Back

Rohan Saha

Founder - Burn Inves... • 10m

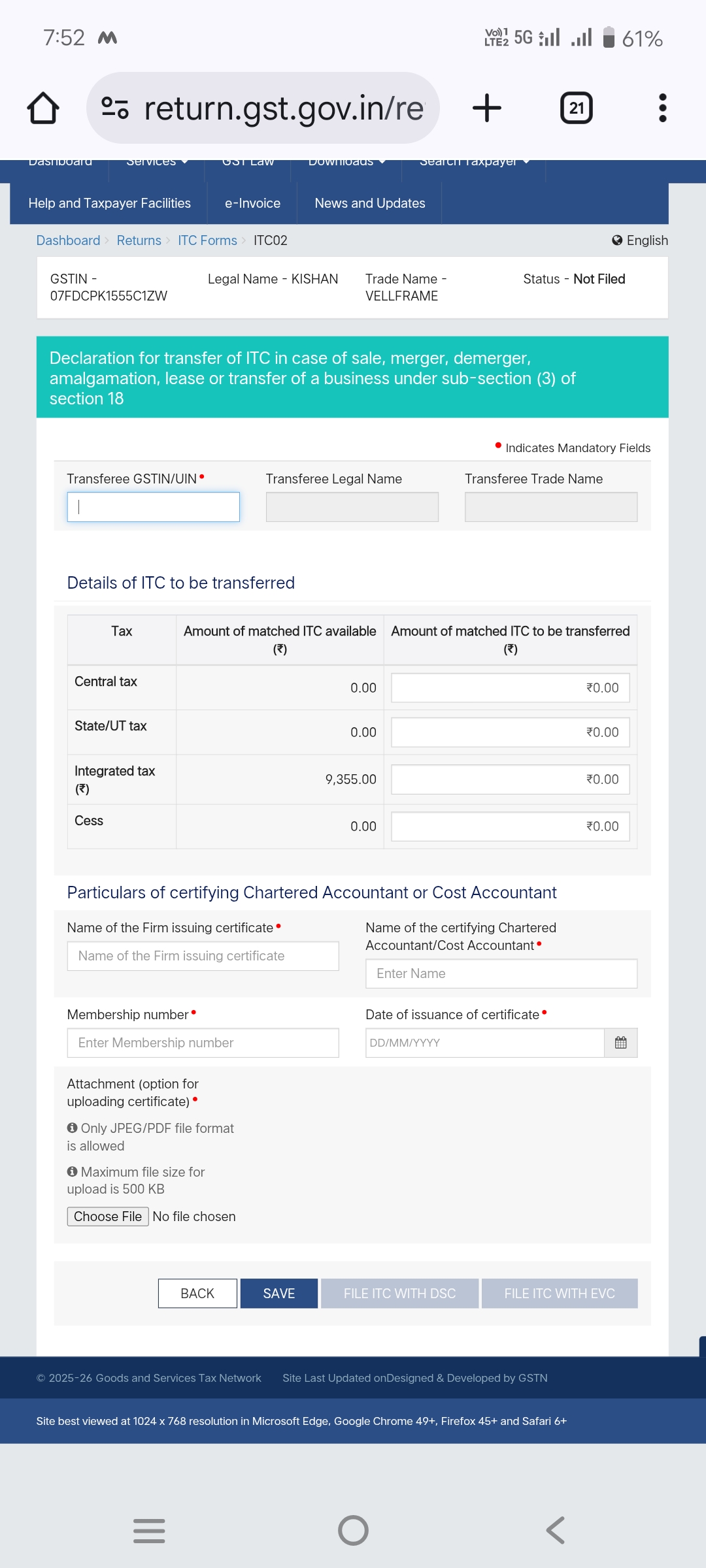

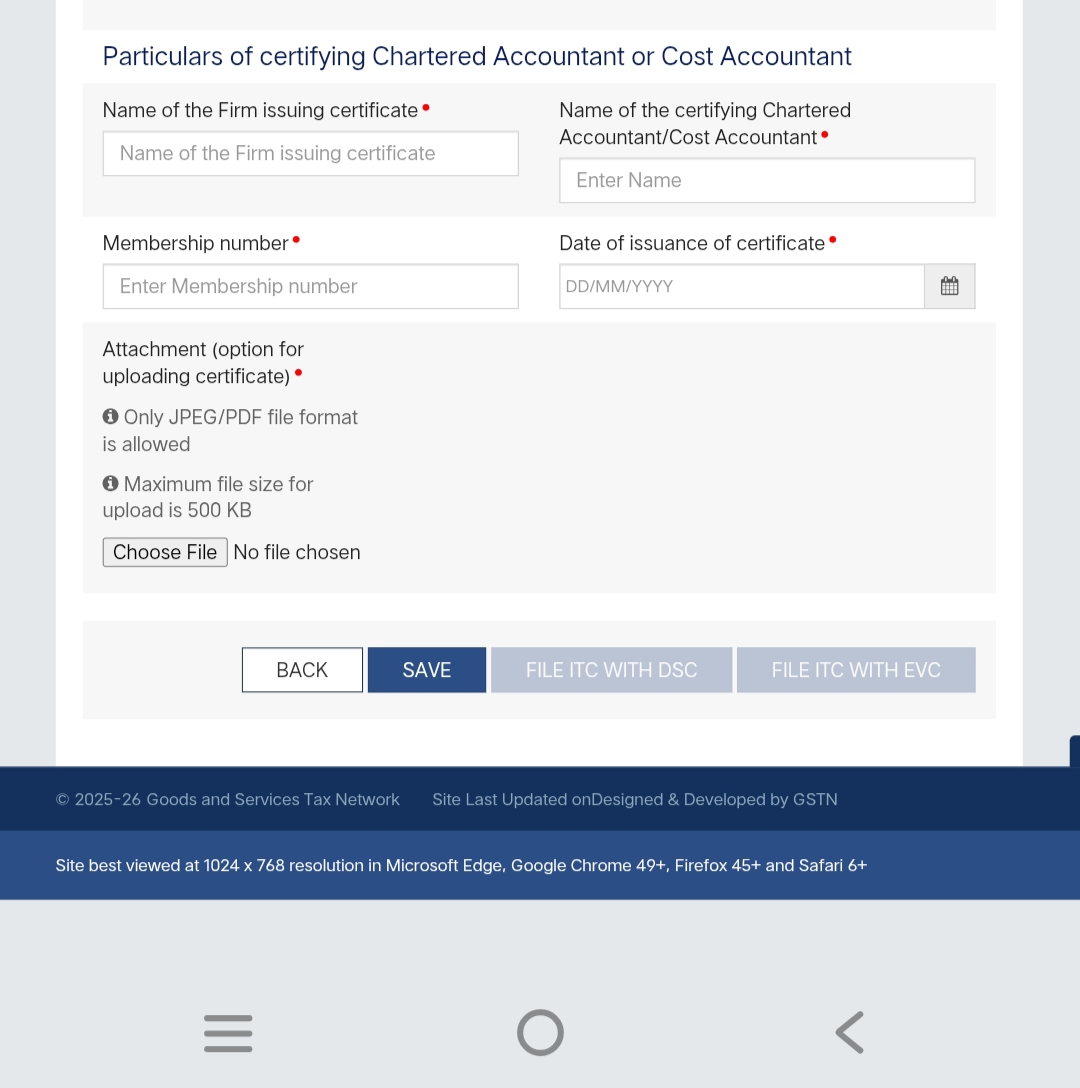

Half news and knowledge is dangerous - UPI pe 18% GST ka sach

Replies (6)

More like this

Recommendations from Medial

Aditya Sahu

Big thinking always ... • 1y

carbonated drinks pe gst hai 40% 28% gst and 12% cess and isme 28% ko 35% karne ka soch rhi hai government mai ek startup start karne ka soch raha tha drinks me jo ye tha ki mai mocktail ki 20 rs ki bottle per consumers ko dena ka soch raha tha lekin

See Moregray man

I'm just a normal gu... • 10m

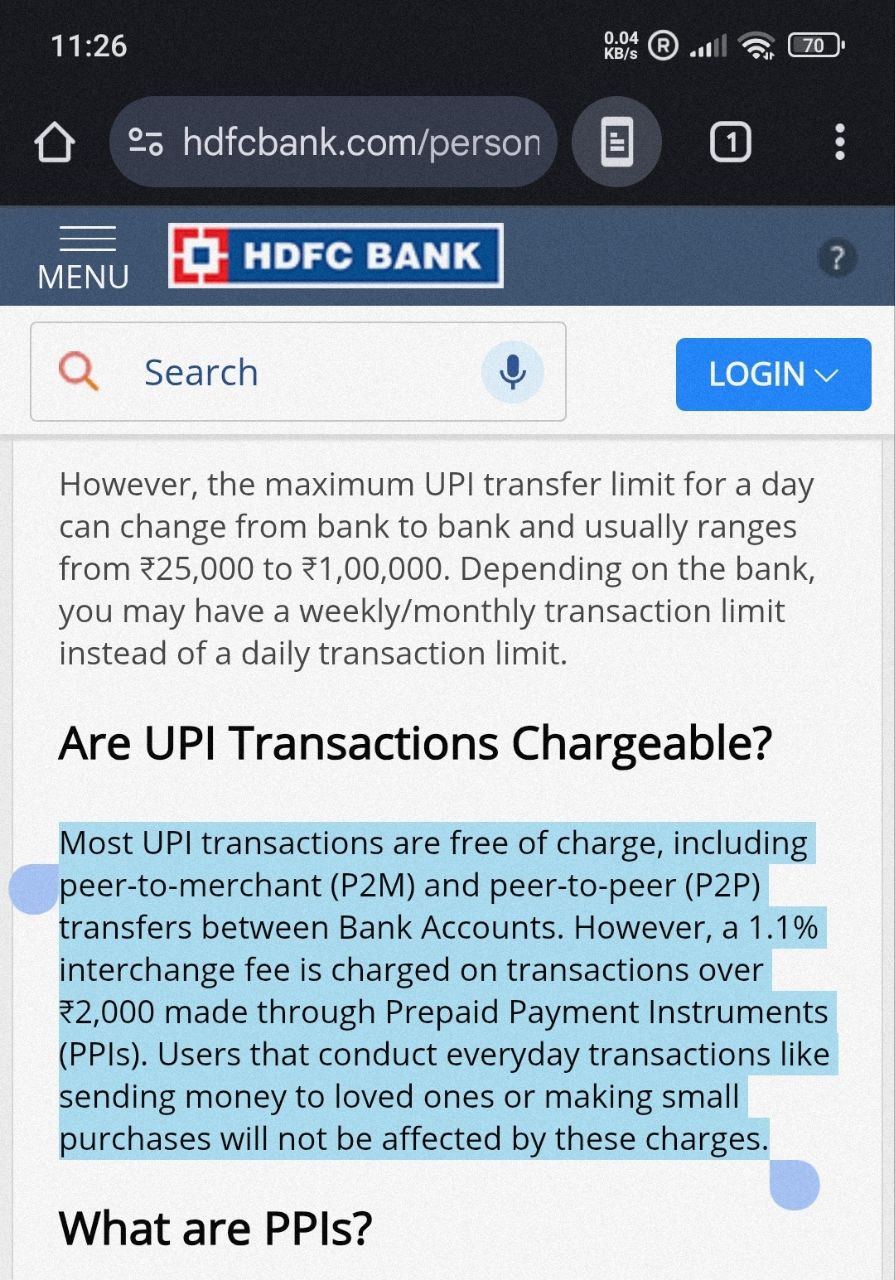

The Finance Ministry has dismissed reports suggesting that the government is considering imposing Goods and Services Tax (GST) on UPI transactions exceeding INR 2,000. In an official statement, the ministry clarified, “The claims that the government

See More

Rohan Saha

Founder - Burn Inves... • 1y

Ajj kal bohot log kuch experts ye boll rahe he ki indian market overvalued ho geya he.... Lakin indian market ka PE ratio avi 5 years ke average ke ass pass hi ghum raha he.... Or bank nifty ka PE to 5 years average se bohot nicea hai... Indian mar

See MoreLetsConnect Mind care technology pvt ltd

•

Signitycs • 1y

In india Upto 18% GST Is Applicable - Education sector. Medical Industries - GST is Applicable. Luxury cars - Low ROI Tractors, - High ROI This Rules are Correct What is your opinion. its just an Question.. Because we stopped questionings..??

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)