Back

IncorpX

Your partner from St... • 9m

🚀 Empowering India's Innovators: DPIIT's Enhanced Credit Guarantee Scheme In a significant move to bolster India's startup ecosystem, the Department for Promotion of Industry and Internal Trade (DPIIT) has announced pivotal enhancements to the Credit Guarantee Scheme for Startups (CGSS). These changes aim to provide startups with greater access to collateral-free funding, fostering innovation and growth. Key Highlights of the Revised CGSS: Increased Guarantee Cover: The maximum guarantee cover per borrower has been doubled from ₹10 crore to ₹20 crore. Enhanced Coverage Percentage: The scheme now offers an 85% guarantee for loans up to ₹10 crore and a 75% guarantee for loans exceeding ₹10 crore. Reduced Annual Guarantee Fee (AGF): Startups operating in 27 identified 'Champion Sectors' under the 'Make in India' initiative will benefit from a reduced AGF of 1% per annum, down from the previous 2%. Implications for the Startup Ecosystem: Facilitating R&D and Innovation: The enhanced scheme aims to reduce the perceived risks associated with lending to startups, thereby enabling greater financial flow for startups to undertake research and development (R&D), experimentation, and create cutting-edge innovation and technologies. Encouraging Financial Institution Participation: With increased guarantee support and coverage, more financial institutions are expected to provide credit support to startups, increasing the overall fund flow within the startup ecosystem. Promoting Self-Reliance: These measures align with the vision of transforming India into an innovation-driven, self-reliant economy, addressing the financing needs of innovation-driven startups. A Step Towards 'Viksit Bharat': The revised CGSS is a strategic initiative to propel India towards becoming a 'Viksit Bharat' (Developed India) by nurturing a vibrant startup ecosystem. By providing enhanced credit support and reducing financial barriers, the government is fostering an environment conducive to innovation and entrepreneurship. For Startups: Eligible startups recognized by DPIIT can approach registered financial institutions, including Scheduled Commercial Banks, All India Financial Institutions (AIFIs), Non-Banking Financial Companies (NBFCs), and SEBI-registered Alternative Investment Funds (AIFs), to avail the benefits under the revised CGSS. Let's embrace this opportunity to drive innovation and contribute to India's growth story. #StartupIndia #Innovation #Entrepreneurship #DPIIT #CGSS #ViksitBharat #MakeInIndia #StartupFunding

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

💰 In 2023, over 1,500 Indian startups were funded through government schemes like the Startup India early stage Seed Fund Scheme (SISFS), which allocated ₹950 crore, and the Credit Guarantee Scheme for Startups (CGSS) By BJP Government and interesti

See More

CA Chandan Shahi

Startups | Tax | Acc... • 11m

🚀 Seeking 10 Startups for Seed Funding! 🚀 We are helping 10 promising startups secure funding under the Startup India Seed Fund Scheme (GOI). If your startup is ready to scale, this is your chance! Eligibility Criteria: ✅ Registered as Pvt Ltd/LL

See MoreSanskar

Keen Learner and Exp... • 1y

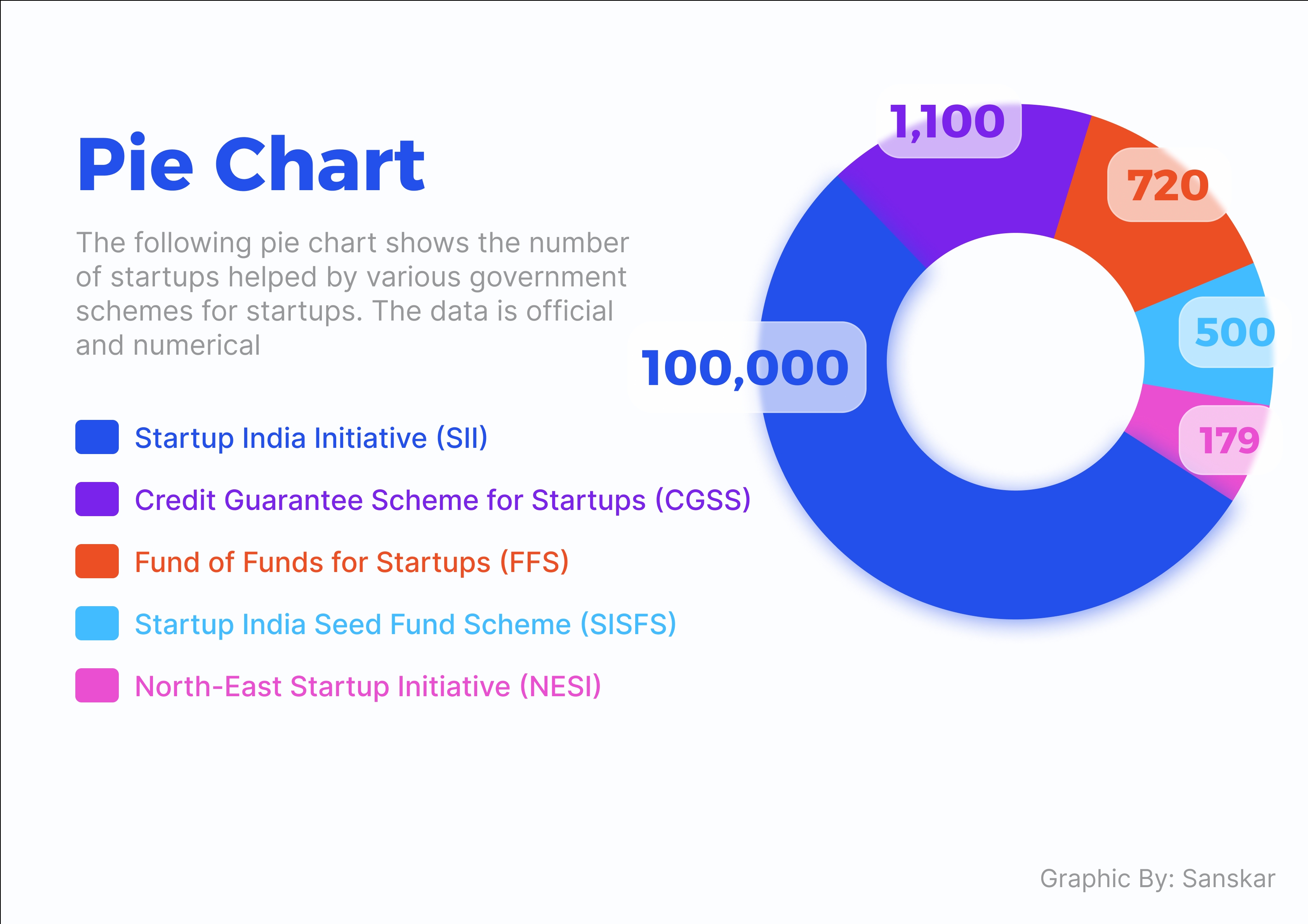

How many of these government schemes to support the startup ecosystem are you aware of? 1. Startup India Initiative (SII) [2016] - This scheme offers three years tax holiday and reduced regulatory burden along with access to a Fund of Funds worth ₹1

See More

Vamshi Yadav

•

SucSEED Ventures • 10m

Govt Doubles Startup Loan Guarantees to ₹20 Cr, But 90% Founders Will Still Miss Out. Here's Why While most founders have spent an exciting time pitching VCs and regarding equity as capital, a quiet little yet great update in Budget 2025 has changed

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)