Back

Anonymous

Hey I am on Medial • 9m

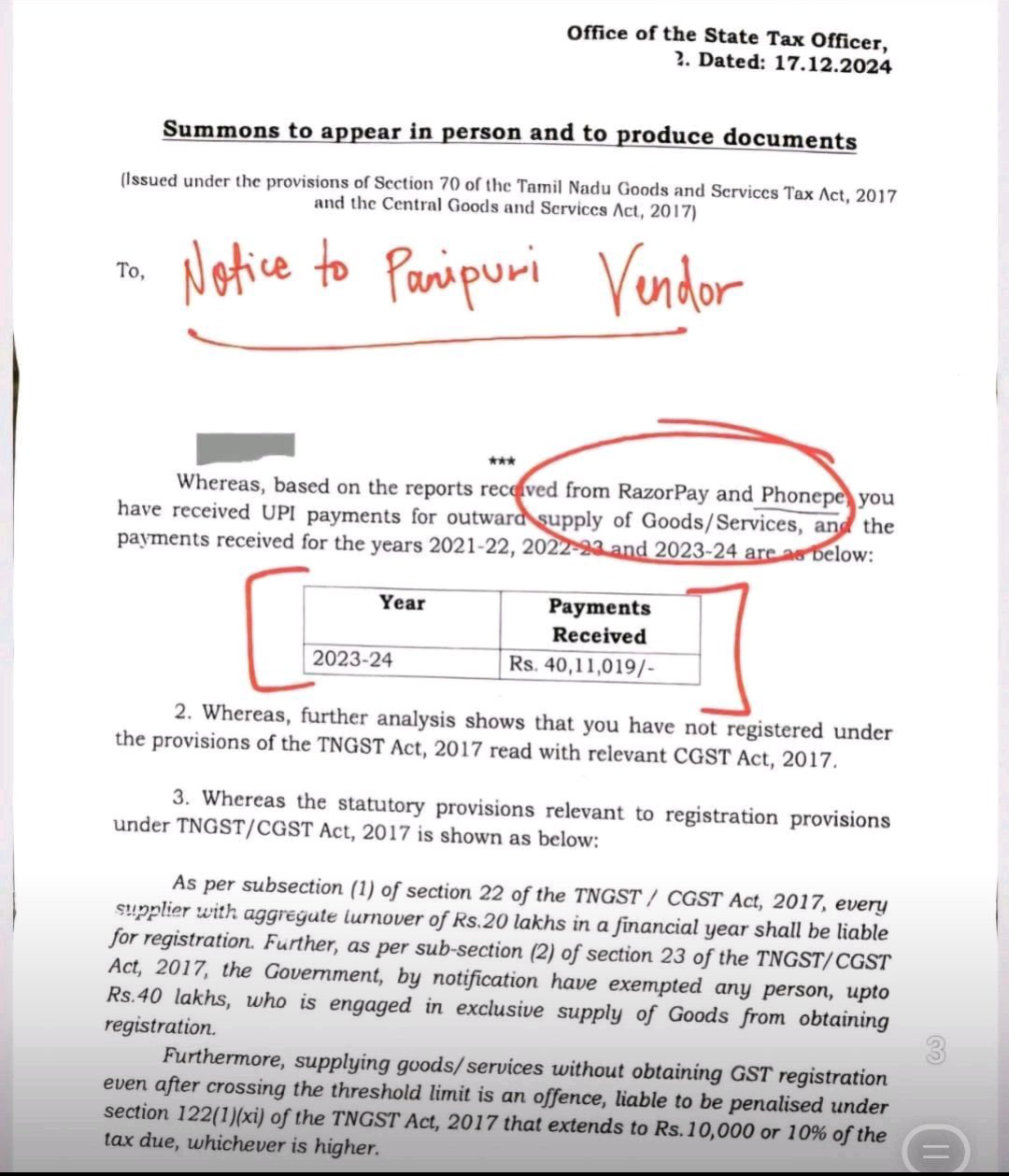

need to take tax , they earning huse money, if government don't take, other institutions will feel guilt. #indiangovernment #भारत #IPL

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

“I have been earning around 10 LPA (lakhs per annum), but a significant portion of my income is being deducted as taxes. I’m unsure about what steps to take. Could you please provide some tips on how I can minimize my tax liability and save more mone

See More

Anonymous

Hey I am on Medial • 1y

Hundreds of elephants 🐘 and forests animals are dieing every year in India because of no food so the question is where is Money going ? because government allocated thousands of crores money........ we need to build a startup that will organise and

See More

Anil Sharma

Hey I am on Medial • 9m

Government must take over the business and handover to another corporate instead of finishing the business. This is really a unmature decision from the government side. This company was running well. They could handover it to another corporate for so

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)