Back

IncorpX

Your partner from St... • 9m

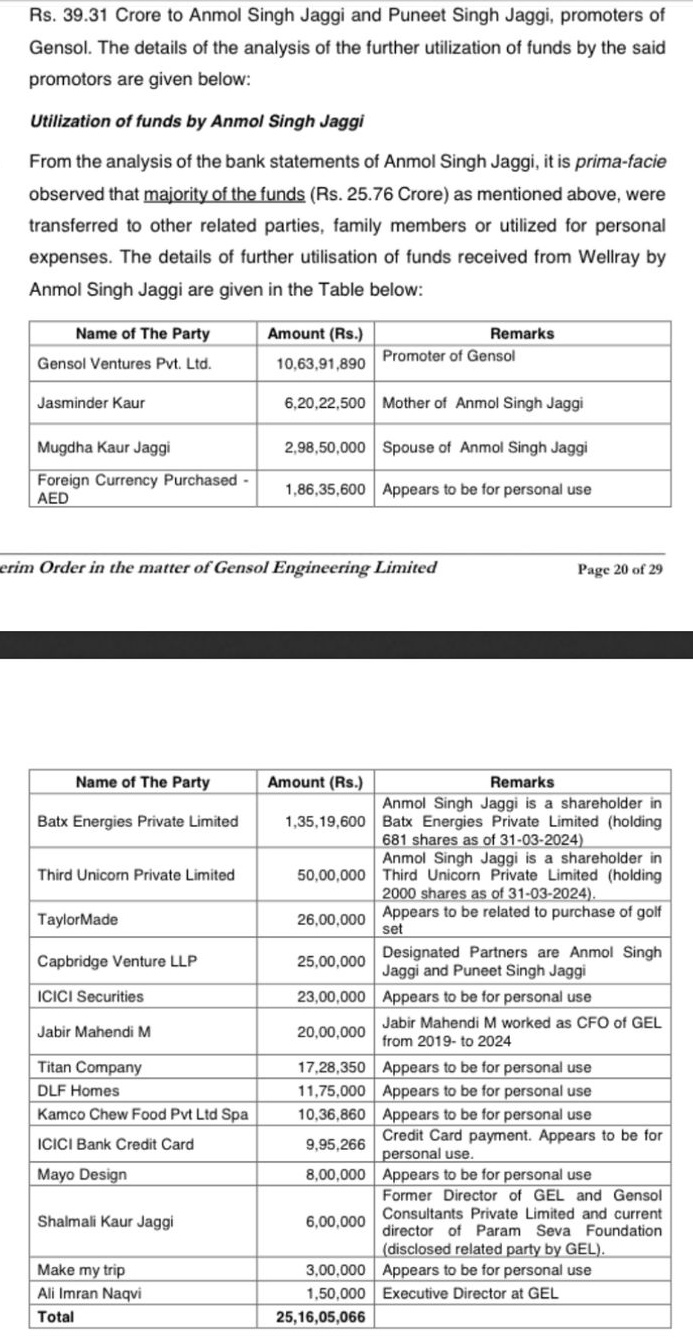

BluSmart’s Reboot: A Story of Promise, Pitfalls, and Possible Redemption In a dramatic turn for India’s all-electric ride-hailing pioneer BluSmart, major investors including BP Ventures are now in advanced talks to acquire co-founder Anmol Singh Jaggi’s stake—a move aimed at stabilizing the company after a storm of controversies and regulatory setbacks. What went wrong? ⚠️ Anmol Singh Jaggi and his brother Puneet, founders of Gensol Engineering, were hit with an interim order from SEBI for allegedly siphoning off over ₹250 crore through complex financial schemes. 🔁 Allegations include circular trading, undisclosed related-party transactions, and misuse of investor funds routed into personal companies. ⛔ These actions deeply affected BluSmart: 📉 Gensol’s stock crashed ❌ IPO plans were shelved 🚧 BluSmart's operations came to a halt 🚖 Drivers were left in uncertainty What’s happening now? 💼 Investors, led by BP Ventures, are stepping in to: ✅ Acquire Anmol Jaggi’s stake ✅ Inject fresh capital ✅ Resume services ✅ Rebuild trust with regulators and stakeholders Why it matters: ♻️ BluSmart is more than just a mobility startup—it symbolizes India’s push toward sustainable, electric-first transportation. ⚡ Its revival could be a landmark moment for green innovation, startup governance, and investor protection. Key takeaways: 1️⃣ Governance is non-negotiable 2️⃣ Founders create value—but investors preserve it It’s a crucial moment for BluSmart—and for India’s startup ecosystem. Let’s see if this course correction leads to a stronger, more resilient future.

Replies (2)

More like this

Recommendations from Medial

Sanskar

Keen Learner and Exp... • 10m

India's Latest Start Up Scandal Gensol borrowed almost ₹978 crore to rent electric vehicles (EVs) to BluSmart. And the interesting fact here is that Gensol has no direct equity or ownership interest in BluSmart as a distinct legal entity. Gensol do

See More

Armaan Nath

Startups | Product • 1y

BluSmart - Revolutionizing Sustainable Mobility in India⚡ BluSmart is an Indian startup that aims to revolutionize the urban mobility sector by providing eco-friendly transportation solutions. Founded in 2019 by Anmol Jaggi, Punit K Goyal, and Punee

See MorePoosarla Sai Karthik

Tech guy with a busi... • 10m

So here’s what went wrong with Gensol & BluSmart. The founders, Anmol and Puneet Singh Jaggi, raised a fat ₹978 crore in loans from IREDA and PFC. The money was supposed to be used to build an EV fleet for BluSmart. But guess what? Only 4,704 EVs wer

See MoreRohan Saha

Founder - Burn Inves... • 10m

After Gensol's fraudulent activities, even BluSmart has stopped taking bookings in many areas now. Gensol was a very important partner for them the majority of the vehicles that BluSmart had were leased to them by Gensol. Now, they're even having tro

See MoreSiddharth K Nair

Thatmoonemojiguy 🌝 • 9m

From Gaon to Global: The Biscuit Brand That Outsmarted the Big Names Did you know India’s 4th largest biscuit brand is Anmol, yet most haven’t heard of it? While big brands chased cities with celebrity ads, Anmol’s founder saw a gap rural India lack

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)