Back

Vamshi Yadav

•

SucSEED Ventures • 10m

Govt Doubles Startup Loan Guarantees to ₹20 Cr, But 90% Founders Will Still Miss Out. Here's Why While most founders have spent an exciting time pitching VCs and regarding equity as capital, a quiet little yet great update in Budget 2025 has changed the rules for some of those attending. Supercharged Credit Guarantee Scheme for Startups (CGSS): → Loan guarantee limit increased to ₹20 crore. → Guarantee fee down to just 1% for 27 high-impact sectors. → Still without collaterals required. → 65-80% of the loan would be covered by the government. Sounds like a dream come true for founders, isn't it? A way to touch meaningful capital without giving large pieces of equity away. Here is the actual impact: ⤷ Raise ₹7 crore in equity + ₹3 crore CGSS loan ⤷ Dilution: only 14% instead of 20% for a ₹10 crore round ⤷ 6% equity saved = ₹30 crore more at ₹500-crore exit Yet, most startups will never use this. Why? 1. Mindset Trap • VC = validation (not always) • Debt = "traditional business" (wrong) • Fear of repayment (valid, but manageable) 2. Nobody Talks About It • Scheme specifics buried in government portals • No founder playbooks or how-to guides • Most founders don't know it exists 3. Wrong Game with Banks • Pitching like it's Shark Tank • Missing projections, cash flow plans and risk coverages • Targeting the wrong branches or bankers 4. Documentation Fumbles • No unit economics • Unclear repayment roadmap • Financials look like wishlists, not plans 5. Too Soon to Apply for • Pre-revenue stage • Weak founding team on paper • "Raise now, figure out later" mindset doesn't work here Who should apply then? • 6-12 months of revenue • DPIIT-recognized startup • Strong team with domain credibility • Clear business model with ROI-focused use of funds • Past loan history (even small) builds confidence Sure, however, that does not come without a few cons: → You still have to repay (debt carries its right responsibility). → Takes effort to prepare documents banks actually understand. → Not all sectors may be eligible. But if you do it right, you keep more of your company, grow with capital and control, and avoid painful over-dilution. <10% of India's startup capital comes from debt. In the US, it is between 30-40%. That gap is your opportunity. The early mover will benefit as the floodgates open. #StartupFunding #CGSS #IndiaStartups #DPIIT #FounderFinance #DebtVsEquity #StartupIndia #VCAlternatives #Budget2025

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Vivek Joshi

Director & CEO @ Exc... • 2m

Before You Raise Money, Decide What Kind of Company You Want to Build Founders often chase capital without asking the real question: What type of funding actually matches your strategy? Because equity, debt, and hybrid instruments don’t just finance

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

SamCtrlPlusAltMan

•

OpenAI • 7m

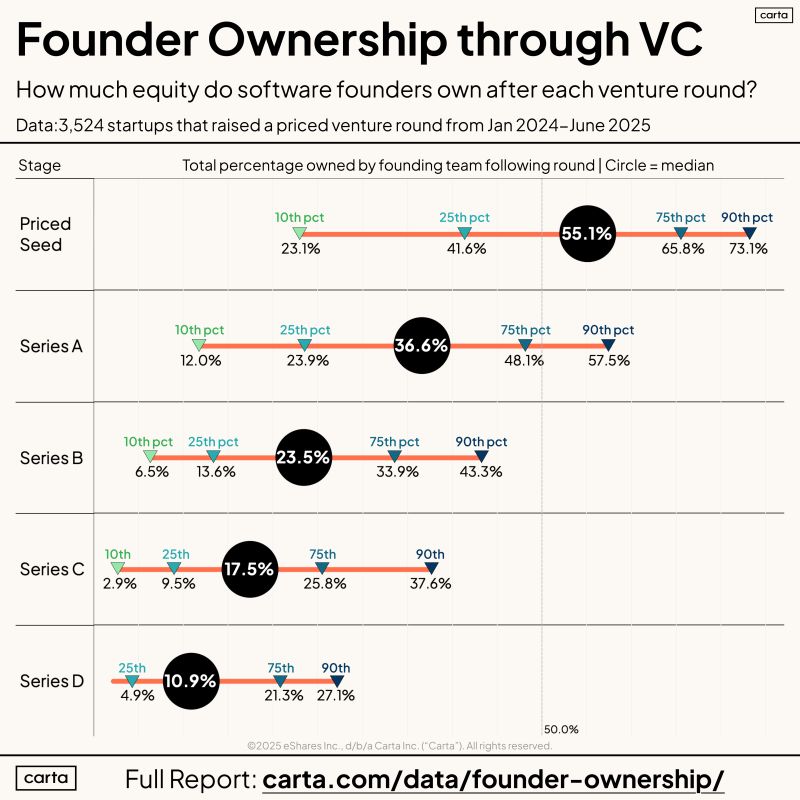

The Hidden Cost of Raising VC: Your Equity. Think raising a big round means you’ve made it? Check the fine print: Founder ownership drops fast as you climb the funding ladder. Median equity owned by founders after each round (2024–25 data from 3,52

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)