Back

Harsh Dwivedi

•

Medial • 1y

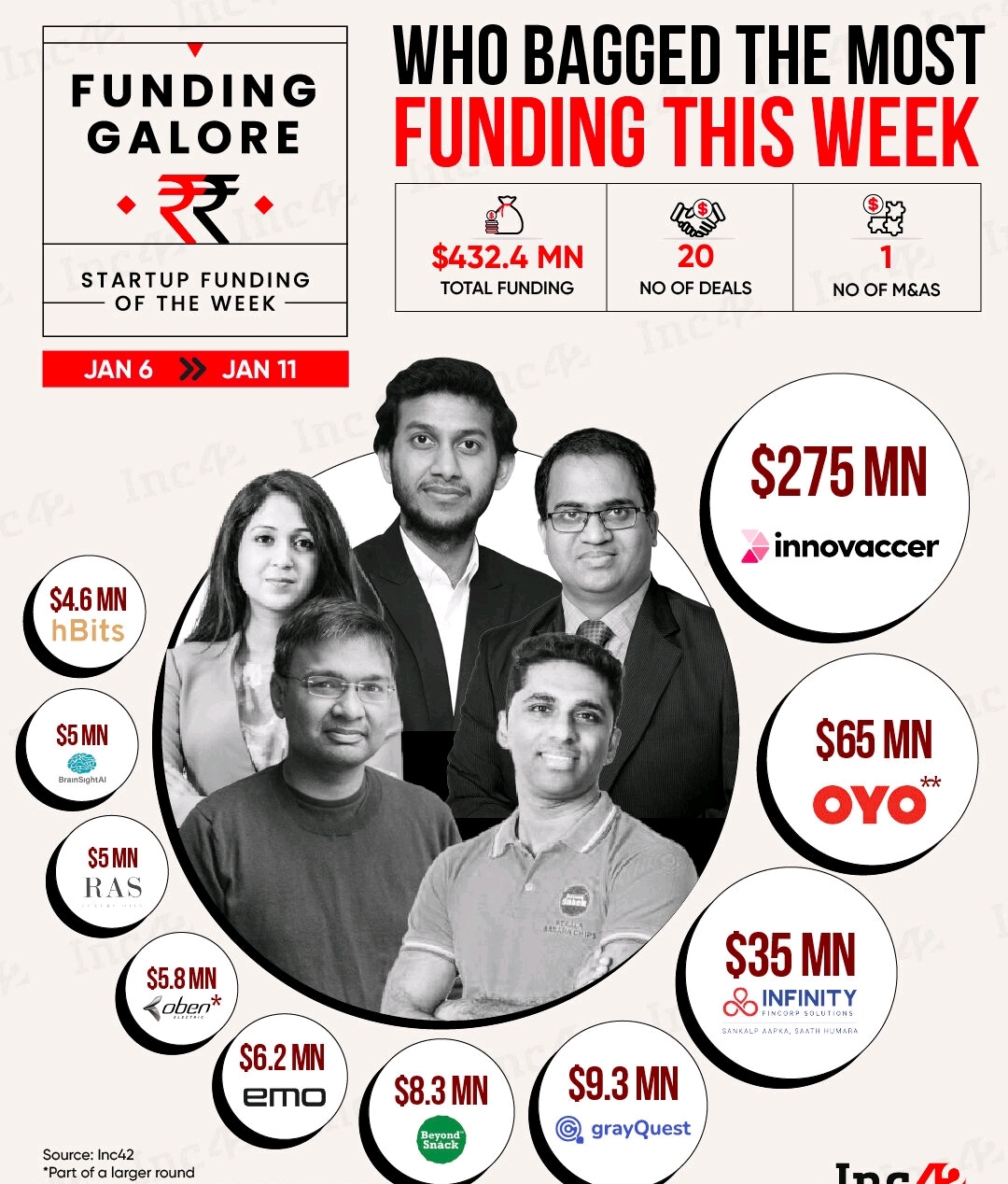

Top News of the Week: 1. Funding: - On a weekly basis, startup funding barely increased 3.9% to $402.34 million as compared to around $387.23 million raised during the previous week. - 17 Indian startups raised around $402.34 million in funding this week. These deals count 4 growth-stage deals and 11 early-stage deals. With two early-stage startups who kept their transaction details undisclosed. - Growth-stage deals, 4 startups raised $317 million in funding this week. Eyewear retailer Lenskart led the list with its $200 million secondary funding followed by a digital lending startup Fibe with $90 million, - Electric two-wheeler manufacturer Ather Energy with $15 million, and Small and medium enterprises-focused digital lending platform LendingKart with its $12 million debt funding. - 11 early-stage startups secured funding worth $85.34 million during the week. Spun off from Polygon, blockchain startup Avail spearheaded the list. - Followed by online astrology platform AstroTalk, AI-based low-code test automation platform Testsigma, fintech platform iPiD, and robotics startup Botsync. - Undisclosed: IoT-driven green robotics solution provider Aegeus Tech and D2C nutrition brand Greenday (Better Nutrition). 2. Layoffs - Simpl, a Bengaluru-based fintech startup, has undergone its second round of layoffs in less than a month, cutting around 30 employees. This move follows a previous layoff of around 100 employees. Ashish Kulshrestha, head of communications at Simpl, explained that these layoffs are part of the company’s efforts to achieve profitability by mid-2025 and to enhance operational efficiency. 3. M&A - Amazon has now confirmed the acquisition of certain assets from MX Player, although the transaction isn’t yet complete. An Amazon spokesperson mentioned their continuous efforts to enhance customer experiences with local content available on Prime Video and miniTV in India. - Absolute Sports, the parent company of Sportskeeda.com and ProFootballNetwork.com and a subsidiary of Nazara Technologies is set to acquire all assets of SoapCentral.com, a leading entertainment content source in the US. The all-cash deal is valued at $1.4 million (approximately Rs 11.6 crore) and is expected to close within the next 30 days. 4. ESOP Deals - Leverage.biz, the company behind the study abroad platform Leverage Edu, Fly.Finance, and Fly Homes, has completed its second ESOP buyback exercise. This initiative benefited over 50 employees across various functions, although the exact amount of the stock buyback was not disclosed. Leverage Edu previously concluded its first ESOP buyback in June 2022. - PB Fintech, a company whose employee share plan was approved by investors earlier this week, has issued nearly 4.83 million new shares. However, it is uncertain how many employees will benefit from this plan. 5. Top Exits - Hemesh Singh, co-founder of edtech platform Unacademy, has announced his decision to step down as Chief Technology Officer and transition to an advisory role. - Sachin Bansal has sold his remaining 7.5% shareholding in Ather. The shares were acquired by Hero MotoCorp (2.2%) and Nikhil Kamath, cofounder of Zerodha (5.3%). - Narayan Gangadhar, the CEO of 5Paisa, has resigned from his position. His resignation will be effective from August 28. Gangadhar, who previously worked at Angel One, joined 5Paisa a year ago. 6. Other Developments - Scimplify, a platform for sourcing and manufacturing specialty chemicals, is raising a new $5 million round led by Omnivore with participation from existing investors, just six months after its previous round. - Meragi, an online platform for wedding-related services and products, is set to raise $8 million in a new round led by Accel, with existing investors Surge and Venture Highway also participating. The deal is in the final stages. - Statiq, an electric vehicle charging network operator, is in discussions to raise $50 million in its Series B round, with existing investors Shell Ventures and Y Combinator, along with new investors. - InsuranceDekho, the insurance arm of CarDekho, is in the final stages of acquiring a majority stake in wealth tech startup BankSathi through a share swap deal, allowing BankSathi shareholders to receive a stake in InsuranceDekho. Stay Updated. Stay Informed. Stay Ahead. Share the Medial App with your network, colleagues, and friends. Let's brainstorm, discuss together and help each other achieve our goals. And don't forget to rate us on the iOS App Store and Google Play Store to help us reach even more amazing people like you.

Replies (4)

More like this

Recommendations from Medial

Venture Linkup

Where Businesses Con... • 10m

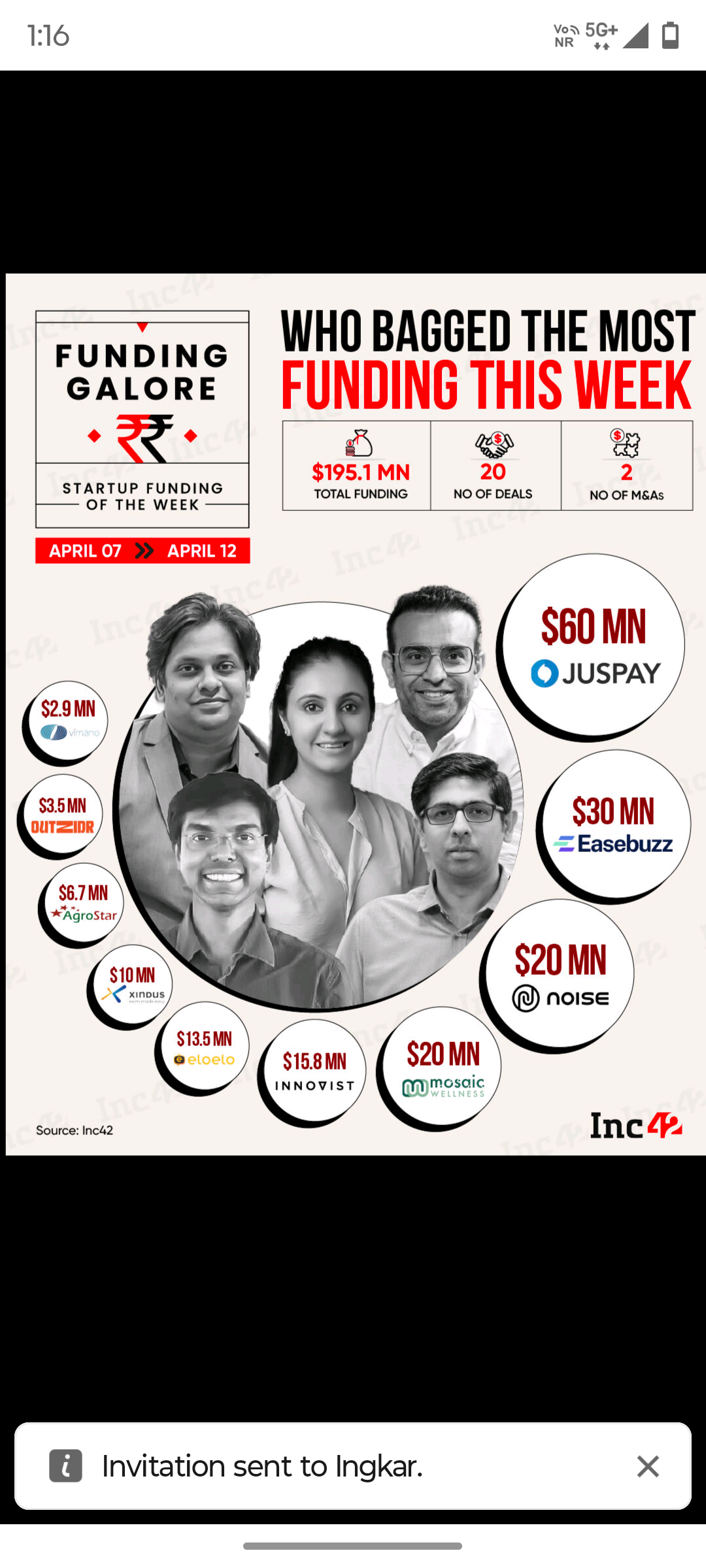

Between April 7 and 12, Indian startups collectively secured $195.1 million across 20 funding deals, reflecting a 35% increase from the $144.4 million raised by 22 startups the previous week. While fintech emerged as the top-funded sector, it was ec

See MoreAhmad Raza Siddiqui

CEO & Founder at Aaz... • 9m

Aazakart, an AI-powered e-commerce. Recent Funding Activities Seed Funding Round: Aazakart successfully raised $10 million in a seed funding round. This capital is aimed at accelerating the company's growth strategy, enhancing technological capabil

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)