Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

Tesla Doesn't Make Money by Selling Cars.💀🔥 This Sounds Tricky, Right! When Elon Musk was building Tesla’s electric vehicles, he encountered a stark reality of the auto industry: new car sales alone rarely generate profits. In a widely cited interview, Musk shared that a leading automotive investor quipped to him that “car companies don’t make any money on new car sales; they make all of their money selling parts to the existing fleet” This razor-and-blades business model creates a massive barrier for new automakers, since they start without the lucrative replacement-parts revenue stream that established players rely on . Today, Tesla’s own “services and other” segment-which includes parts, maintenance, and repairs-generated roughly $8.3 billion in fiscal year 2023, representing just under 9 percent of total revenue but commanding higher margins than car sales . Understanding this dynamic sheds light on both Tesla’s strategy and the broader challenges facing EV startups. ✅️ Tesla’s Business Model Beyond Car Sales ✅️ Vehicle Sales vs. Aftermarket Revenue Tesla’s automotive segment-which includes vehicle sales, regulatory‐credit sales, and services-accounted for over 90 percent of its total revenue in fiscal year 2024, with pure vehicle sales comprising the lion’s share . However, the margins on new‐car sales are razor-thin: Tesla’s automotive gross margin declined to around 17 percent in 2024, down from a peak of 27 percent in 2021 . In contrast, its services segment-encompassing parts, maintenance, and other vehicle‐related revenue-reported a 5.9 percent gross margin in late 2023 and grew 37 percent year-over-year, reaching $8.3 billion . ✅️ Diversification: Credits, Energy, and Software Tesla has deliberately diversified beyond selling cars. In Q3 2024, while vehicle sales hit $20 billion, substantial profit also came from selling carbon credits and its expanding battery and solar business . This diversification is partly why some analysts argue Tesla “isn’t a car company” at its core but rather an energy and software innovator . ✅️ The Golden Steering Wheel Anecdote In June 2022, during a conversation with Tesla Owners of Silicon Valley club leaders, Musk recounted receiving Germany’s Golden Steering Wheel award and meeting a renowned automotive investor at Axel Springer headquarters . The investor predicted Tesla’s failure and bluntly explained the industry’s profit engine: “Car companies don’t make any money on the new car sales. They make all of their money selling parts to cars - to the existing fleet. So when the warranty runs out…you can sell high-margin replacement parts for the fleet and sell new cars at effectively zero margins.” Musk noted that roughly 80 percent of a car fleet is out of warranty at any time, making replacement parts a perennial, high-margin revenue source that new entrants lack. ✅️ Why Parts Matter More Than Cars 1. High Margins on Replacement Parts Once a vehicle’s warranty expires (typically after four years), owners pay out-of-pocket for the parts and labor. These items often carry gross margins significantly above those on new vehicles . 2. Steady Recurring Revenue An established automaker with millions of vehicles on the road has a reliable aftermarket business. Tesla’s $8.3 billion in services revenue in 2023 demonstrates how even a growing EV maker depends on this segment . 3. Barrier to Entry Without an existing fleet, startups cannot tap this aftermarket. To compensate, they must price new vehicles at a premium-demanding a product so compelling (e.g., superior autonomy, design, or brand) that customers willingly pay above incumbent prices . ✅️ Implications for New EV Entrants Capital Intensity: Developing a parts and service network requires massive upfront investment in distribution, logistics, and inventory. Scale Challenge: Startups must rapidly scale deliveries to seed a future parts business-a catch-22 if early production is limited. Razor-Blades Strategy: Like printers and ink, selling cars at minimal or zero margins can win market share, but only if an aftermarket profits stream exists later.

Replies (3)

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 7m

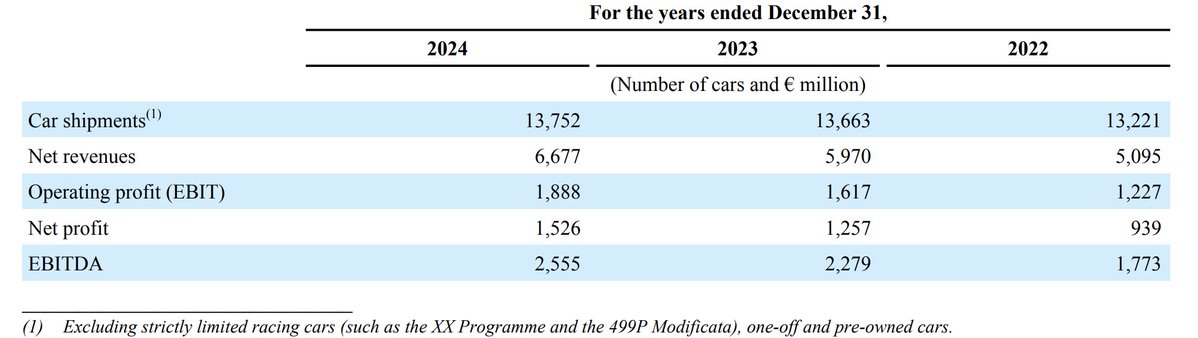

Ferrari seems like a car company on paper. But most investors would argue → it operates more like a SaaS company. In '24, Ferrari sold 13,752 cars. ⤷ 81% (or ~11,139 cars) were sold to existing customers (people who already owned one or more). Rev

See More

Niranjan Sengar

TRUST THE PROCESS • 1y

Hey Guys, I'm new here, I'm doing a research on my idea of car booking business. Diesel cars in delhi gets expired after 10 years. I want to create business with their owners. I want these cars (3-5 cars in starting) for booking service in my MP regi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)