Back

Rohan Saha

Founder - Burn Inves... • 9m

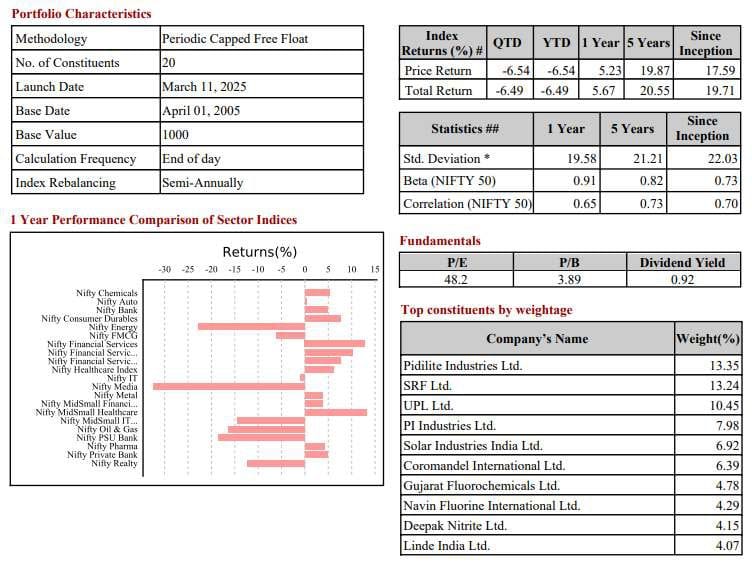

The market might have bounced back, but I can confidently say that many people’s portfolios still look the same or maybe even worse. One big reason behind this is something called the advance-decline ratio. A lot of us tend to judge our portfolios based on how the index is doing. But here’s the thing: the companies that make up the index aren’t always the same ones we personally own. That’s why NSE and BSE publish the advance-decline ratio every day it gives a better picture of what’s really happening under the surface. For example, let’s say there are 100 companies listed on the NSE. If only 10 of them are doing well (in the green), that means the other 90 are in the red. What really matters is how many of your stocks fall into those two groups. If most of the stocks are declining, chances are your day’s profit and loss (P&L) will be in the red too. And if more are rising, then your P&L will likely be green. In the end, it's your individual stocks that matter not the overall index. Sometimes, the index can drop sharply, but your portfolio might barely move. That’s because your holdings might not even be part of that index. Take Nifty 50, for instance it includes India’s top 50 companies. But it’s not like everyone owns the same 50 stocks. It might sound a bit complicated at first, but once you understand how it works, it all starts to make sense and it's actually pretty simple.

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

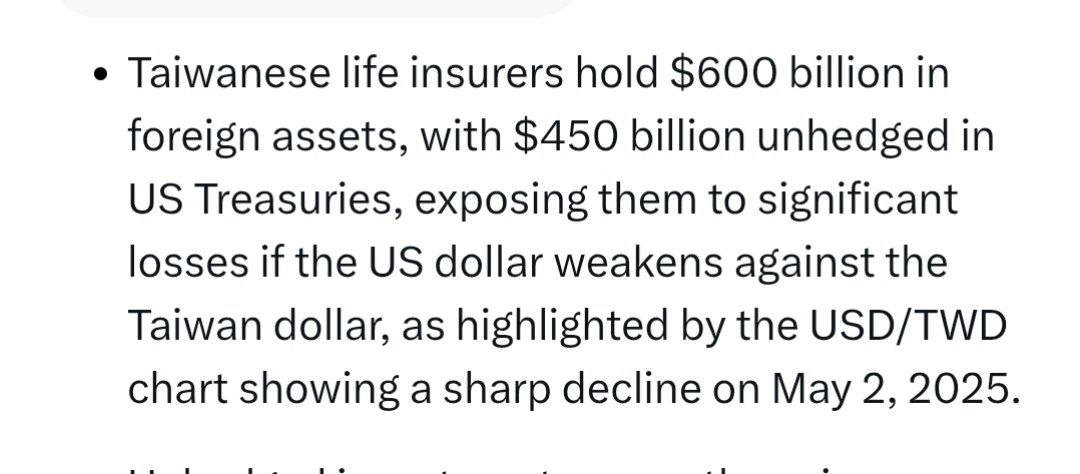

Oh, we didn't even think of this the dollar can fall further because the companies that have made some investments in the USA will definitely see a decline in their portfolios if the dollar drops. To prevent this, companies might sell US bonds or st

See More

Atharva Deshmukh

Daily Learnings... • 1y

The Stock Market Index When we want to know about the trends in the market, we need to analyze few of the important companies in each industry. The important companies are pre-packaged and continuously monitored to give you this information. This pr

See MoreAryan patil

Intern at YourStory ... • 1y

SEBI warned ⚠️ investors about Stock market bubble is about to burst anytime soon 📉 because The price-to-book (P/B) ratio of the Nifty Midcap 150 index is 4.26, and the Nifty Midcap 50 index has a P/B ratio of 3.64 This Means valuations of the Mid/s

See Morefinancialnews

Founder And CEO Of F... • 1y

"Nifty Smallcap 100 Drops 3.5%: 17 Stocks Plunge Over 5%" The Nifty SmallCap 100 index saw a sharp decline of 3.5% in today’s intraday trade, dropping below the 18,200 mark to 18,149. This is the lowest level for the index since mid-August, reflecti

See Morefinancialnews

Founder And CEO Of F... • 1y

Nifty 50 Index: Signs of Reversal Amid Risky Patterns The Nifty 50 index is exhibiting patterns that signal potential market volatility and a possible reversal. Recent technical indicators, such as overbought levels and resistance zone challenges, s

See MoreRohan Saha

Founder - Burn Inves... • 1y

I focused exclusively on trading the index this month, and fortunately, not a single stop loss was hit, thanks to God. I recognize that profits from the index are lower than those from stocks, but trading the index is somewhat easier in a competitive

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)