Back

Havish Gupta

Figuring Out • 10m

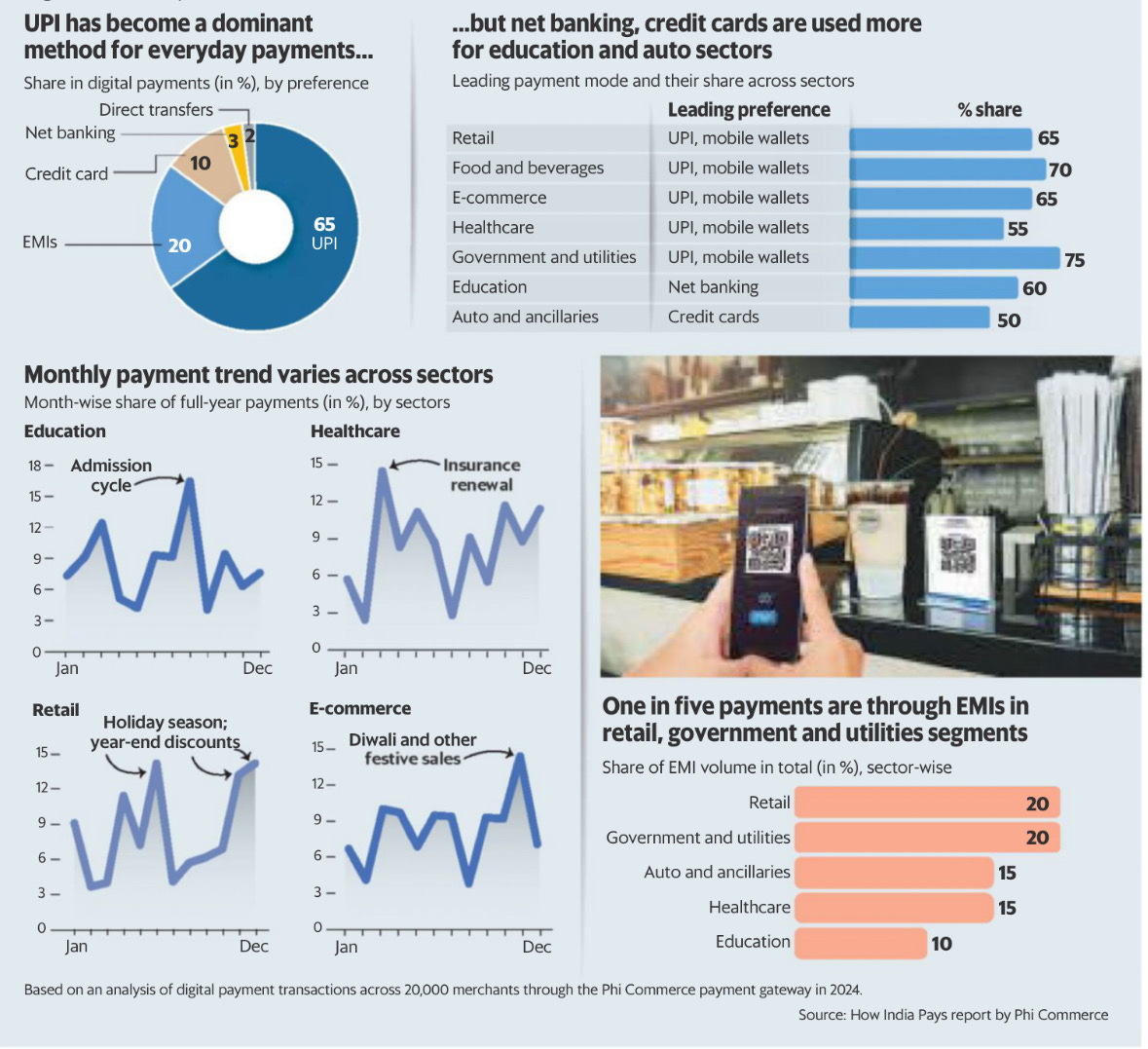

Ohh, then I think it will cause increase in consumer spending and digitalisation of transactions. This digitalisation will provide data about consumer spending and will help banks provide loans to them just like what Bharat Pe did. Tho i don't see any big negative effects apart from over spending and digital scams. What do you think?

Replies (1)

More like this

Recommendations from Medial

Akshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreSARASHI ASSOCIATION

Hey I am on Medial • 1y

Sarashi Association Need help for startup and grow.....My aim is to provide loans to common poor business people at very low interest rates, and much lower than normal banks and finance company like half interest loans, small medical expenses loans

See MoreSameer Patel

Work and keep learni... • 1y

The Great Depression (1929-1939) The Great Depression (1929-1939) was a severe global economic crisis starting with the U.S. stock market crash on October 29, 1929, known as Black Tuesday. Over-speculation (risky investments) and excessive borrowing

See MoreTushar Aher Patil

Trying to do better • 9m

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

Mr Kumar

I will do something ... • 1y

I need investors for the idea I have. Just like banks give loans against gold or property, our company wants to give loans against old machines. Poor farmers or labourers who have old iron machines or iron goods can mortgage them and take loans at v

See MoreHavish Gupta

Figuring Out • 1y

Why do you think that in the last 2 years, the Number of Instant Loan Startups have skyrocketed, and also almost every company have started to provide loans? Like what happened in this period that have helps these companies dicide whom to give loans

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)