Back

Rohan Saha

Founder - Burn Inves... • 9m

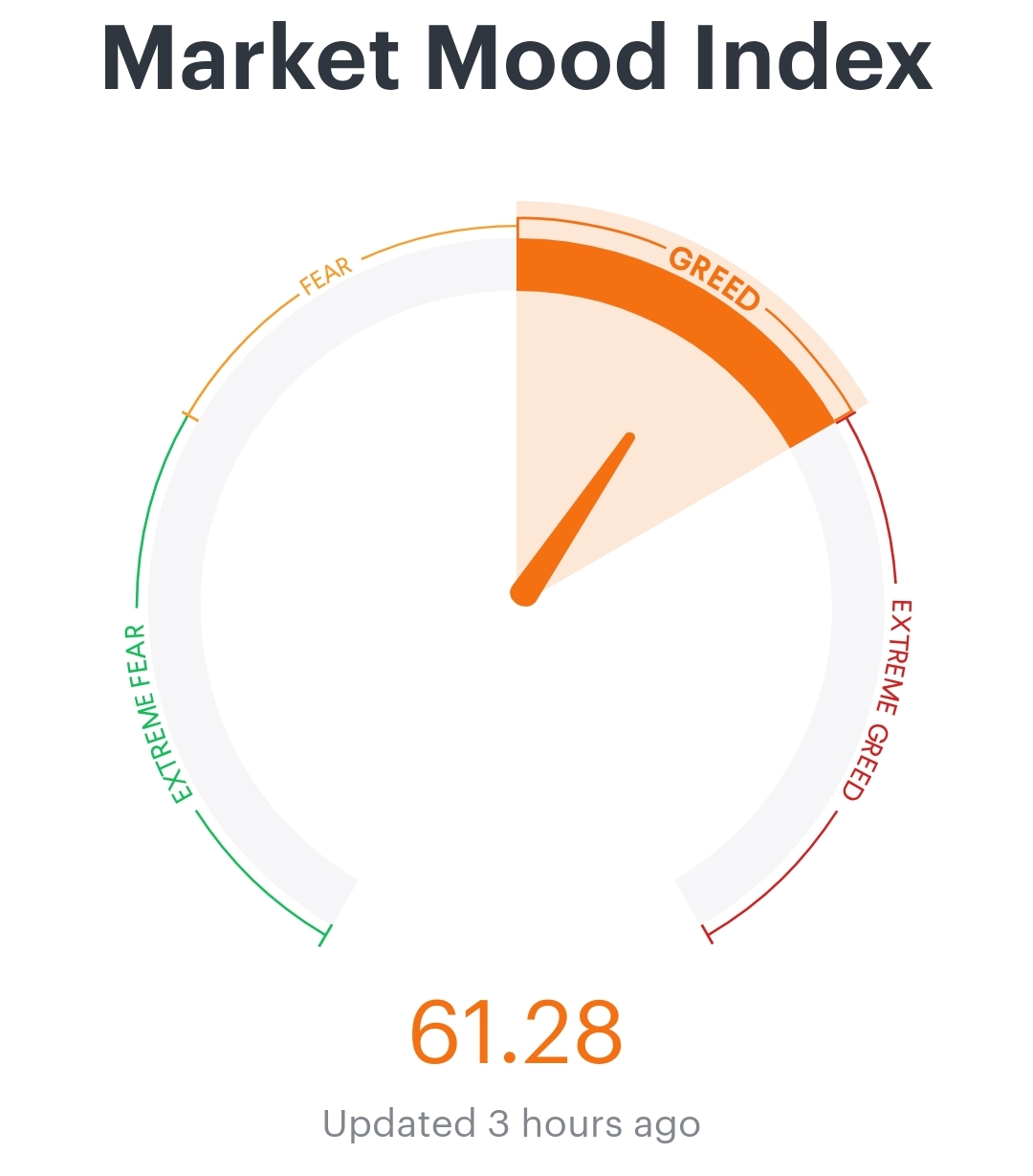

The market has now come to a somewhat fairly valued position. How much further it will go from here is unknown to anyone, but with the current scenarios, reaching an all-time high seems difficult. And even if it does reach it, sustaining it would be challenging. On the other hand, if we talk about the MMI Index today, it's around 66; on the last trading day, it was around 68. So that's a positive sign, but still, we need to keep an eye on valuations and news developments.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 8m

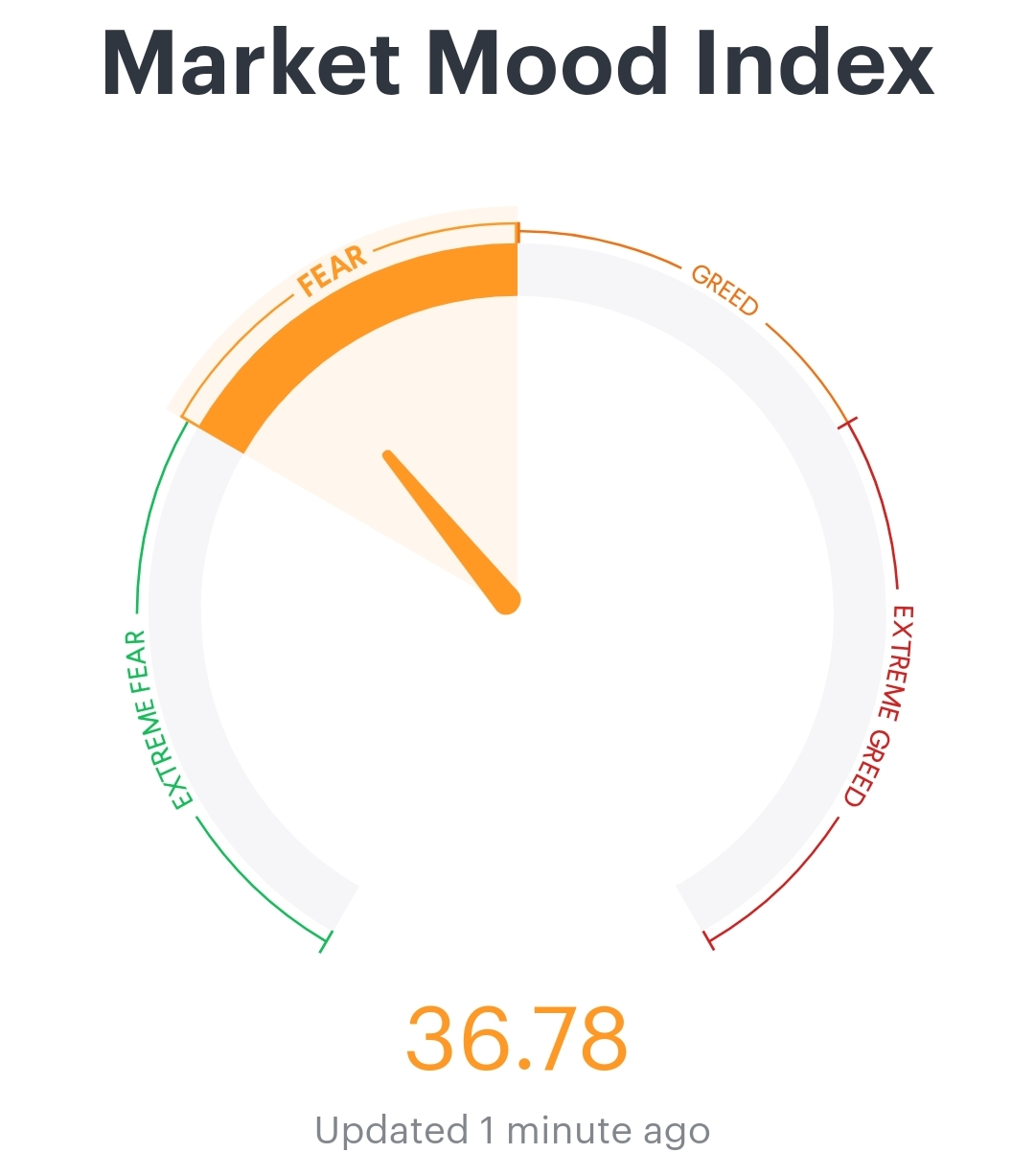

Looking at today’s MMI it seems pretty clear that even if the market does correct it probably won’t be a major drop we might just see a small dip enough to bring valuations to a reasonable level and then the market could bounce back Yesterday the MMI

See More

Rohan Saha

Founder - Burn Inves... • 8m

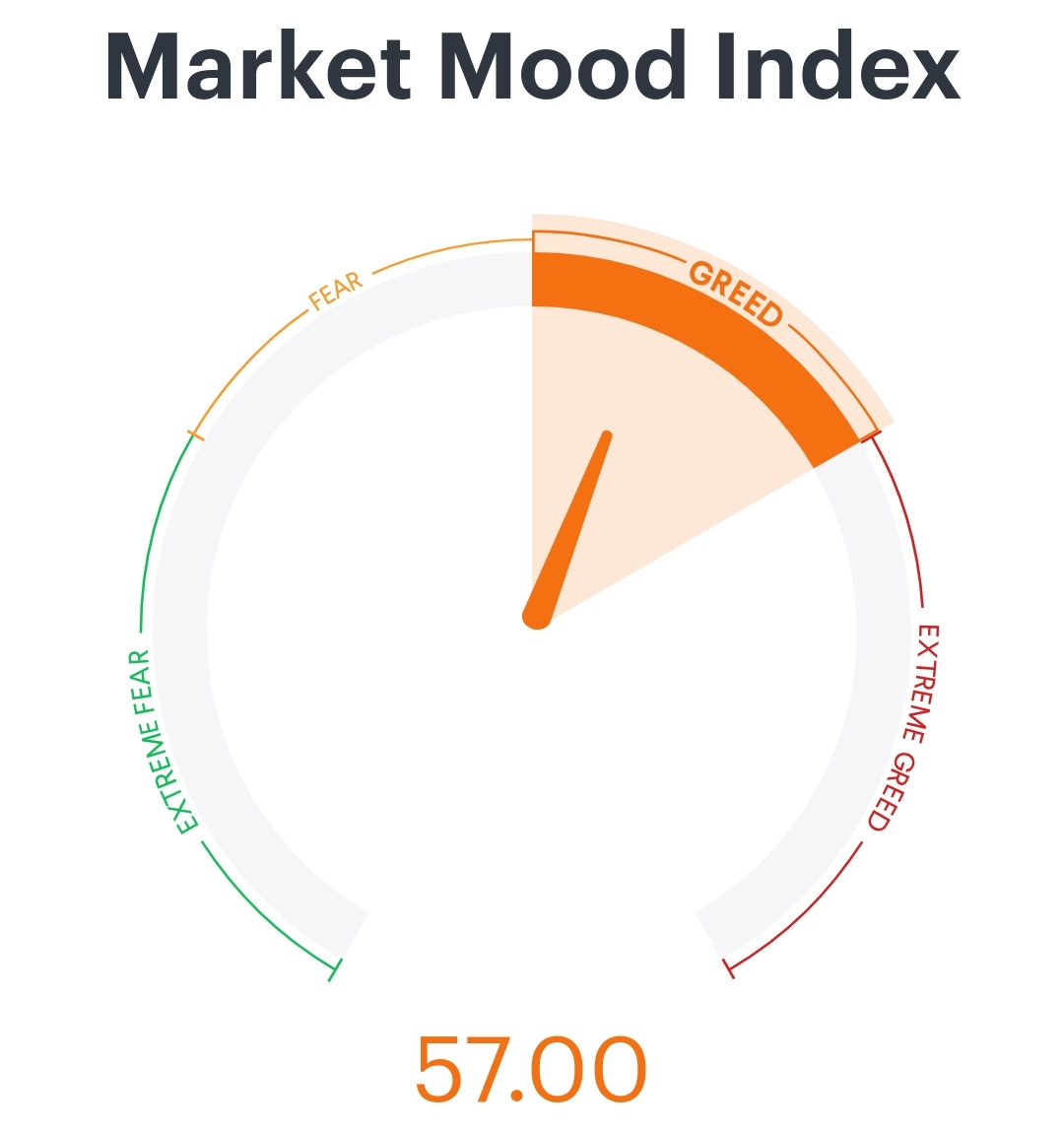

The Market Mood Index (MMI) is currently hovering around 57, which usually points to a bullish setup and potential for some decent upside. But we can't ignore the bigger picture global markets are still full of uncertainties. The US job data didn’t r

See More

Rohan Saha

Founder - Burn Inves... • 9m

Even though the market fell today, our MMI index still jumped from 64 to 67 it's now just a few points away from the 'extreme greed' zone. I have a feeling that even a small move in the Indian market could trigger a noticeable shift in the MMI, espe

See MoreRohan Saha

Founder - Burn Inves... • 7m

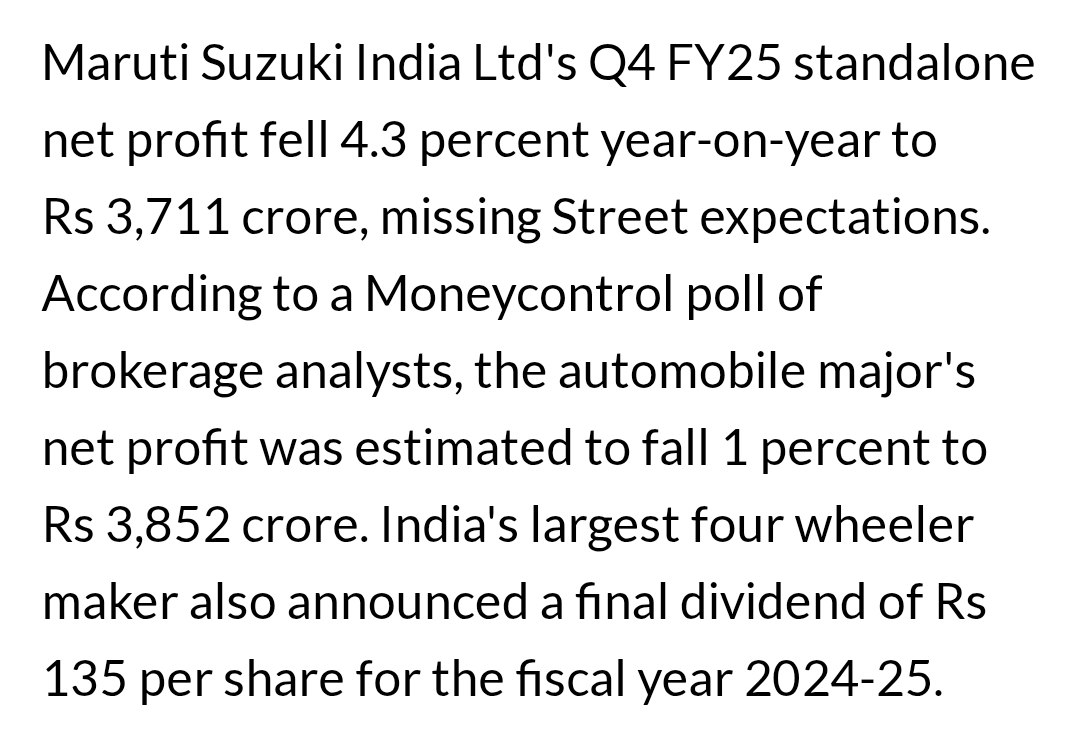

The market might remain range bound during this results season right now it’s not about technicals at all the focus should be entirely on fundamentals with the Nifty 500 trading at a PE of 25.3 the market looks fairly valued FII and DII activity has

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)