Back

Account Deleted

Hey I am on Medial • 10m

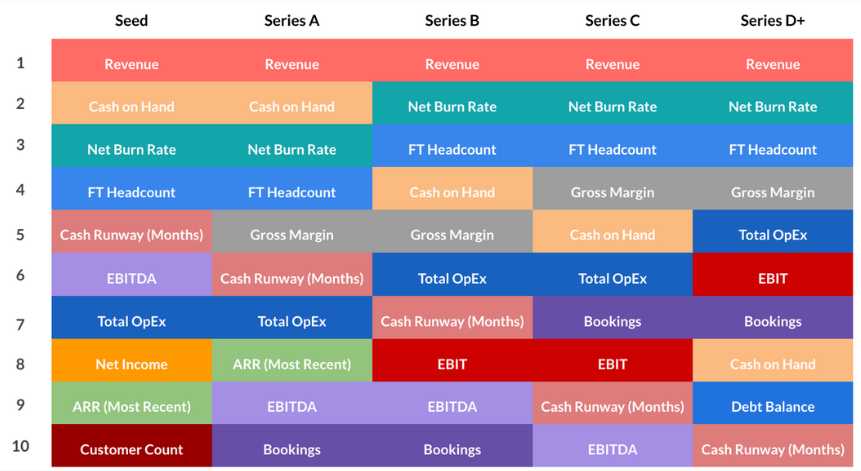

It depends. Valuation is based on potential in early stages and on revenue in later stages. 1. Early-stage startups: Valued on potential- market size, team, and idea 2. Growth-stage startups: Valued on revenue, profits, and performance metrics Keep it simple: No revenue? = Valued on future potential Growing revenue? = Valued on real numbers + potential

More like this

Recommendations from Medial

Pulakit Bararia

Founder Snippetz Lab... • 1y

I recently posted how do you calculate violation, many people were saying most startup doesn't earn profit , so there are two more ways you can go about Revenue Multiples Method 1. Focus on Revenue: Use your company’s current or projected revenue

See MoreVivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates We back visionary businesses across stages: I. Sector-Agnostic Early-Stage – First institutional checks to startups showing early traction & revenue. Investment: ₹1–8 Cr for 8–18% equity. II. SME Credit Opportunities – Up to $5M c

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates We back visionary businesses across stages: I. Sector-Agnostic Early-Stage – First institutional checks to startups showing early traction & revenue. Investment: ₹1–8 Cr for 8–18% equity. II. SME Credit Opportunities – Up to $5M c

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

Investment Mandates We back visionary businesses across stages: I. Sector-Agnostic Early-Stage – First institutional checks to startups showing early traction & revenue. Investment: ₹1–8 Cr for 8–18% equity. II. SME Credit Opportunities – Up to $5M c

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How Silicon Valley Companies Thinks? What Matters 'Profits' or 'Valuations'........🤔 let me tell you a secret. In silicon valley, companies often operate differently from traditional businesses. here the focus is less on making immediate profits a

See More

Suraj Tiwari

Hey I am on Medial • 2m

Hi everyone, I am looking to fund small and early-stage startups, especially SaaS-based startups that are currently at the ideation stage. In the pitch deck, I would like the following points to be clearly explained: The problem being solved and the

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)