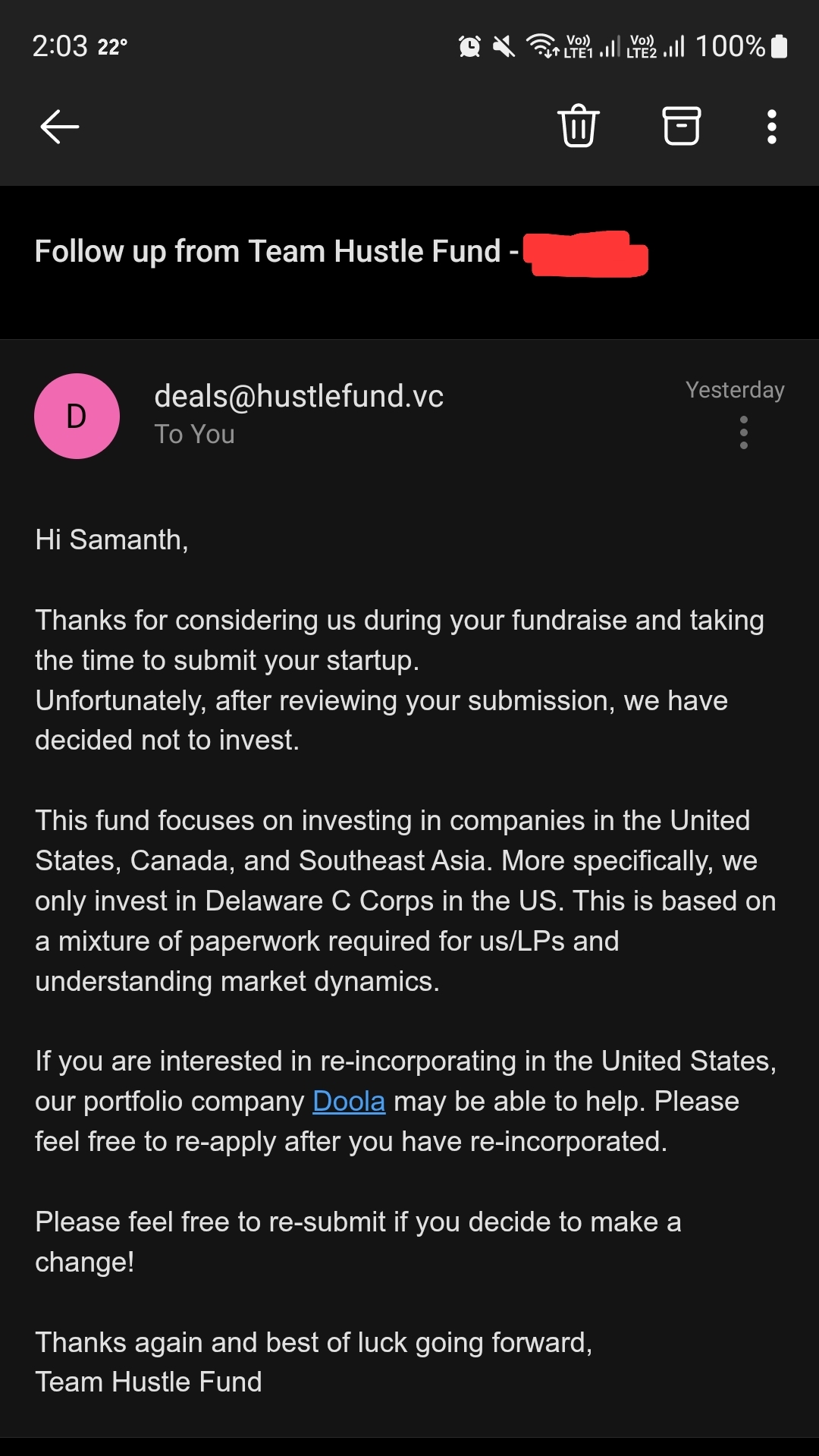

Samanth Shetty

Be yourself • 8m

Made a mistake while applying, letting y'all know while applying for any VC fund just read all their eligibility criteria. I had read it but I just got confused thinking that India is a part of South East Asia, later i realised that India is part of

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

HSBC Restructures Investment Banking Operations HSBC announced a significant reduction in its investment banking operations, particularly shutting down its Equity Capital Markets and Mergers & Acquisitions advisory businesses in the UK, Europe, and

See More

Suman solopreneur

Exploring peace of m... • 1y

ATOMIC HABITS: The Law of Least Effort states that people favour simpler solutions. behaviours & Energy: High-effort behaviours wane, whereas low-effort ones endure. Outcome Over Habit: The objective is the outcome rather than the habit. Reduce

See MoreVENTURE NAVIGATOR

INVESTOR | Start up ... • 1y

Scaling a Traditional Business with Debt Funding 💰🍦 Recently, I had the opportunity to consult the founder of an ice cream brand looking to raise funds—not for an exit, but for scaling up! 🚀 With an annual turnover of ₹2 Cr, he needed ₹30 Lakhs

See More

Shreyas Ramdasi

Mechanical Engineer • 1y

Lohum Preps Up For INR 1,000 Cr Manganese-Based Batteries Project, Ropes In Tesla Veteran The New Delhi-based company is looking to invest INR 1,000 Cr over the next three years and will be setting up a capacity of over 20 GWh This comes days after

See MoreTUCSI Bharat

"From Grassroots to ... • 1m

Backing the next generation of impact-driven entrepreneurs. NextGenFounders, powered by Tucsi Foundation and co-powered by Tucsi Business Ventures Pvt. Ltd., helps entrepreneurs aged 18–35 access ₹5–25 lakh in seed funding, mentorship and a trusted C

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)