Back

Anonymous 2

Hey I am on Medial • 10m

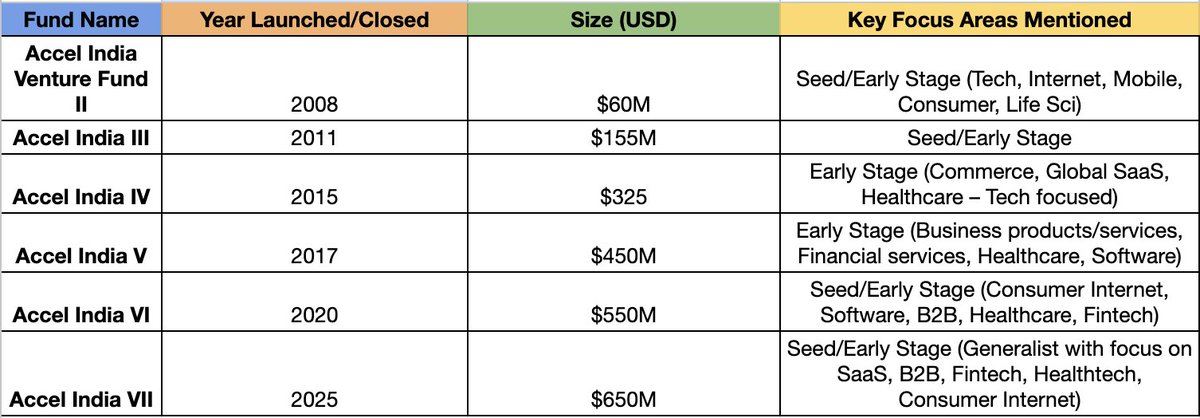

AI astrology startup? SERIOUSLY? This is peak bubble behavior. Accel used to have a reputation for backing solid, sustainable businesses, not pseudo-science cash grabs. This signals they're getting desperate for returns as the Indian tech ecosystem matures. Also worth noting that their biggest wins (Flipkart, Freshworks) were from their earlier, smaller funds. As their fund size has grown, their ability to pick winners seems to be diluting. They're writing bigger checks into later stages which fundamentally changes their risk profile and incentives.

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 10m

Accel in India has come a long way. Entered 2008→ acq. Erasmic Venture Fund —transforming EVF’s $10 M seed fund into 'Accel Venture Fund I'. Fund II closed in 08' with $60 M. Fast forward to today, the latest fund has 10x’ed, closed at a $650 M co

See More

Saket Sambhav

•

ADJUVA LEGAL® • 8m

The Surprising Metric We're Proud Of - 93 Refunds. Yes, You Read That Right 🫰 Time for a half-yearly review! Many founders talk about sales, growth, and user numbers. But today, I want to share a different metric. From January to June this year,

See More

Nishant Mittal

Entrepreneur, musici... • 7m

As entrepreneurs, we’ve all worked with a lot of Soham Parekhs. They begin okay, and then you find out that they’ve been working at 4 places, just because you weren’t that horrible, Hari Sadhu type annoying micromanaging boss. And then when the leve

See MoreNishant Mittal

Entrepreneur, musici... • 8m

Pharmeasy had raised a total $1.6 Billion at a peak valuation of $5.6 Billion. And now the company is pretty much done and the founders are out. It's quite an interesting story.. When Pharmeasy acquired 66% in Thyrocare (a 30 year old, strong and pr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)